In the ever-evolving realm of finance, option trading has emerged as a sophisticated strategy that empowers investors to harness market dynamics and mitigate risk. Tencent, a global tech behemoth, offers a comprehensive platform for option trading, providing a gateway to a vast array of opportunities for astute investors. This comprehensive guide delves into the intricate world of Tencent option trading, empowering you with the knowledge and insights to make informed decisions in this dynamic market.

![Dove e come comprare azioni Tencent [2024] Previsioni dividendo ...](https://www.binaryoptioneurope.com/wp-content/uploads/2023/04/dove-e-come-comprare-azioni-tencent-previsioni-dividendo-930x620.jpg)

Image: www.binaryoptioneurope.com

Understanding Tencent Option Trading: A Foundation for Success

Option trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, on or before a predefined date, the expiration date. In the case of Tencent option trading, the underlying asset is Tencent shares, giving traders the flexibility to capitalize on fluctuations in the share price while managing risk.

Options contracts come in two primary flavors: calls and puts. Call options confer the right to buy the underlying asset, while put options give the holder the right to sell. The price of an option contract, known as the premium, is determined by a complex interplay of factors, including the underlying asset’s price, time to expiration, volatility, and interest rates.

Benefits of Tencent Option Trading: Unveiling the Advantages

Tencent option trading offers a plethora of benefits that appeal to both novice and seasoned traders. These include:

-

Flexibility: Tencent option contracts afford traders the flexibility to adapt their strategies to evolving market conditions. Whether seeking to speculate on price movements, hedge against downside risk, or generate income, option trading empowers traders to tailor their approach to suit their specific goals.

-

Leverage: Options offer a form of leverage, allowing investors to control a larger position in the underlying asset with a relatively small capital outlay. This leverage can amplify potential returns, but it also magnifies risk, underscoring the importance of prudent risk management.

-

Income Generation: Option trading presents opportunities for generating income through various strategies, such as selling covered calls or writing puts. These strategies involve selling option contracts to other traders, potentially generating income even when the underlying asset’s price remains stagnant.

Historical Evolution of Tencent Option Trading: Tracing the Journey

Tencent’s foray into option trading can be traced back to 2015, when the Shenzhen Stock Exchange launched stock options for a select group of companies, including Tencent. Since then, Tencent option trading has experienced steady growth, attracting both domestic and international investors. In 2019, Tencent options were listed on the Hong Kong Stock Exchange, further broadening the accessibility of this trading instrument.

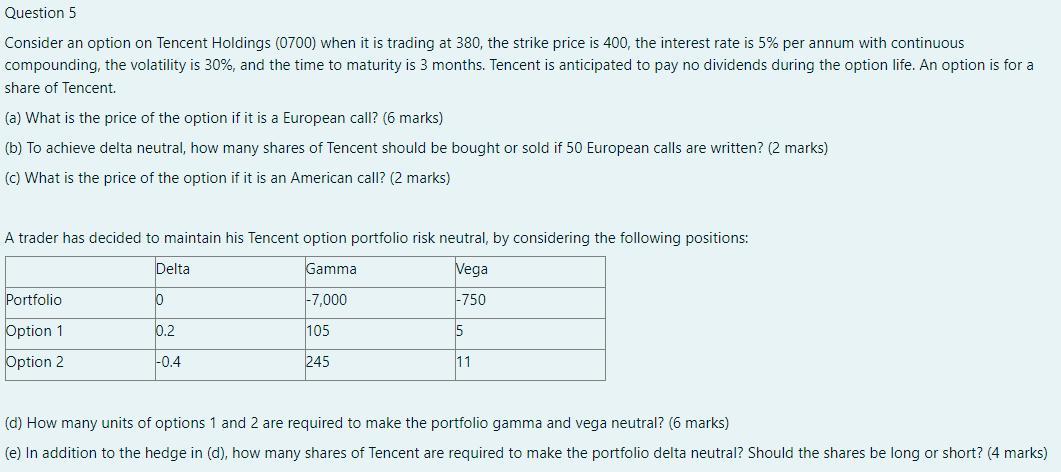

Image: www.chegg.com

Real-World Applications of Tencent Option Trading: Exploring Practical Use Cases

Tencent option trading finds application in a variety of real-world scenarios, including:

-

Hedging: Investors can use Tencent options to hedge against potential losses in their underlying investments. For instance, an investor holding a substantial position in Tencent shares could purchase put options to mitigate downside risk in the event of a market downturn.

-

Speculation: Option trading also offers opportunities for speculation on the direction of Tencent’s stock price. Traders can buy call options, betting on a price increase, or sell put options, speculating on a price decline.

-

Income Generation: As mentioned earlier, Tencent option trading can be employed to generate income. Selling covered calls involves selling call options while simultaneously holding an equivalent number of shares in the underlying asset, potentially generating income as long as the underlying price remains below the strike price.

Tencent Option Trading

Image: seekingalpha.com

Conclusion

Tencent option trading presents a powerful tool for investors seeking to enhance their portfolio returns and manage risk. By comprehending the intricacies of option contracts and their application in the context of Tencent’s stock, traders can harness the potential of this trading instrument to achieve their financial goals. As with any form of trading, a thorough understanding of the risks involved is crucial, and investors should approach Tencent option trading with prudence and a sound risk management strategy.