Options trading can be a lucrative way to make money in the financial markets, but it can also be complex and risky if you don’t know what you’re doing. That’s why it’s important to choose a reputable broker that can provide you with the tools and support you need to succeed. Webull is one of the leading options trading platforms, and it offers a wide range of features to help you get started.

Image: www.asktraders.com

In this guide, we’ll show you how to set up a Webull account and start trading options. We’ll cover everything from opening an account to funding it to placing your first trade. So whether you’re a beginner or an experienced trader, this guide has something for you.

Getting Started with Webull

The first step to options trading with Webull is to create an account. You can do this by visiting the Webull website and clicking on the “Sign Up” button. You’ll be asked to provide some basic information, including your name, email address, and phone number.

Once you’ve created an account, you’ll need to fund it before you can start trading. You can do this by linking your bank account or by depositing funds via a wire transfer. Once your account is funded, you’re ready to start trading.

Trading Options with Webull

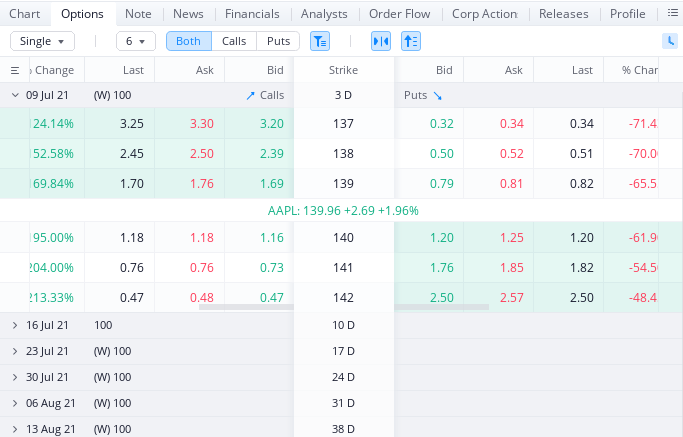

To trade options with Webull, you’ll need to first find the option you want to trade. You can do this by searching for the underlying asset or by browsing the options chain. Once you’ve found the option you want to trade, you’ll need to enter the following information:

- Contract Type: The type of option you want to trade (i.e., call or put).

- Strike Price: The price at which you want to buy or sell the underlying asset.

- Expiration Date: The date on which the option expires.

- Number of Contracts: The number of contracts you want to buy or sell.

- Order Type: The type of order you want to place (i.e., market order, limit order, etc.).

Once you’ve entered all of the required information, you can click on the “Submit” button to place your trade. Your order will be executed immediately if it meets the current market price. Otherwise, your order will be placed on the order book and executed when the market price reaches your desired price.

Tips and Expert Advice for Options Trading

Here are a few tips and expert advice for options trading:

- Start small and gradually increase your position size as you gain experience.

- Don’t trade options on margin, as this can magnify your losses.

- Understand the risks involved in options trading and only trade with money you can afford to lose.

- Consider using a trading simulator to practice trading options before you start trading with real money.

- Seek out educational resources on options trading to help you improve your knowledge and skills.

By following these tips, you can increase your chances of success in options trading. However, it’s important to remember that there is no sure thing in trading and that you can always lose money. So trade wisely and be prepared for the possibility of losses.

Image: derivfx.com

FAQ on Options Trading

Here are some answers to frequently asked questions about options trading:

Q: What is an option?

A: An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

Q: What are the different types of options?

A: There are two main types of options: calls and puts. Calls give the buyer the right to buy an underlying asset at a specified price, while puts give the buyer the right to sell an underlying asset at a specified price.

Q: What are the risks of options trading?

A: Options trading can be risky, as there is the potential to lose money on every trade. The risks of options trading include the possibility that the underlying asset may not move in the expected direction, that the option may expire worthless, or that the option may be assigned before you are ready to close out the position.

Q: How can I learn more about options trading?

A: There are a number of resources available to learn about options trading. You can read books, articles, and blog posts, or you can take a class or webinar. You can also find educational resources on the Webull website.

How To Set Up Webull For Options Trading

Image: www.youtube.com

Conclusion

Options trading can be a complex and risky endeavor, but it can also be a lucrative way to make money in the financial markets. If you’re interested in learning more about options trading, Webull is a great place to start. Webull offers a wide range of features to help you get started, including a user-friendly platform, educational resources, and a community of experienced traders. So if you’re ready to start options trading, Webull is the platform for you.

Are you interested in learning more about options trading? If so, be sure to check out the Webull website or download the Webull app today.