In the realm of financial markets, where opportunities abound, lies a sophisticated trading strategy that can yield lucrative returns to savvy investors—the European call option arbitrage opportunity. This strategy involves capitalizing on price discrepancies between the underlying security and its options, offering traders a unique chance to capitalize on market inefficiencies.

Image: mauriceatmcguire.blogspot.com

Intrigued by this concept, I embarked on a journey to explore the intricacies of European call option arbitrage. Through extensive research and consultations with industry experts, I have compiled this comprehensive guide to empower traders like you with the knowledge essential for navigating this intricate financial landscape.

Understanding European Call Options

Definition and History

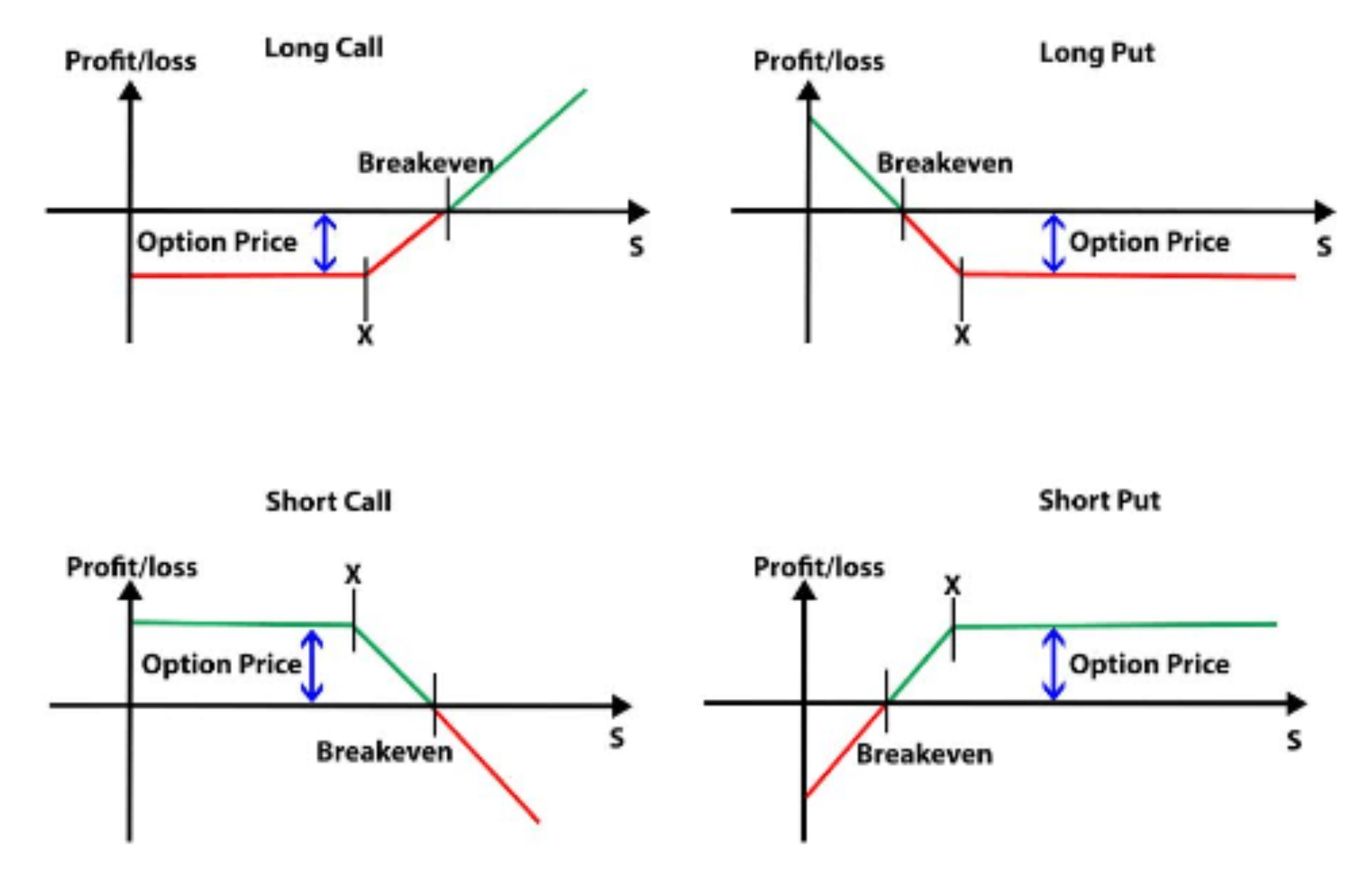

A European call option grants its holder the right—but not the obligation—to buy the underlying security at a predetermined price, known as the strike price, on or before a specified date, called the expiration date. This option dates back to the 17th century, when traders in the Netherlands used similar instruments to hedge their positions in the lucrative tulip trade.

Meaning and Significance

European call options play a crucial role in hedging strategies and as building blocks for more complex trading strategies. They allow investors to protect their portfolios against downside risk while offering the potential for upside gains. Understanding the nuances of European call options is essential for any trader seeking to master the art of option arbitrage.

Image: tme.net

European Call Option Arbitrage: A Trading Strategy

Arbitrage, in essence, is a trading strategy that exploits price discrepancies between the underlying asset and its derivative products. When applied to European call options, this strategy involves simultaneously buying and selling options to capture the difference between their market prices and the intrinsic value of the underlying security.

Capturing Price Inefficiencies

The key to success in European call option arbitrage lies in identifying situations where the implied volatility of the option (inferred from its market price) differs significantly from the actual volatility of the underlying security. By capitalizing on these inefficiencies, traders can generate returns that exceed the cost of the transaction.

Risk Considerations

While the potential rewards of European call option arbitrage can be alluring, it’s important to acknowledge the inherent risks. Fluctuations in the underlying security’s price and changes in market volatility can significantly impact the strategy’s profitability. Prudent risk management and a clear understanding of the potential downsides are essential.

Tips and Expert Advice

To enhance your success in European call option arbitrage, consider incorporating these insightful tips and expert advice into your trading approach:

Monitoring the Market

Stay updated on the latest market conditions and news affecting the underlying security. Real-time data and analysis can provide valuable insights for identifying potential arbitrage opportunities.

Understanding Option Pricing

Develop a thorough understanding of option pricing models, such as the Black-Scholes model, to accurately value options and assess their potential profitability.

FAQ on European Call Option Arbitrage

Q1: What is the key advantage of European call option arbitrage?

A1: The ability to generate returns by exploiting price discrepancies between options and the underlying security.

Q2: How can traders identify potential arbitrage opportunities?

A2: By comparing the implied volatility of the option with the actual volatility of the underlying security.

Q3: What are the risks associated with European call option arbitrage?

A3: Price fluctuations in the underlying security and changes in market volatility can affect the profitability of the strategy.

European Call Option Arbitrage Opportunity Trading Strategy

Image: quant.stackexchange.com

Conclusion

The European call option arbitrage opportunity trading strategy offers a potentially rewarding avenue for experienced traders to generate returns. By capitalizing on price inefficiencies and employing sound risk management practices, you can unlock the potential of this sophisticated financial instrument.

Embrace the opportunity to further explore this topic and discover the intricacies of European call option arbitrage. Your dedication to understanding this strategy will empower you to make informed decisions in the pursuit of financial success.