Unveiling the Intricacies of Intraday Option Trading

Navigating the dynamic landscape of financial markets, traders seek strategies that empower them with the potential to capitalize on short-term price fluctuations. Intraday option trading, a fast-paced and potentially lucrative pursuit, has emerged as a formidable tool in the trader’s arsenal. Let’s delve into the fundamental strategies employed to unlock the profit-making potential of intraday option trading.

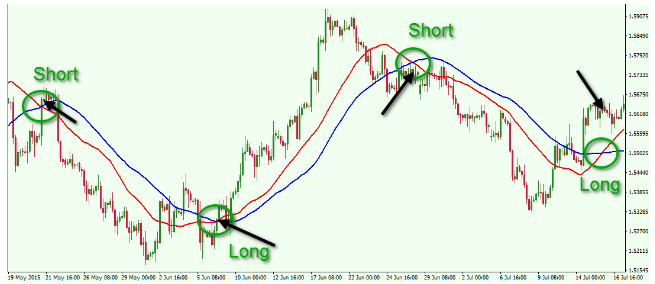

Image: www.adigitalblogger.com

Deciphering Delta-Neutral Strategies: A Balancing Act

Delta-neutral strategies stand out for their innate ability to neutralize market risks, making them a preferred choice for traders seeking downside protection. By pairing a long call option with a short put option of the same strike price and expiration date, the delta of the combined position is effectively reduced to zero. This strategic maneuvering allows traders to capitalize on directional price movements while mitigating the impact of volatility.

Exploiting the Upside: Bull Call Spread and Bull Put Spread

Bull call spreads involve purchasing a call option with a lower strike price and simultaneously selling a call option with a higher strike price. This configuration positions the trader to profit from upward price movements within a specific range, while also limiting potential losses. Similarly, bull put spreads entail buying a put option at a higher strike price and selling a put option at a lower strike price, enabling the trader to benefit from positive price fluctuations within a defined boundary.

Striking at the Core: Iron Condor and Strangle

Iron condor strategies combine four options – two calls and two puts – to create a trading zone within which the trader expects the underlying asset to fluctuate. Situated on opposite sides of this zone are two call spreads, with the lower strikes purchased and the higher strikes sold. Two put spreads complete the iron condor, with the lower strikes sold and the higher strikes purchased. By establishing this intricate framework, traders aim to profit from minimal price movements while profiting from time decay.

Strangle strategies resemble iron condors, employing two call options and two put options, but differ in their strike price configuration. Both call options (for a strangle) or both put options (for a bear strangle) are purchased at strike prices above and below the underlying asset’s current price, respectively. This construction suits traders anticipating substantial price fluctuations and is frequently employed in highly volatile markets.

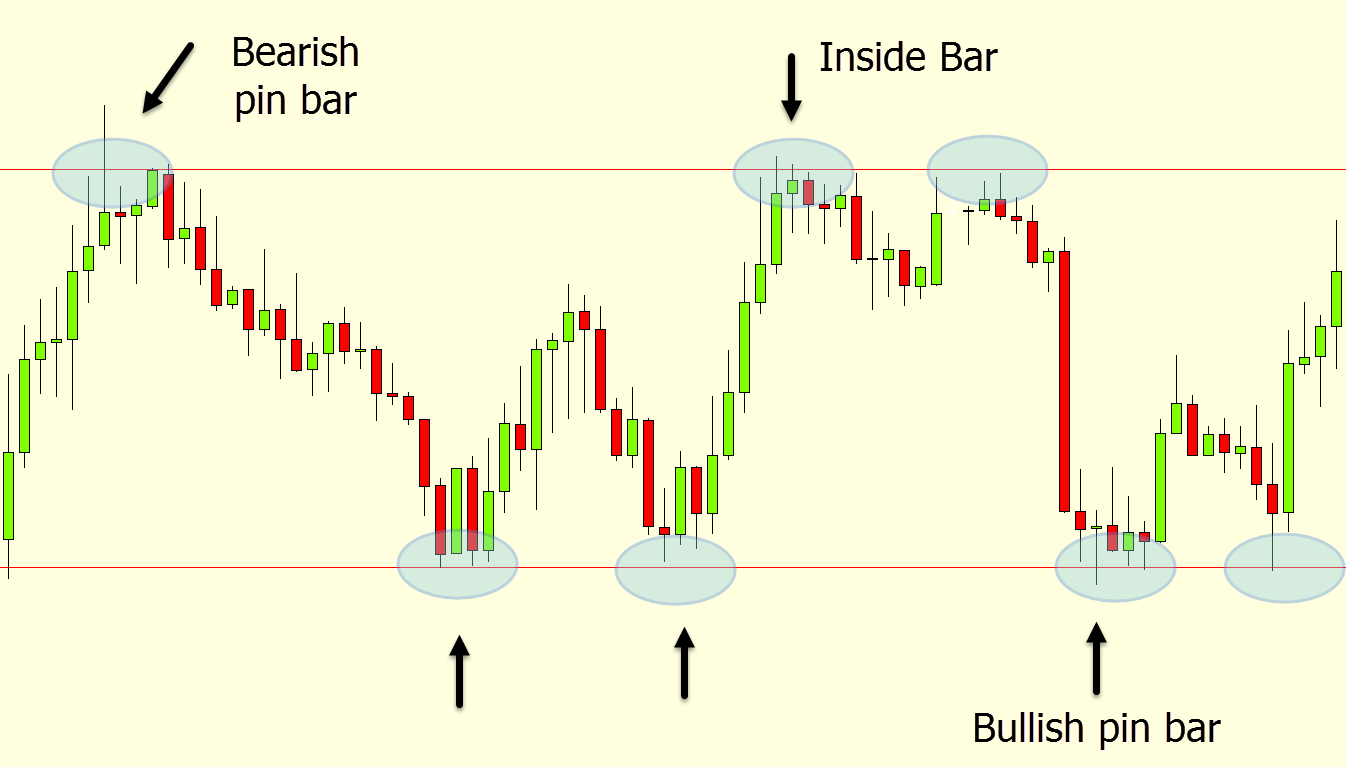

Image: pettitwhory1993.blogspot.com

Option Trading Strategies For Intraday

Image: blog.thetrader.top

Conclusion: Embarking on the Path to Intraday Option Trading Mastery

Intraday option trading presents a landscape of opportunities for traders seeking to profit from short-term market movements. By mastering the strategies outlined above – delta-neutral, bull call/put spreads, iron condors, and strangles – traders can navigate the dynamic financial markets with increased confidence. However, it is crucial to note that successful intraday option trading demands a thorough understanding of market dynamics, rigorous risk management practices, and a disciplined trading approach.