Introduction

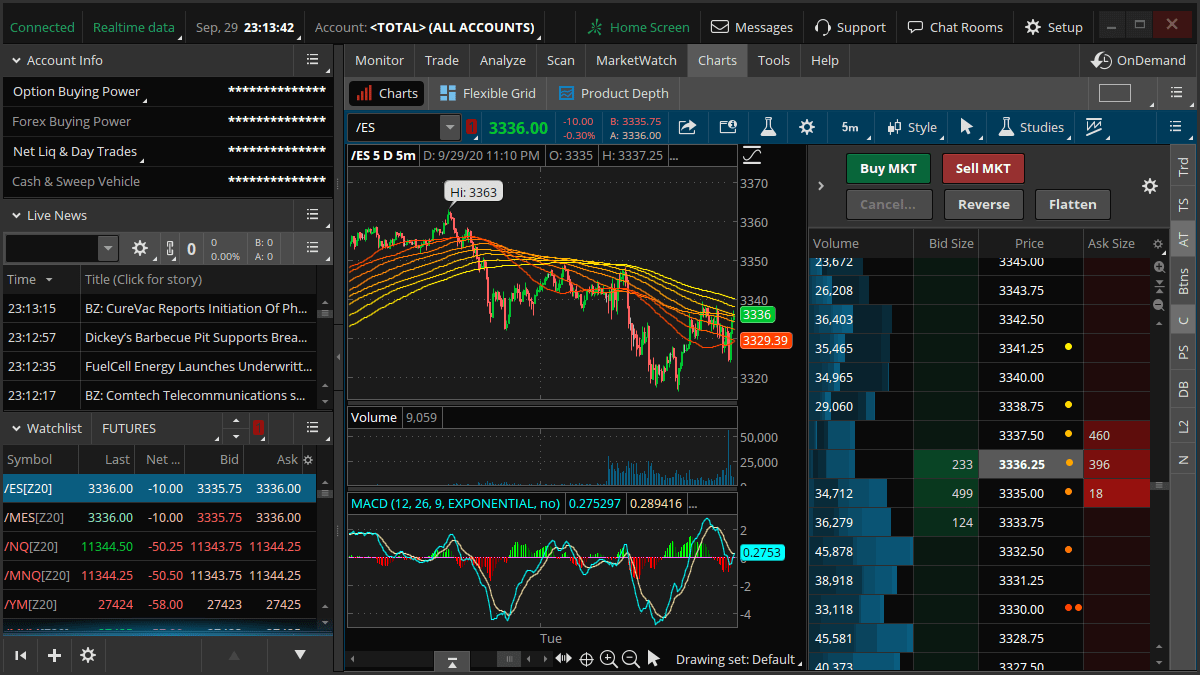

As a seasoned options trader, I’ve experienced firsthand the transformative power of using Thinkorswim, the renowned trading platform. Its robust features and intuitive interface have revolutionized my ability to navigate the complex and dynamic world of options trading. In this comprehensive guide, I will delve into the intricacies of trading ES options with Thinkorswim, empowering you to unlock the full potential of this remarkable platform.

Image: www.wallstreetzen.com

Unleashing the Power of Thinkorswim

Thinkorswim has established itself as the industry-leading platform for options traders due to its unparalleled set of tools and functionalities. From real-time market data and advanced charting capabilities to sophisticated order entry systems and comprehensive risk management features, Thinkorswim caters to traders of all levels. Whether you’re a seasoned professional or just starting your journey in options trading, Thinkorswim has everything you need to succeed.

Options Trading 101

Before diving into the specifics of using Thinkorswim, let’s establish a solid foundation in options trading. Options are derivative contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset (ES in this case) at a predetermined strike price on or before a specific expiration date. They provide traders with various strategies for speculating on the future price movements of an asset, hedging against potential losses, and generating income.

Getting Started with ES Options

The ES (E-mini S&P 500) is a futures contract based on the S&P 500 index. It is a popular underlying asset for options trading due to its high liquidity, transparency, and correlation with the overall stock market. To trade ES options on Thinkorswim, you will need to open an account with a brokerage that supports futures trading and install the Thinkorswim platform. Once you have set up your account, you can begin exploring the various options trading opportunities available through Thinkorswim.

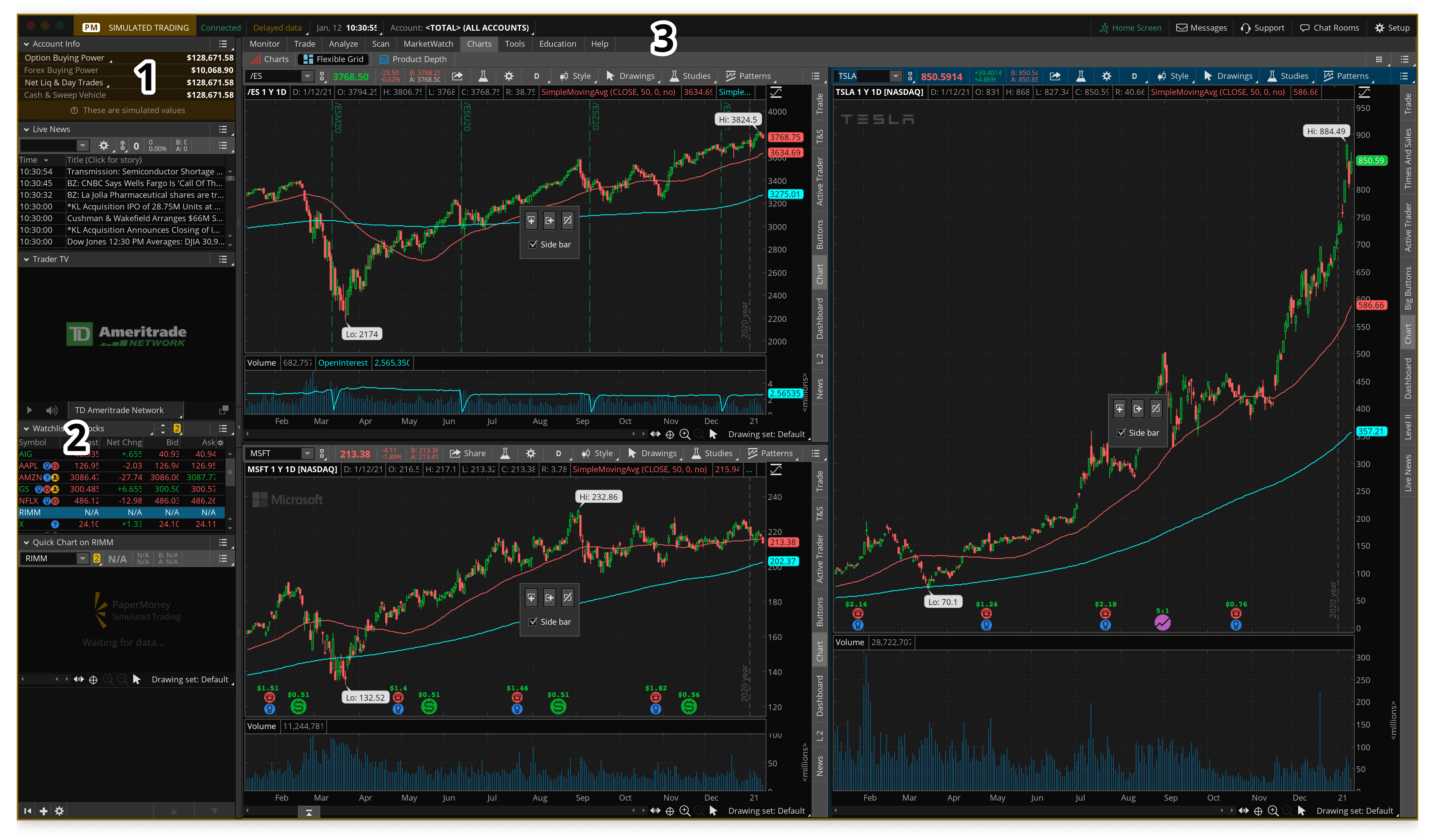

Image: thecollegeinvestor.com

Trading Strategies with Thinkorswim

Thinkorswim offers a multitude of strategies and tools to enhance your options trading experience. Some of the most popular strategies include:

- Bull Call Spread: Buying a call option with a lower strike price and selling a call option with a higher strike price to create a bullish position.

- Bear Put Spread: Buying a put option with a higher strike price and selling a put option with a lower strike price to create a bearish position.

- Iron Condor: Combining a bull call spread and a bear put spread with the same expiration date but different strike prices.

- Strangle: Buying a call option and a put option at the same strike price but with different expiration dates.

- Straddle: Buying a call option and a put option at the same strike price and expiration date.

Tips and Expert Advice

- Use technical analysis to identify potential trading opportunities.

- Utilize risk management techniques such as stop-loss orders and position sizing.

- Monitor the news and economic indicators to stay informed about market conditions that may impact ES prices.

- Practice your trading strategies on a paper trading account before risking real capital.

- Consult with experienced options traders or seek professional advice to enhance your knowledge and skills.

FAQs

- What is the minimum capital required to trade ES options?

The minimum capital depends on the brokerage you choose and the strategy you plan to trade. It is advisable to consult with your broker to determine appropriate requirements. - What are the risks involved in trading ES options?

Trading options involves inherent risk, including the potential for losing some or all of the invested capital. It is crucial to manage risk effectively and thoroughly understand the options strategies you employ. - What is the difference between options and futures?

Options are contracts that give the holder the right, but not the obligation, to buy or sell the underlying asset. Futures are contracts that obligate the holder to buy or sell the underlying asset at a predetermined price on a specific date.

Trading Es Options With Thinkorswim

Image: www.youtube.com

Conclusion

Trading ES options with Thinkorswim offers a powerful avenue for sophisticated investors to capitalize on market opportunities. By leveraging Thinkorswim’s comprehensive suite of tools and features, you can navigate the options trading landscape with greater confidence and precision. Remember, knowledge and experience are fundamental to success in options trading. I invite you to continue exploring the vast world of Thinkorswim and options trading to unlock the full potential of your trading endeavors.