Unlocking the Opportunities of Market Volatility

The fast-paced world of options trading presents a unique opportunity to harness market volatility and capitalize on potential gains. Understanding the intricate workings of options trading times is crucial in navigating this dynamic landscape successfully. In the United States, Eastern Daylight Time (EDT) governs the trading hours for options markets, dictating when traders can place and execute orders.

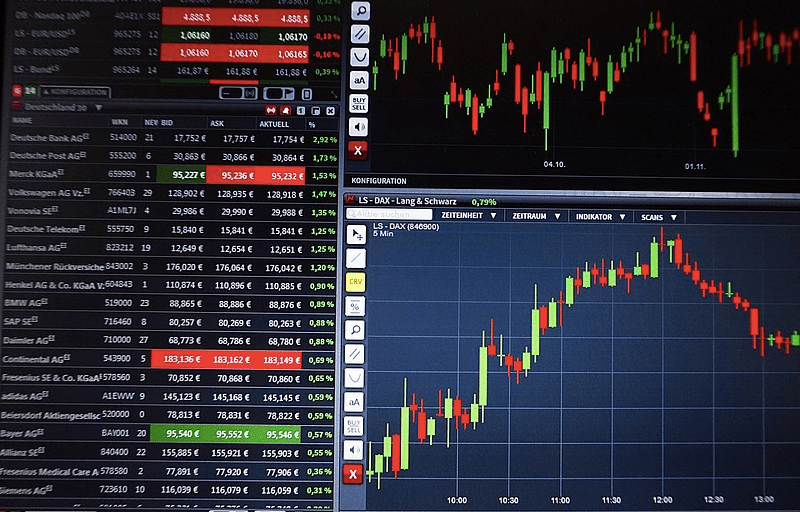

Image: www.youtube.com

EDT aligns with the time zone observed in the Eastern United States and applies to the trading sessions of major exchanges such as the CBOE and CME Group. The trading hours for options on these exchanges typically span from 9:30 AM EDT to 4:15 PM EDT, providing traders with ample time to analyze market conditions, make informed decisions, and execute their trading strategies.

Maximizing Trading Potential

Options traders can leverage the entirety of the trading session to maximize their potential gains. The opening bell at 9:30 AM EDT marks the start of the most active trading period, as large institutional investors and hedge funds often place sizeable orders to establish positions. This heightened activity creates opportunities for traders to execute orders at favorable prices and secure advantageous positions.

As the trading day progresses, volatility tends to decrease, leading to a calmer market environment. However, the period before the closing bell often witnesses a surge in activity as traders adjust their positions or close out expiring contracts. This volatility resurgence provides additional chances for traders to capture profits before the market closes at 4:15 PM EDT.

Understanding options trading times EDT is paramount for successful navigation of the options market. By aligning with the established trading hours, traders can optimize their strategies and capitalize on market movements. Moreover, adhering to the designated trading times helps traders maintain compliance with regulatory requirements and avoid potential penalties.

Image: www.daytrading.com

Options Trading Times Edt

Image: purepowerpicks.com

Q&A

Q: What are the options trading times EDT?

A: Options trading hours on major U.S. exchanges generally run from 9:30 AM EDT to 4:15 PM EDT.

Q: Why is it important to adhere to options trading times?

A: Complying with trading hours ensures compliance with regulations and prevents the potential for penalties. Additionally, aligning with the active trading period allows traders to execute orders at optimal prices.

Q: What are the benefits of understanding options trading times EDT?

A: Understanding EDT trading hours enables traders to maximize their trading potential, capitalize on market volatility, and adjust their strategies based on the market environment.

Q: Are there any exceptions to the standard options trading times?

A: Occasionally, exchanges may adjust trading hours for special events or holidays. It is recommended to refer to the official exchange websites for the most up-to-date information.

Conclusion

Mastering options trading times EDT empowers traders to navigate the options market strategically. By aligning with the designated trading hours, traders can seize opportunities, mitigate risks, and maximize their chances of success. Whether you are a seasoned trader or just starting your journey into the world of options, understanding the intricacies of trading times is essential for maximizing your potential gains.

Are you ready to unlock the possibilities of options trading within the confines of Eastern Daylight Time? Embrace the knowledge, hone your skills, and prepare to capitalize on the market’s every move.