Introduction

The world of investing is vast and complex, with endless opportunities to generate wealth. Option arbitrage trading stands out as a sophisticated strategy that allows traders to profit from price discrepancies in the options market. This article aims to shed light on the intricacies of option arbitrage trading, empowering investors with the knowledge to navigate this lucrative realm effectively.

Image: corporatefinanceinstitute.com

What is Option Arbitrage Trading?

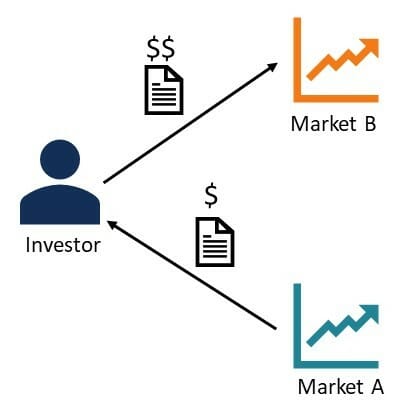

Option arbitrage trading involves exploiting price inefficiencies between options contracts and the underlying assets they represent. Arbitrageurs capitalize on these discrepancies by buying one option while simultaneously selling another option on the same stock to lock in a riskless profit.

Getting Started with Option Arbitrage

Before delving into the world of option arbitrage, it is crucial to understand its nuances and potential risks. Traders should possess a strong grasp of options pricing models, market dynamics, and risk management techniques. Additionally, a solid understanding of option terminology and contract stipulations is essential for effective execution.

Furthermore, traders should meticulously research the underlying assets, analyze market conditions, and employ sophisticated trading algorithms to identify potential arbitrage opportunities. It is equally important to partner with reputable brokers and exchanges to ensure fair pricing and seamless trade execution.

Trending Developments and Industry Insights

The option arbitrage landscape is continuously evolving, with new strategies and innovations emerging. A recent advancement is the advent of automated arbitrage trading software, which utilizes advanced algorithms to scan markets for potential opportunities and execute trades in real-time. This technological advancement has democratized option arbitrage, making it more accessible to a broader range of investors.

Another trend gaining traction is the use of statistical arbitrage in option trading. This approach involves employing statistical models to identify price patterns and correlations in the options market, enabling traders to capitalize on inefficiencies that may not be immediately apparent.

:max_bytes(150000):strip_icc()/arbitrage-4201467-1-705aa79c9d6f4128b8eb7b9588403849.jpg)

Image: www.investopedia.com

Expert Tips and Advice for Effective Option Arbitrage

1. Prioritize Risk Management: Option arbitrage may appear riskless in theory, but unexpected market movements and liquidity issues can introduce risks. Adept risk management practices, such as diversifying across multiple arbitrage positions and setting stop-loss orders, are essential for mitigating potential losses.

2. Embrace Continuous Market Monitoring: Option arbitrage requires constant vigilance. Traders should closely monitor market fluctuations, option pricings, and any news or events that may impact the underlying assets. This vigilance ensures that traders can adapt their positions swiftly when necessary.

FAQs: Tackling Common Concerns about Option Arbitrage Trading

Q1: Is option arbitrage trading profitable?

A: Option arbitrage trading can be profitable, but it requires extensive knowledge, skills, and continuous market monitoring.

Q2: What are the potential risks of option arbitrage trading?

A: Potential risks include unexpected market movements, liquidity issues, and the mathematical possibility of arbitrage positions becoming unfavorable.

Q3: Is option arbitrage suitable for all investors?

A: Option arbitrage is recommended for experienced traders with a robust understanding of options pricing and risk management.

Option Arbitrage Trading Strategies

Conclusion

Option arbitrage trading offers a unique way to generate profits by exploiting price discrepancies in the options market. While the potential rewards can be significant, the complexity of arbitrage strategies necessitates a thorough understanding of the underlying principles. Traders who arm themselves with knowledge, employ risk management techniques, and leverage the latest trading tools can increase their chances of success in this thrilling arena.

Are you fascinated by the intricate world of option arbitrage trading? Ready to explore the strategies and expertise that drive this multifaceted investment technique? Dive into the captivating content presented in this article, and embark on a journey toward unlocking the potential of option arbitrage.