Imagine controlling the outcome of your investment fortunes, setting the rules for your gains and losses. Enter options trading—a captivating strategy that grants you the power to shape your financial future. This comprehensive guide will unveil the fundamentals of options trading, empowering you to navigate this thrilling arena with confidence and finesse.

Image: www.youtube.com

What are Options?

Options are financial contracts that grant you the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price on or before a specified date. Think of options as tickets that give you the option to either board or disembark from an investment ride at a time and price of your choosing.

Understanding Key Concepts

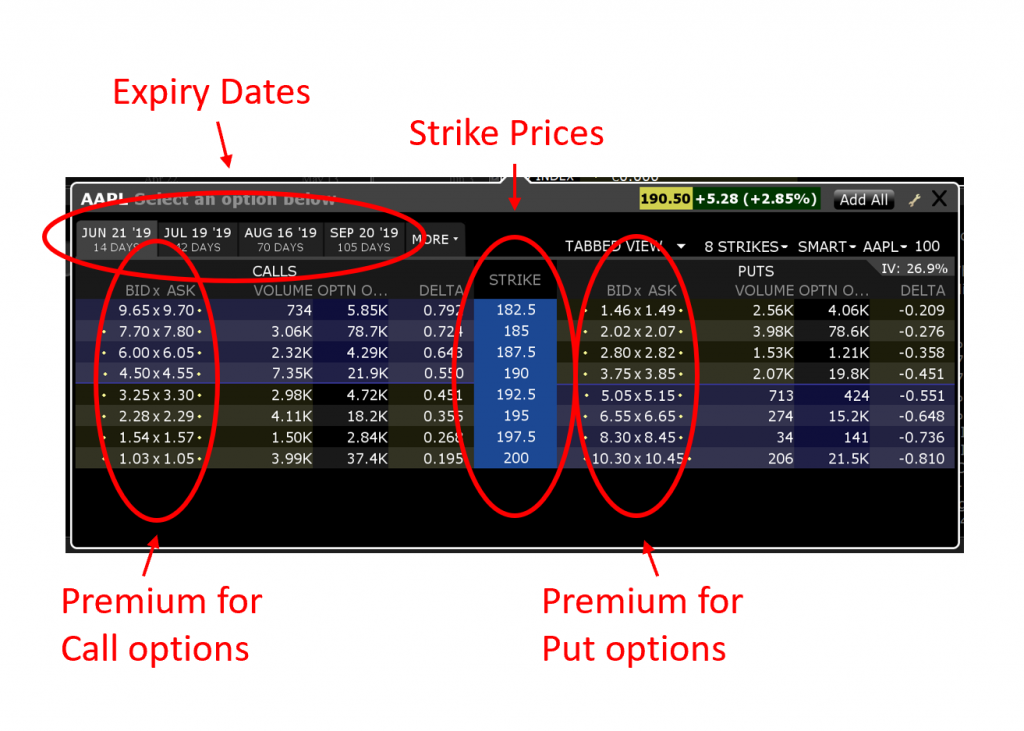

- Underlying Asset: The underlying asset can be stocks, bonds, commodities, ETFs, or indices. It’s the asset to which your options contract pertains.

- Strike Price: This is the price at which you have the right to buy (call) or sell (put) the underlying asset.

- Expiration Date: This is the final date on which you can exercise your right to buy or sell under your option contract.

- Premium: The premium is the price you pay to acquire an options contract.

Types of Options

Call options provide you with the right to buy the underlying asset at the strike price on or before the expiration date. Put options, on the other hand, grant you the right to sell at the strike price.

Benefits of Options Trading

- Limited Risk: Unlike owning the underlying asset, your risk is limited to the premium you pay for the options contract.

- Leverage: Options can provide a higher potential for returns compared to owning the underlying asset, allowing you to multiply your profits.

- Flexibility: Options empower you to customize your trading strategy, setting parameters tailored to your risk tolerance and market expectations.

Understanding Options Trading Strategies

From speculative to risk-averse, there’s an array of options trading strategies to choose from. Popular ones include covered calls, cash-secured puts, straddles, and strangles. Explore the intricacies of each strategy to find your optimal fit.

Expert Insights and Actionable Tips

- “Options trading is like playing chess—anticipating your opponent’s moves and devising a strategy accordingly.” – Warren Buffett

- “When the market moves against you, don’t panic. Sell your options to limit your losses.” – Michael J. Khouw

Remember

Options trading carries risks, but with proper knowledge and risk management, it can be an exciting avenue for financial growth. Seek guidance from a qualified financial advisor before making any trades.

Conclusion

Embrace the thrill of options trading, armed with the knowledge and insights provided in this comprehensive guide. Unveil the potential returns, master risk management strategies, and conquer the untamed world of options trading. The power to shape your financial destiny is in your hands.

![The Basics of Options [Infographic]](https://infographicjournal.com/wp-content/uploads/2018/02/The_Basics_of_Options.jpg)

Image: infographicjournal.com

Options Trading Basics Ppt

Image: algotrading101.com