It has been widely recognised that option trading can be a lucrative avenue for investors looking to enhance their returns and manage risk. However, navigating the complex world of options requires a firm understanding of the expected option trading level (EOTL). In this comprehensive guide, we will delve into the concept of EOTL, exploring its significance, practical applications, and the factors that influence its determination. By the end of this article, you will gain valuable insights and a practical framework for leveraging EOTL to make informed trading decisions.

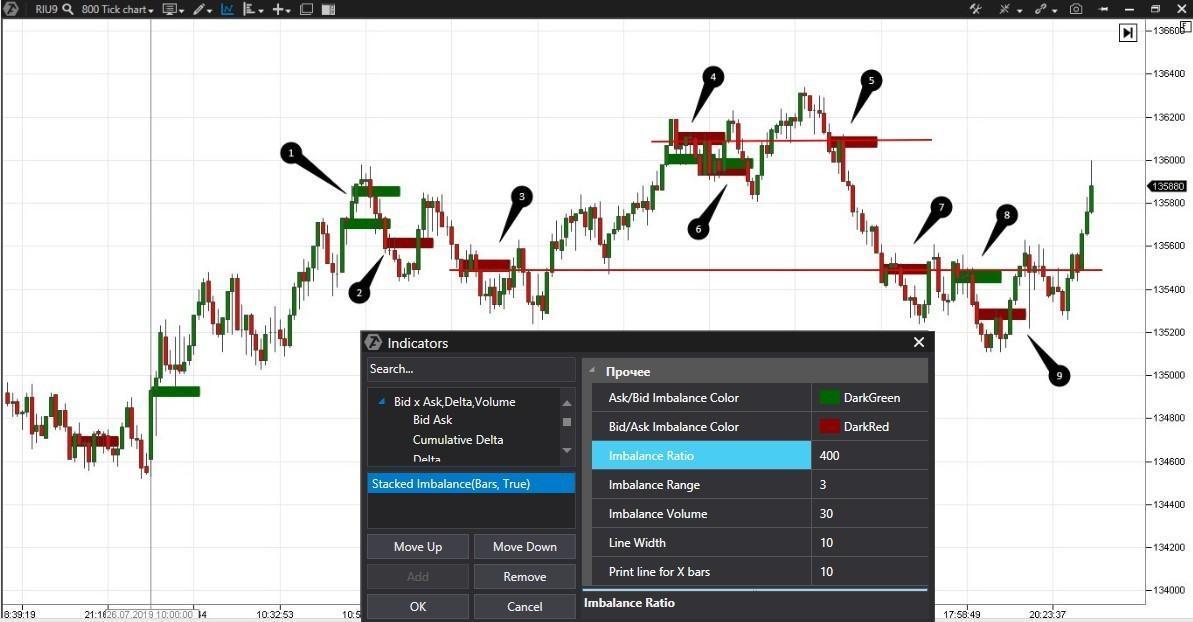

Image: atas.net

What is Expected Option Trading Level (EOTL)?

Expected Option Trading Level (EOTL) represents the average price of an underlying asset over the lifetime of an option contract. It serves as a benchmark against which the actual price of the underlying asset is compared to assess the profitability of an option trade. Essentially, EOTL reflects the market’s consensus on the expected future value of the underlying asset, considering various factors such as market conditions, economic trends, and the option’s strike price.

Understanding EOTL is crucial for option traders as it provides them with a baseline for evaluating potential trades and making informed decisions about whether to exercise or sell their options. If the actual price of the underlying asset deviates significantly from the EOTL, traders may adjust their strategies accordingly, such as adjusting the strike price or adjusting the expiration date, to maximise their profit potential or mitigate losses.

Factors Influencing Expected Option Trading Level

Various factors play a significant role in determining the expected option trading level. These include:

-

Underlying Asset Price: The current price of the underlying asset serves as a primary factor in determining the EOTL. Options with strike prices close to the underlying asset’s current price typically have lower EOTLs, while options with strike prices further away have higher EOTLs.

-

Time to Expiration: The time remaining until the option’s expiration date also influences the EOTL. The longer the time to expiration, the higher the EOTL, as there is more uncertainty about the future direction of the underlying asset’s price.

-

Volatility: Market volatility measures the rate at which the price of an underlying asset fluctuates. Higher volatility is associated with higher EOTLs, as options with higher volatility have a greater potential for significant price movements.

-

Interest Rates: Interest rates impact the EOTL of options because they influence the cost of carrying the underlying asset. Higher interest rates increase the cost of carry, resulting in lower EOTLs.

-

Dividend Yield: For stocks, the dividend yield should also be taken into account as it influences the EOTL. Stocks with higher dividend yields tend to increase the EOTL of call options and reduce the EOTL of put options.

By considering these factors, traders can gain a deeper understanding of how EOTL is determined and leverage this knowledge to make more informed trading decisions.

Image: blog.dhan.co

Expected Option Trading Level

Image: www.simplertrading.com

Practical Applications of Expected Option Trading Level

EOTL has several practical applications in option trading:

-

Evaluating Option Premiums: By comparing the option premium with the EOTL, traders can assess whether the option is priced fairly or overpriced/underpriced.

-

Determining Breakeven Points: The EOTL provides a reference point to calculate the breakeven price for an option trade, which is the price at which the trader will neither profit nor loss from the trade.

-

Assessing Option Volatility: EOTL can be used to gauge market sentiment towards the volatility of the underlying asset. Higher EOTLs indicate higher expected volatility.

-

Identifying Trading Opportunities: By analysing EOTL, traders can identify potential trading opportunities. For instance, if the EOTL is significantly different from the current price of the underlying asset, an opportunity for a profitable trade may exist.

-

Hedging Risk: EOTL can assist in determining the appropriate parameters for hedging strategies using options, enabling traders to manage risk effectively.

In summary, understanding and applying EOTL is essential for successful option trading. By considering the factors that influence EOTL and its practical applications, traders can enhance their decision-making process and improve their chances of profiting from option trading while efficiently managing risk.