Introduction

Image: firstmilli.com

The allure of day trading options has captivated countless investors seeking quick profits. However, navigating this volatile market requires a keen understanding of which options are truly worth the risk. In this comprehensive guide, we’ll delve into the nuances of day trading options, exploring the strategies, risks, and rewards involved in identifying the most lucrative opportunities.

Understanding Option Contracts

An option is a financial contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). By day trading options, you’re speculating on the future value of the asset, hoping to profit from price movements within the same trading day.

Worthwhile Options Strategies for Day Trading

Numerous option strategies can be employed for day trading, each with its unique set of risk-reward dynamics. Here are some of the most commonly used:

-

Scalping: Aiming for small, quick profits by buying and selling options within minutes or even seconds. This strategy requires lightning-fast execution and a high level of technical understanding.

-

Range Trading: Identifying a price range where the option’s value oscillates and trading within those boundaries. This approach reduces risk but also limits potential profits.

-

Trend Trading: Buying or selling options that align with the prevailing market trend, profiting from sustained price movements. This strategy is less volatile but requires sound market analysis.

-

Spread Trading: Simultaneous purchase or sale of options with different strike prices and expiration dates, creating a spread. Spreads can limit risk but also require careful management to achieve maximum profitability.

Factors to Consider When Selecting Day Trading Options

Numerous elements should be meticulously considered when choosing which options to trade during the day:

-

Volatility: The higher the volatility of the underlying asset, the more potential for profit, but also risk.

-

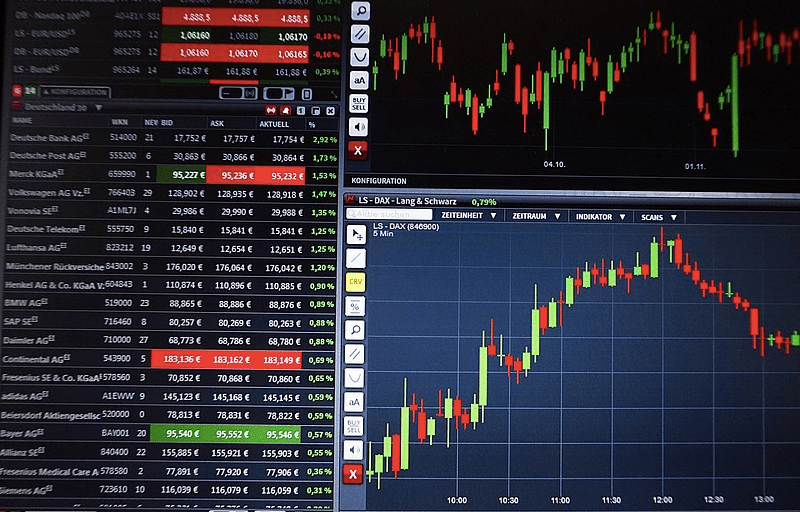

Liquidity: Options with high liquidity (volume) ensure quick and efficient execution of trades.

-

Implied Volatility: This measure reflects the market’s expectations of future volatility and can influence option pricing.

-

Time to Expiration: The closer an option is to expiration, the less time it has to appreciate in value, potentially limiting potential profits.

Expert Insights and Actionable Tips

To succeed in day trading options, incorporating insights from experienced traders is crucial. Here’s a snippet of wisdom:

-

“Always remember, the market can stay irrational longer than you can stay solvent.” – John Maynard Keynes

-

Risk Management: Risk management is paramount. Know your risk tolerance and manage your trades accordingly.

-

Stay Informed: Continuously monitor market news and technical indicators to stay ahead of market movements.

-

Set Realistic Goals: Don’t expect to get rich quick. Day trading options requires patience, discipline, and consistency.

Conclusion

Day trading options can offer lucrative possibilities, but it’s crucial to exercise caution and equip yourself with the necessary knowledge and skills. By thoroughly comprehending the options landscape, employing sound trading strategies, and adhering to risk management principles, you can significantly enhance your chances of success in this fast-paced market. Remember, investing in options always carries inherent risks, and diversification is essential in any investment portfolio.

Image: www.youtube.com

Which Options Are Worth Day Trading

Image: www.daytrading.com