SEO Title: Advanced Iron Condor Strategies: A Comprehensive Guide for Options Trading Rookies

Engaging Headline: The Iron Condor: Your Ticket to Options Trading Mastery

Introduction

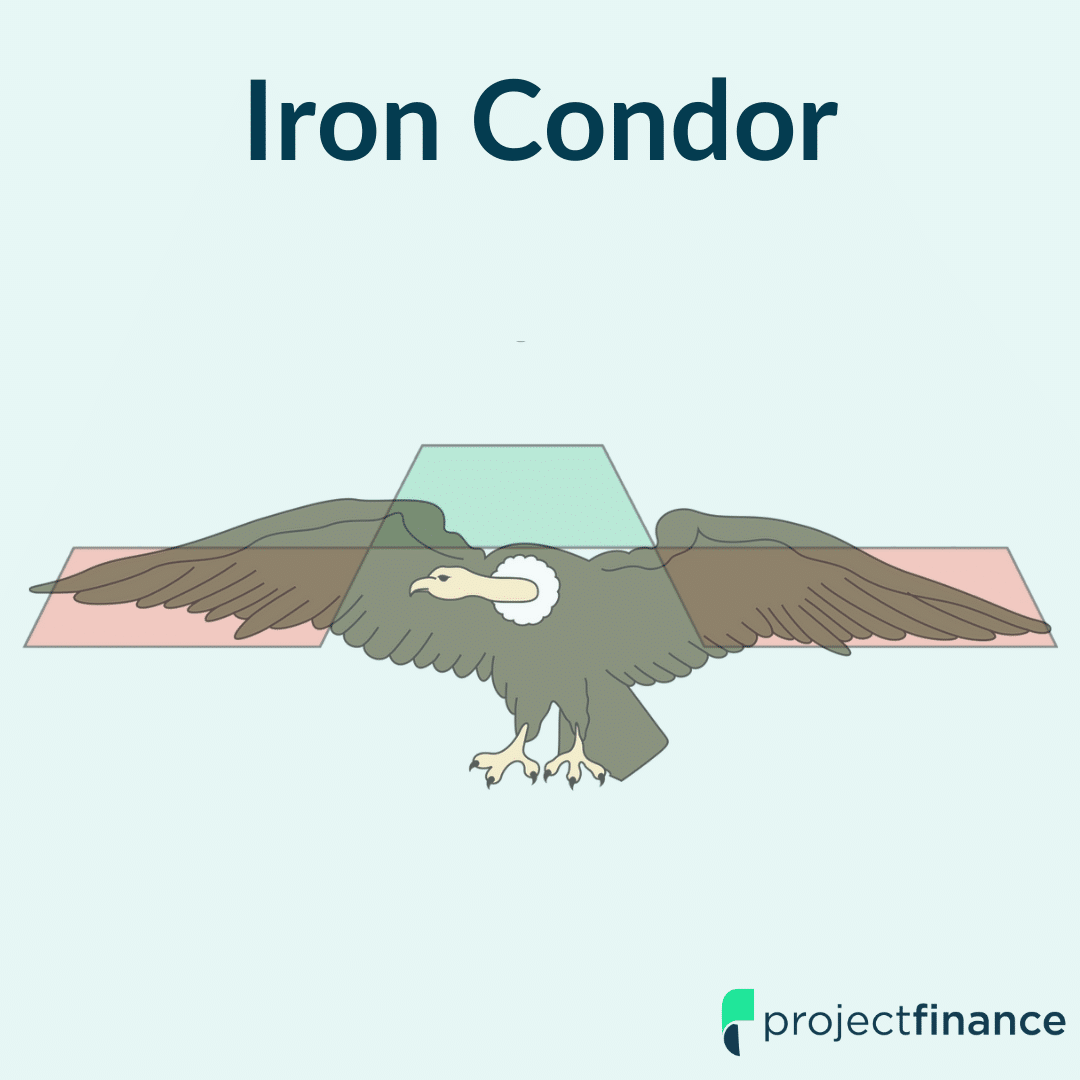

In the realm of options trading, the Iron Condor strategy stands tall as a versatile tool for both seasoned traders and aspiring rookies. It presents a unique blend of risk management and profit potential, inviting traders to navigate market fluctuations with precision. This comprehensive guide will delve into the intricacies of advanced Iron Condor strategies, empowering you with the knowledge to unlock its full potential.

Image: www.projectfinance.com

Understanding the Iron Condor

An Iron Condor is a multi-leg options strategy that involves selling both a Bull Call Spread and a Bear Put Spread at different strike prices. The goal is to capture profits from time decay and market neutrality while managing potential risks. By simultaneously selling both a call spread and a put spread, traders seek to profit from a narrow range-bound market where the underlying asset’s price stays within a predetermined corridor.

Defining the Key Components

Bull Call Spread: This involves selling a higher-priced call option (at-the-money or slightly in-the-money) and buying a call option with a higher strike price. The profit potential is limited to the premium received from the sale of the higher-priced call option, minus any premium paid for the purchase of the second call option.

Bear Put Spread: This entails selling a lower-priced put option (at-the-money or slightly in-the-money) and buying a put option with a lower strike price. The profit potential is capped at the premium received from selling the lower-priced put option, minus any premium paid for purchasing the second put option.

Advanced Strategies for Enhanced Returns

Adjusting the Wing Width: The distance between the strike prices of each spread influences the potential profit and risk. Wider wings lead to higher profit potential but also increased risk, while narrower wings lower the risk but limit profit. Traders must strike a balance based on their risk tolerance and market expectations.

Rolling the Short Call and Put: As the underlying asset price fluctuates, traders may consider adjusting the strike prices of the call spread and put spread to maintain market neutrality. This involves selling the existing options contracts and purchasing new ones with strike prices closer to the new market price.

Incorporating Time Decay: Iron Condors benefit from time decay as the value of the sold options diminishes over time. Traders must carefully consider the expiration dates of the options contracts to maximize the impact of time decay.

Managing Risk through Adjustments: Advanced Iron Condor strategies involve proactively monitoring the performance of the individual legs and adjusting them as needed. This may include selling or buying additional options contracts to reduce potential losses or secure profits.

Image: emugepavo.web.fc2.com

Options Trading For Rookies Advanced Iron Condor Strategies

Image: www.pinterest.com

Conclusion

The Iron Condor strategy, when combined with advanced techniques such as adjusting the wing width, rolling options contracts, and leveraging time decay, becomes a powerful tool for options traders. By understanding the underlying components and mastering these strategies, you can unlock the potential for profitable trades in a variety of market conditions. Remember, options trading carries both risks and rewards, and it’s crucial to approach it with a comprehensive understanding of the factors involved.