Tencent, a Chinese multinational conglomerate, has attracted the attention of investors worldwide. With its vast presence in various industries, including social media, gaming, and fintech, it offers exciting opportunities for option traders. Thinkorswim, a renowned trading platform, has emerged as a popular choice for traders seeking to trade Tencent options.

Image: s3.amazonaws.com

Understanding Tencent Option Trading

Option trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell a specified asset at a certain price on a future date. In the case of Tencent option trading, traders can speculate on the price movements of Tencent’s stock (TCEHY) using these contracts.

Types of Tencent Options

There are two main types of Tencent options: calls and puts. Call options confer the right to buy Tencent shares at a specific strike price on or before the expiration date. Put options, on the other hand, provide the right to sell Tencent shares at the specified strike price before expiration.

Advantages of Tencent Option Trading

Trading Tencent options offers several advantages, including:

- Limited risk: Options have predetermined maximum losses, unlike trading shares, where potential losses can be substantial.

- Flexibility: Options contracts allow traders to customize their strategies based on risk tolerance and time horizon.

- Leverage: Traders can control a significant number of Tencent shares with a relatively small investment.

Image: www.johnharpertrader.com

Tips and Expert Advice for Tencent Option Trading

Consider the following tips when trading Tencent options on Thinkorswim:

- Conduct thorough research: Analyze Tencent’s financial statements, news, and market trends to make informed decisions.

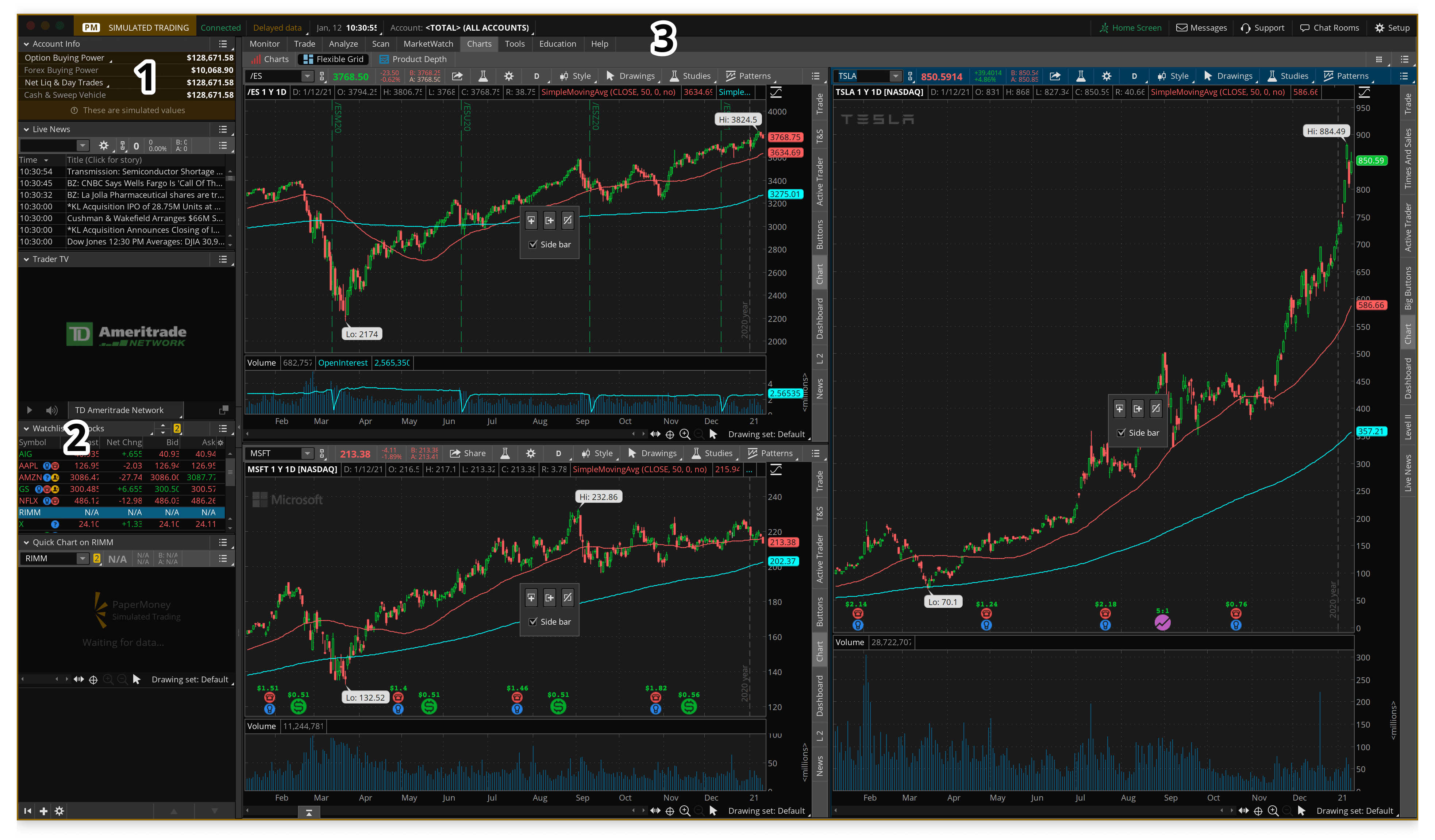

- Use technical analysis: Study historical price charts and identify potential trading opportunities using technical indicators.

- Manage risk effectively: Set precise stop-loss levels and limit your position size.

- Consider options strategies: Explore various options trading strategies to enhance potential returns, such as covered calls and iron condors.

Explanation of Expert Advice

The expert advice provided focuses on mitigating risk and maximizing gain. By conducting thorough research, traders can stay updated with Tencent’s developments and make prudent decisions. Technical analysis aids in identifying trading signals that can increase accuracy. Implementing effective risk management measures safeguards against excessive losses, while options strategies can enhance profit potential through more sophisticated maneuvers.

FAQs on Tencent Option Trading

What are the risks involved in Tencent option trading?

Option trading carries the risk of losing the entire invested capital. Traders should carefully assess their risk tolerance before engaging.

How do I get started with Tencent option trading on Thinkorswim?

Open an account with a broker that offers Thinkorswim, fund it, and learn the platform’s features and options trading mechanics.

What is the minimum investment required for Tencent option trading?

The minimum investment depends on the strike price, premium, and number of contracts traded. It can vary significantly.

How long do Tencent options contracts last?

Most Tencent options contracts expire monthly, giving traders varying time frames for their trades.

Tencent Option Trading Think Or Swim

![[Thinkorswim] Option Trading Earning Strategy - YouTube](https://i.ytimg.com/vi/Gm4U7LNkdXc/maxresdefault.jpg)

Image: www.youtube.com

Conclusion

Tencent option trading on Thinkorswim offers traders the opportunity to speculate on the price movements of a global tech giant. By following the tips, expert advice, and carefully considering the risks involved, traders can navigate the complexities of options trading and potentially reap its rewards. Embrace the power of options to enhance your investment portfolio and elevate your trading game. Would you like to delve deeper into the realm of Tencent option trading?