Introduction

In the realm of financial markets, the pursuit of risk and reward has given rise to a diverse array of instruments. Among these, European style options occupy a prominent position, offering savvy investors the potential to harness market movements to their advantage. This comprehensive guide delves into the intricacies of European style options, providing a roadmap to their intricacies while empowering readers with actionable insights and practical guidance.

Image: marketmasteryhints.com

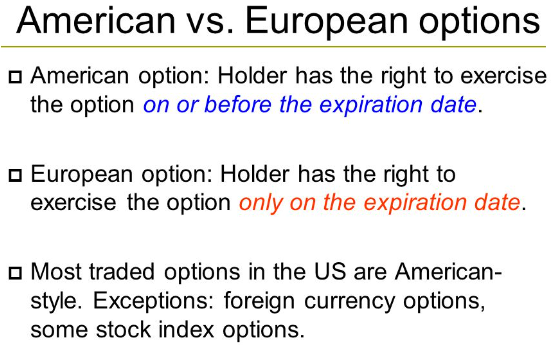

Understanding European Style Options

European style options are a type of financial derivative that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on a specific date (exercise date). They derive their name from the restriction that they can only be exercised on their specified expiration date. Unlike their American counterparts, which offer flexibility in terms of exercise timing, European style options impose a strict deadline for execution.

Mechanism of European Style Options

At the core of European style options lies a contractual agreement between the buyer (holder) and seller (writer). The buyer pays a premium to the seller in exchange for the right to exercise the option at their discretion. If the market price of the underlying asset aligns favorably with the conditions outlined in the contract, the holder can choose to exercise the option, locking in a predetermined profit or mitigating potential losses.

Advantages and Disadvantages of European Style Options

The exclusive nature of European style options offers several advantages over their American counterparts. Firstly, their standardized expiration dates eliminate the need for continuous monitoring, alleviating potential stresses related to market timing. Secondly, they often come with lower premiums due to their reduced flexibility, making them a cost-effective approach to risk management. However, this rigidity also poses limitations, restricting the holder’s ability to seize opportunities that may arise before the exercise date.

Image: www.myespresso.com

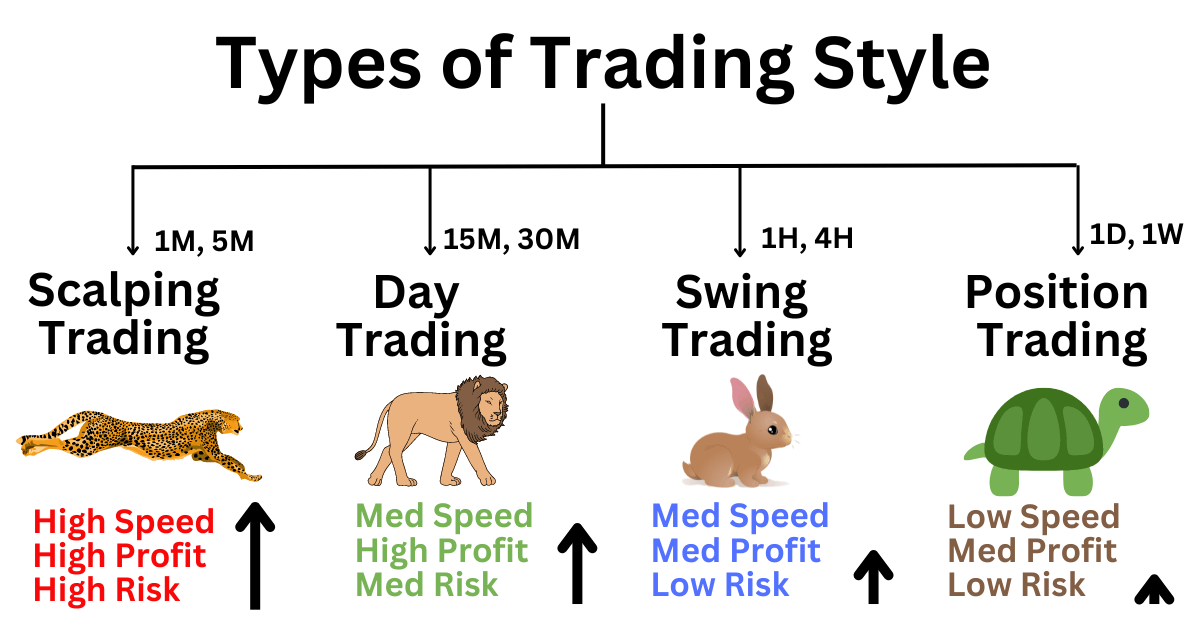

Applications of European Style Options

European style options serve a multitude of purposes in financial portfolios. They can be utilized for hedging against market fluctuations, speculating on price movements, or generating income through option premiums. Their versatile nature caters to both conservative and aggressive investment strategies, making them an indispensable tool for navigating the complexities of financial markets.

Expert Insights and Actionable Tips

“European style options provide a unique blend of precision and flexibility,” explains Dr. Emily Carter, a renowned options expert. “By carefully considering your market outlook and risk tolerance, you can harness these options to maximize returns while mitigating potential losses.” Here are a few practical tips to guide your European style options endeavors:

- Conduct thorough research on the underlying asset and market trends.

- Understand the implications of the option’s strike price and expiration date.

- Set realistic profit targets and risk parameters to maintain discipline.

- Consider using options strategies, such as spreads or combinations, to enhance efficiency.

Trading European Style Options

Image: forexbee.co

Conclusion

Trading European style options is an art that requires knowledge, skill, and unwavering dedication. This article has laid the foundation for your journey into this multifaceted world. By absorbing the insights and actionable tips presented herein, you are well-equipped to unlock the potential of European style options and elevate your financial acumen. Remember, the path to success in the markets is paved with a combination of judicious decision-making and the unwavering pursuit of knowledge.