Delving into Complex Options Strategies

Options trading involves various strategies that can enhance investment returns and manage risks. To assess your understanding of these strategies, let’s dive into the fifth quiz in our TD Ameritrade Options Quiz series.

Image: toughnickel.com

Section 1: Advanced Call and Put Strategies

-

Bull Call Spread: Explain how a bull call spread is constructed and its potential profit and loss profile.

-

Bear Put Spread: Describe the setup of a bear put spread, emphasizing its purpose and risk-reward characteristics.

-

Iron Condor: Illustrate an iron condor strategy, detailing its construction, profit potential, and risk considerations.

Section 2: Multi-Leg Options Strategies

-

Collar: Describe how a collar strategy combines a long call and a short put to provide both protection and potential returns.

-

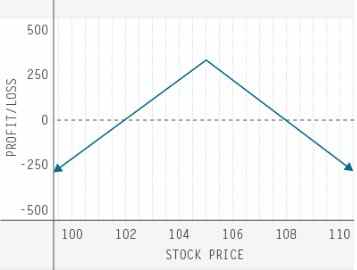

Butterfly Spread: Explain the construction and risk-reward profile of a bullish butterfly spread strategy.

-

Condor Spread: Discuss the different types of condor spreads (bullish, bearish, iron) and their respective profit/loss potential.

Section 3: Advanced Options Trading Concepts

-

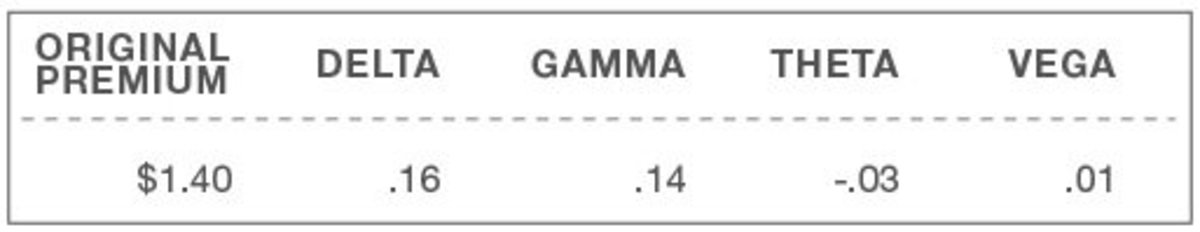

Delta Hedging: Explain the concept of delta hedging and its role in managing potential losses from long option positions.

-

Theta Gang: Describe the theta gang trading strategy, including its advantages and limitations.

-

Calendar Spread: Explain the setup and purpose of a calendar spread, highlighting its benefits and risks.

Image: toughnickel.com

Section 4: Practice Questions

-

Consider the following scenario: Stock XYZ is trading at $100. You expect a moderate increase in the stock price. Design an options strategy to profit from this scenario, explaining your rationale.

-

Describe the potential benefits and drawbacks of using margin in options trading.

-

Discuss the importance of managing risk in options trading, highlighting key strategies to mitigate losses.

Trading Options: Td Ameritrade Options Quiz Five Of Six

Image: toughnickel.com

Conclusion

This fifth quiz in our TD Ameritrade Options Quiz series has tested your knowledge of advanced call and put strategies, multi-leg options strategies, and advanced options trading concepts. By mastering these strategies, you can enhance your options trading prowess and potentially improve your returns while managing risks effectively. Remember, a comprehensive understanding of options trading is imperative for success in this dynamic market, and this quiz series aims to provide the necessary insights to navigate options strategies confidently.