When I first ventured into the world of options trading, one name echoed through every corner: European options. Intrigued by their subtle nuances and elegant simplicity, I embarked on a journey to unravel the enigmatic world of these financial instruments. Along the way, I discovered a tapestry of knowledge that I am eager to share, offering you a comprehensive guide to understanding what lies within the realm of trading European options.

Image: medium.com

Before we delve into the specifics of European options, let us first embark on a brief historical voyage. The year was 1973 when the Chicago Board Options Exchange (CBOE) marked a pivotal moment in the annals of finance by launching the first standardized options market. Thus, a new era of risk management and speculation was ushered in, creating a vibrant marketplace for derivatives trading.

What Defines European Options?

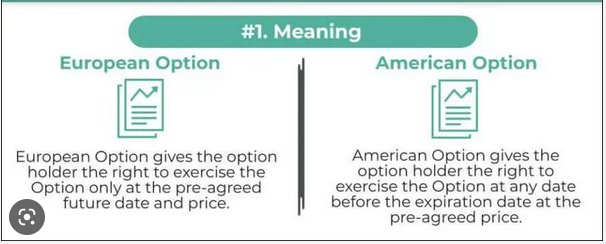

European options stand as distinct members of the options family, characterized by their inherent properties and distinct attributes. Their defining trait lies in the fact that they can only be exercised on their respective expiration dates. This constraint sets them apart from their American counterparts, which grant holders the flexibility to exercise their options any time prior to or on the expiration date.

Breaking Down the Nuances of European Options

To fully grasp the intricacies of European options, we must first deconstruct their anatomy. Each option contract comprises a strike price, which represents the price at which the underlying asset can be bought (in the case of call options) or sold (in the case of put options) upon exercise; an expiration date, which dictates the date when the option expires and can no longer be exercised; and an underlying asset, which can take the form of stocks, bonds, commodities, or indices.

When it comes to the dynamics of European options trading, there are two primary actors: the option buyer and the option seller. The buyer acquires the right, but not the obligation, to either buy or sell the underlying asset at the predetermined strike price on the expiration date. Conversely, the seller has the obligation to fulfill the contract should the buyer choose to exercise their right.

Unlocking the Value of European Options

So, why do investors flock to European options, embracing their unique characteristics? The answer lies in the array of opportunities they present. European options empower traders with the ability to manage risk, speculate on price movements, and potentially generate substantial returns. These instruments serve as valuable tools for investors seeking to navigate the often-choppy waters of the financial markets.

Image: marketmasteryhints.com

Navigating Common Misconceptions

As we delve into the complexities of European options, it is imperative to dispel common misconceptions that can obfuscate their true nature. One such misconception pertains to their perceived superiority over American options. While European options indeed offer advantages in certain scenarios, it is crucial to recognize that both option types possess distinct strengths and weaknesses, demanding careful consideration before choosing one over the other.

Embracing Expert Advice for Navigating the Market

Treading the path of a successful European options trader requires both knowledge and strategy. Drawing upon my experience as a seasoned blogger, I have compiled a collection of invaluable tips and insights to guide your every step:

- Master the Basics: Lay a solid foundation by thoroughly understanding the fundamentals of options trading, including concepts such as call and put options, exercise prices, and expiration dates.

- Research the Underlying Asset: Conduct in-depth research on the underlying asset associated with your options contract. This due diligence will provide valuable insights into its price history, volatility, and market trends.

- Identify Trading Strategies: Develop a清晰的 trading strategy that aligns with your risk tolerance and financial goals. There are numerous strategies to choose from, each with its own advantages and drawbacks.

- Manage Risk Effectively: Implement robust risk management techniques to safeguard your capital. This may involve setting stop-loss orders, hedging positions, and diversifying your investments.

- Seek Professional Guidance: Consider consulting with a financial advisor or broker to gain personalized advice and guidance tailored to your specific needs and circumstances.

Delving into Frequently Asked Questions

To further illuminate the complexities of European options trading, let us address some frequently asked questions:

- Q: What is the difference between a call and a put option?

A: A call option grants the buyer the right to buy the underlying asset at the strike price, while a put option gives the buyer the right to sell the underlying asset at the strike price.

- Q: How do I determine the value of a European option?

A: Option pricing involves complex calculations that consider factors such as the underlying asset’s price, volatility, time to expiration, and risk-free interest rates.

- Q: Can I lose money trading European options?

A: Yes, trading European options carries significant risk. It is possible to lose the entire amount invested, and even more, if not managed properly.

- Q: What is the best way to learn about European options trading?

A: Educate yourself through books, articles, online courses, and webinars. Seek guidance from experienced traders and consult with financial professionals.

- Q: Is it possible to make money trading European options?

A: While it is possible to generate profits through European options trading, it requires skill, knowledge, and a disciplined approach to risk management.

What To Know When Trading European Options

Image: medium.com

Conclusion

Unveiling the intricacies of European options trading requires a deep dive into their defining characteristics, trading dynamics, and practical applications. By comprehending the nuances of these instruments, investors can harness their power to manage risk, speculate on price movements, and potentially enhance their financial returns. Whether you are a seasoned trader or a novice embarking on this journey, I encourage you to continue exploring the vast world of European options, armed with knowledge and unwavering determination.

As you embark on this adventure, I invite you to share your thoughts and experiences. Are you curious about exploring other types of options or delving deeper into the strategies surrounding European options trading? Your questions and insights will not only enrich the dialogue but also illuminate the path to successful and informed trading decisions.