Options trading can be a complex and challenging investment strategy, but it can also be a lucrative one. With the right tools and knowledge, anyone can learn how to trade options profitably. One of the best platforms for options trading is thinkorswim, a powerful and user-friendly software that provides traders with everything they need to succeed.

Image: www.youtube.com

In this guide, we will take a closer look at options trading on thinkorswim. We will cover the basics of options trading, including the different types of options, the risks involved, and how to place an option trade. We will also provide an overview of thinkorswim’s features and capabilities, and we will show you how to use the platform to place and manage your trades.

What is Options Trading?

Options trading is a strategy that allows investors to speculate on the future price of a stock, commodity, or other asset. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. There are two main types of options: calls and puts.

Call options give the buyer the right to buy an underlying asset at a specified price on or before a certain date. Put options give the buyer the right to sell an underlying asset at a specified price on or before a certain date.

Risks of Options Trading

Options trading involves significant risk. The value of an option can fluctuate rapidly, and it is possible to lose money on an option trade even if the underlying asset does not move in your favor.

The risks of options trading include:

- The option may expire worthless.

- The underlying asset may move in an unexpected direction.

- The volatility of the underlying asset may increase or decrease.

How to Place an Option Trade

To place an option trade, you will need to open an account with a broker that offers options trading. Once you have opened an account, you can start trading options by following these steps:

- Choose an underlying asset.

- Decide whether you want to buy a call option or a put option.

- Select the strike price.

- Select the expiration date.

- Enter the number of contracts you want to buy or sell.

- Submit your order.

Image: www.techradar.com

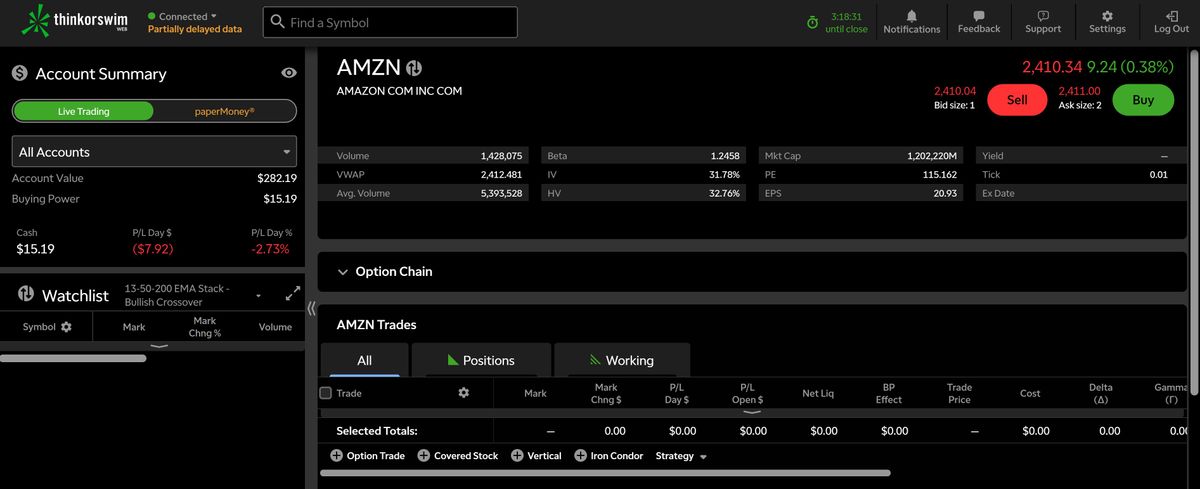

thinkorswim Features and Capabilities

thinkorswim is a powerful and user-friendly options trading platform that provides traders with everything they need to succeed.

Thinkorswim’s features and capabilities include:

- Real-time quotes and charts

- Advanced charting tools

- Trade execution tools

- Risk management tools

- Paper trading

How to Use thinkorswim

To use thinkorswim, you will need to create an account and download the software.

Once you have installed thinkorswim, you can start trading options by following these steps:

- Log in to your account.

- Select the “Trade” tab.

- Choose the underlying asset you want to trade.

- Select the type of option you want to buy or sell.

- Enter the strike price and expiration date.

- Enter the number of contracts you want to buy or sell.

- Click the “Submit Order” button.

Options Trading On Thinkorswim

https://youtube.com/watch?v=QmmLBmtw5Zw

Conclusion

Options trading can be a complex and challenging investment strategy, but it can also be a lucrative one. With the right tools and knowledge, anyone can learn how to trade options profitably.

Thinkorswim is one of the best platforms for options trading. It provides traders with everything they need to succeed, including real-time quotes and charts, advanced charting tools, trade execution tools, risk management tools, and paper trading.