Options trading is a sophisticated investment strategy that involves leveraging financial instruments called options. Options are contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. This unique characteristic allows investors to potentially generate profits even when the market is moving sideways or down.

Image: tradewithmarketmoves.com

Understanding Options Basics

An option contract consists of four key elements:

- Underlying asset: Can be a stock, index, commodity, or currency.

- Strike price: The specified price at which the underlying asset can be bought or sold.

- Expiration date: The point at which the option expires and becomes worthless.

- Premium: The price paid upfront by the buyer to acquire the option.

Types of Options

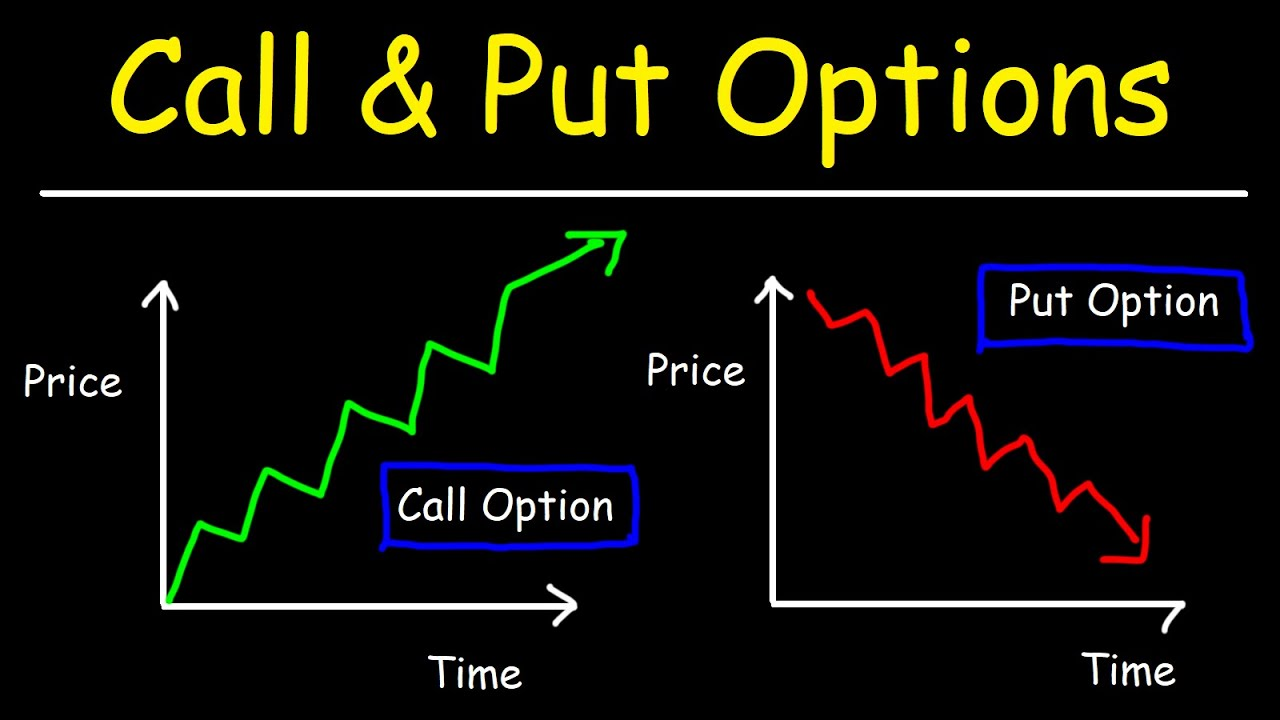

There are two main types of options:

- Call options: Grant the holder the right to buy the underlying asset.

- Put options: Grant the holder the right to sell the underlying asset.

Each option type can be further classified based on its expiration date, such as monthly, weekly, or daily options.

How Options Trading Works

When a trader buys an option, they can speculate on the future price movement of the underlying asset and profit from the difference between the premium paid and the price at which the option can be exercised.

- Call options: Profitable if the underlying asset’s price rises above the strike price.

- Put options: Profitable if the underlying asset’s price falls below the strike price.

However, it’s important to note that options do not guarantee profits. The premium paid can be lost if the underlying asset does not move in the desired direction before the expiration date.

Image: www.markettradersdaily.com

Benefits of Options Trading

- Potential for leverage: Control a substantial amount of the underlying asset with a relatively small investment.

- Hedging against risk: Can use options to reduce the risk exposure of other investments.

- Flexibility: Options come with various expiration dates, strike prices, and contract sizes, allowing for tailored investment strategies.

- Income generation: Premium collected when selling options can provide potential income.

Risks of Options Trading

- Limited profit potential: Profits are capped at the difference between the strike price and the underlying asset’s price.

- Time decay: Option premiums erode over time as the expiration date approaches, regardless of the underlying asset’s price movement.

- High leverage: Can lead to significant losses if the underlying asset’s price moves against the investor’s position.

- Complexity: Options trading requires a thorough understanding of market dynamics and option pricing models.

Strategies in Options Trading

Options traders employ various strategies to maximize returns and manage risk. Some common strategies include:

- Covered calls: Selling call options while owning the underlying asset to generate income from the premium.

- Protective puts: Buying put options to protect a stock position against potential downturns.

- Bull call spread: Buying one call option at a lower strike price and selling another call option at a higher strike price.

- Bear put spread: Selling one put option at a higher strike price and buying another put option at a lower strike price.

Who is Options Trading Suitable For?

Options trading can be a suitable investment for those who:

- Are experienced in financial markets and have a good understanding of options pricing and risk management.

- Are willing to accept potentially high leverage and risk.

- Seek potential income generation and enhanced returns.

- Have the time and effort to closely monitor market conditions.

Options Trading Means

Image: voxt.ru

Conclusion

Options trading presents a versatile investment tool with the potential for both profit generation and risk management. However, it’s crucial to approach options trading with caution and thoroughly understand its complexities before making any investment decisions. By leveraging proper research, strategic planning, and a healthy dose of caution, investors can effectively navigate the world of options trading and harness its potential benefits.