Introduction

In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking to navigate market uncertainties and maximize potential returns. Enter TD Ameritrade, a renowned brokerage firm that boasts a comprehensive platform tailor-made for options enthusiasts. Join us as we delve into the intricacies of does td ameritrade offer options trading, exploring its intricacies and uncovering its potential benefits and drawbacks.

Image: themodestwallet.com

A Deep Dive into Options Trading at TD Ameritrade

Options contracts grant investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. TD Ameritrade offers a wide array of options contracts, encompassing various underlying assets such as stocks, indices, ETFs, and currencies. This flexibility allows traders to customize strategies to align with their unique objectives.

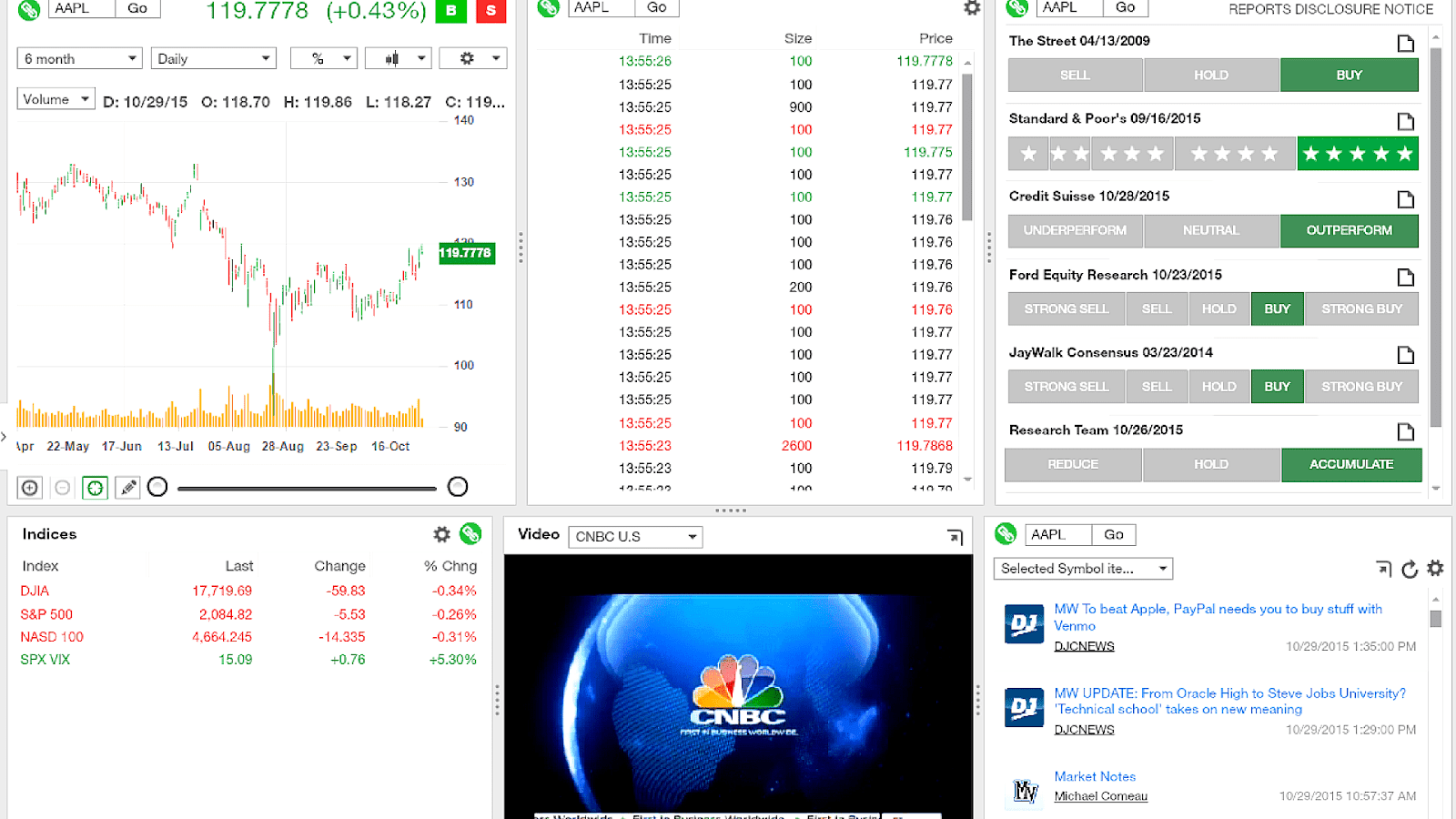

TD Ameritrade’s cutting-edge platform provides a comprehensive suite of trading tools specifically designed for options traders. Real-time market data, sophisticated charting capabilities, and advanced order types empower investors with the necessary insights and control to make informed decisions. Moreover, the firm’s comprehensive educational resources, including webinars, tutorials, and seminars, ensure that traders of all levels are well-equipped to navigate the complexities of options trading.

Expert Insights and Actionable Tips

“Options trading offers a unique blend of risk and reward,” explains financial expert Mark Douglas, “Traders must thoroughly understand the mechanics of options and the potential risks involved.” Douglas emphasizes the importance of thorough research and paper trading before venturing into live options trading.

To enhance their options trading strategies, investors can leverage a host of actionable tips. First, defining clear trading goals and objectives is crucial for guiding decision-making. Second, meticulously assessing market conditions and evaluating potential risks and rewards is paramount. Third, diversification across different option strategies and underlying assets helps mitigate portfolio risk.

Unveiling the Pros and Cons

While options trading at TD Ameritrade offers numerous advantages, it is essential to be cognizant of its potential drawbacks as well.

Advantages

- Potential for substantial returns

- Enhanced portfolio diversification

- Flexibility to customize trading strategies

- Access to a wide range of options contracts

- Comprehensive trading platform and educational resources

Disadvantages

- Higher risk compared to traditional investing

- Can be complex and require significant knowledge

- Time-sensitive nature of options contracts

- Potential for losses exceeding initial investment

- High commission fees for excessive trading

Image: tradechoices.blogspot.com

Does Td Ameritrade Offer Options Trading

Image: www.fondazionealdorossi.org

Conclusion

TD Ameritrade offers a comprehensive options trading platform that caters to the diverse needs of investors, from beginners to experienced traders. With its robust tools, educational resources, and wide selection of options contracts, TD Ameritrade empowers investors to explore and harness the potential rewards of options trading. However, it is crucial to approach options trading with a deep understanding of the inherent risks and to employ sound trading strategies. By leveraging expert insights, actionable tips, and a balanced assessment of pros and cons, investors can navigate the complexities of options trading and potentially reap its benefits.