**An Introspection into the Enticing World of Trading**

In the realm of finance, the allure of trading beckons investors, promising both fortune and peril. Among the diverse trading strategies, two approaches stand out prominently: option trading and intraday trading. Each holds its own distinct advantages and challenges, sparking a fervent debate over which path leads to greater success. This article embarks on an enlightening journey to unveil the intricacies of these trading approaches, empowering you with the knowledge to make an informed choice that aligns with your financial aspirations.

Image: pettitwhory1993.blogspot.com

Option Trading: Navigating the Labyrinth of Contractual Options

Option trading delves into the realm of contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. These contracts, aptly named “options,” offer investors a versatile tool to speculate on the future price movements of stocks, commodities, currencies, or indices.

At its core, option trading revolves around two fundamental types: call options and put options. Call options grant the buyer the right to purchase an underlying asset at a set price (known as the “strike price”) on or before a specific date (the “expiration date”). Conversely, put options bestow upon the buyer the right to sell an underlying asset at the strike price on or before the expiration date.

Intraday Trading: Embracing the Thrill of Fleeting Market Moments

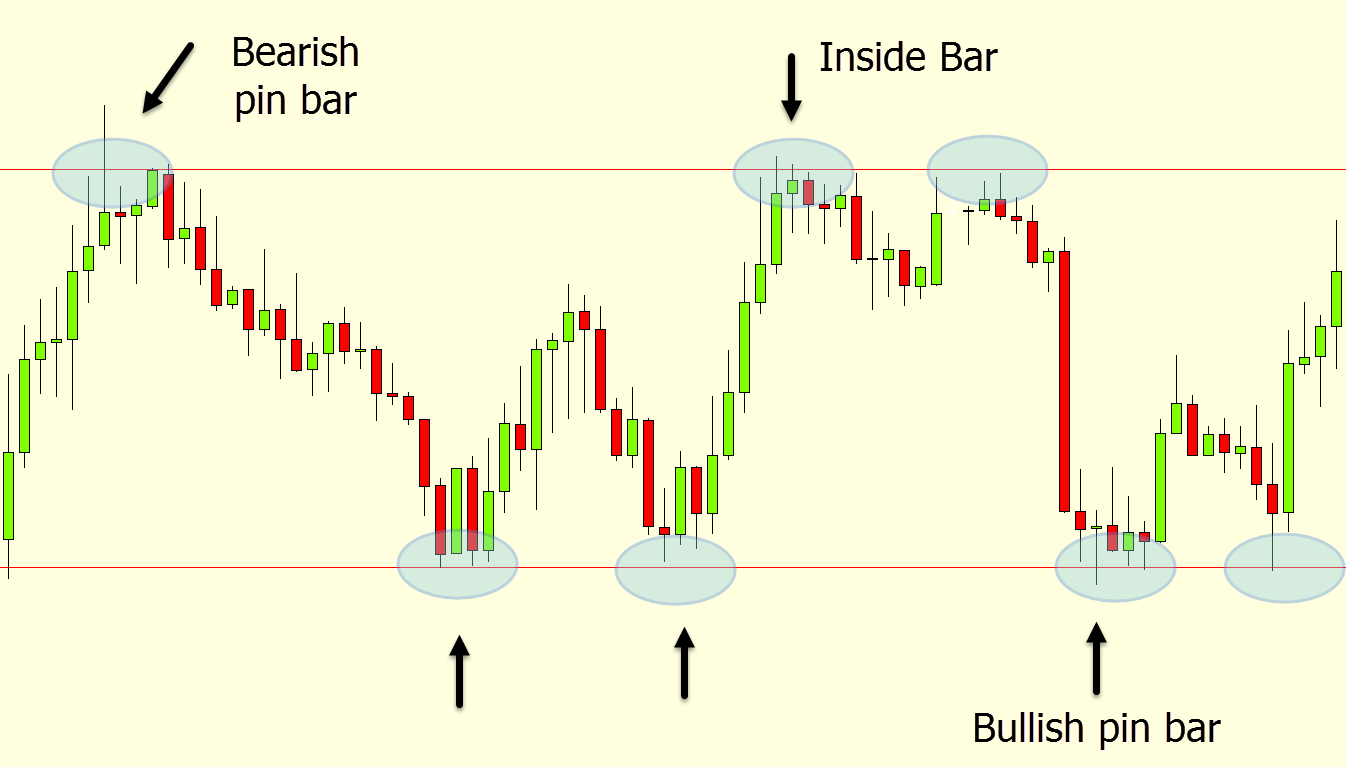

Intraday trading, also known as day trading, captivates traders with its dynamic nature. This strategy entails entering and exiting trades within a single trading day, capitalizing on short-term price fluctuations to accumulate profits. Intraday traders leverage various techniques, including technical analysis, to identify potential trading opportunities and execute trades swiftly.

The primary characteristic that distinguishes intraday trading from option trading lies in its short-term focus. Intraday traders seek to capitalize on intraday price movements, often employing leverage to magnify their potential returns. However, the inherent volatility of intraday trading amplifies the associated risks, making it a strategy better suited for experienced traders with a strong understanding of market dynamics.

Unveiling the Differences: A Comparative Analysis

To elucidate the contrasting attributes of option trading and intraday trading, we embark on a comparative analysis, exploring their key differences:

-

Risk Profile: Option trading generally carries lower inherent risk compared to intraday trading. Options provide a degree of flexibility, allowing traders to limit their potential losses by defining their maximum risk upfront. Intraday trading, on the other hand, exposes traders to potentially significant losses due to its short-term nature and the use of leverage.

-

Time Horizon: Option trading offers greater flexibility in terms of time horizon. Options contracts can have expiration periods ranging from a few days to several months or even years, providing traders with the option to align their trading strategy with their risk tolerance and market outlook. Intraday trading, conversely, is confined to the duration of a single trading day.

-

Capital Requirements: Intraday trading typically demands lower capital requirements compared to option trading. This is because intraday traders do not have to purchase the underlying asset outright, as they only deal with the options contracts. Option trading, on the other hand, requires traders to possess sufficient capital to cover the potential purchase price of the underlying asset.

-

Skill Level: Intraday trading generally requires a higher level of trading experience and expertise compared to option trading. Intraday traders must possess a thorough understanding of technical analysis and the ability to make quick, informed decisions in a fast-paced environment. Option trading, while not devoid of complexities, offers a more forgiving learning curve for novice traders.

Image: www.adigitalblogger.com

Choosing Wisely: Guiding You Towards the Right Path

The choice between option trading and intraday trading hinges upon a careful assessment of your individual circumstances, risk tolerance, and financial objectives. If you are a novice trader seeking a relatively low-risk entry into the trading arena, option trading might serve as a more prudent starting point. It provides you with the flexibility to define your risk upfront and offers valuable learning opportunities.

Conversely, if you possess a solid understanding of technical analysis, are comfortable with higher levels of risk, and have ample time to dedicate to trading, intraday trading could offer the potential for more substantial returns. Be mindful, however, that intraday trading demands a rigorous approach, coupled with the discipline to manage risk effectively.

Option Trading Or Intraday Trading Which Is Better

Conclusion: Embracing an Informed Decision

Whether you embark on the path of option trading or intraday trading, the key to success lies in acquiring a comprehensive understanding of the respective strategies, managing risk with unwavering discipline, and always striving to