Unveiling the Power of Bull Call Spreads

In the realm of options trading, the bull call spread strategy reigns supreme. As a derivative-based technique, it empowers traders to exploit upward market movements while mitigating potential risks. This comprehensive guide will delve into the intricacies of bull call spreads, offering a roadmap for navigating the options trading platform to maximize your gains.

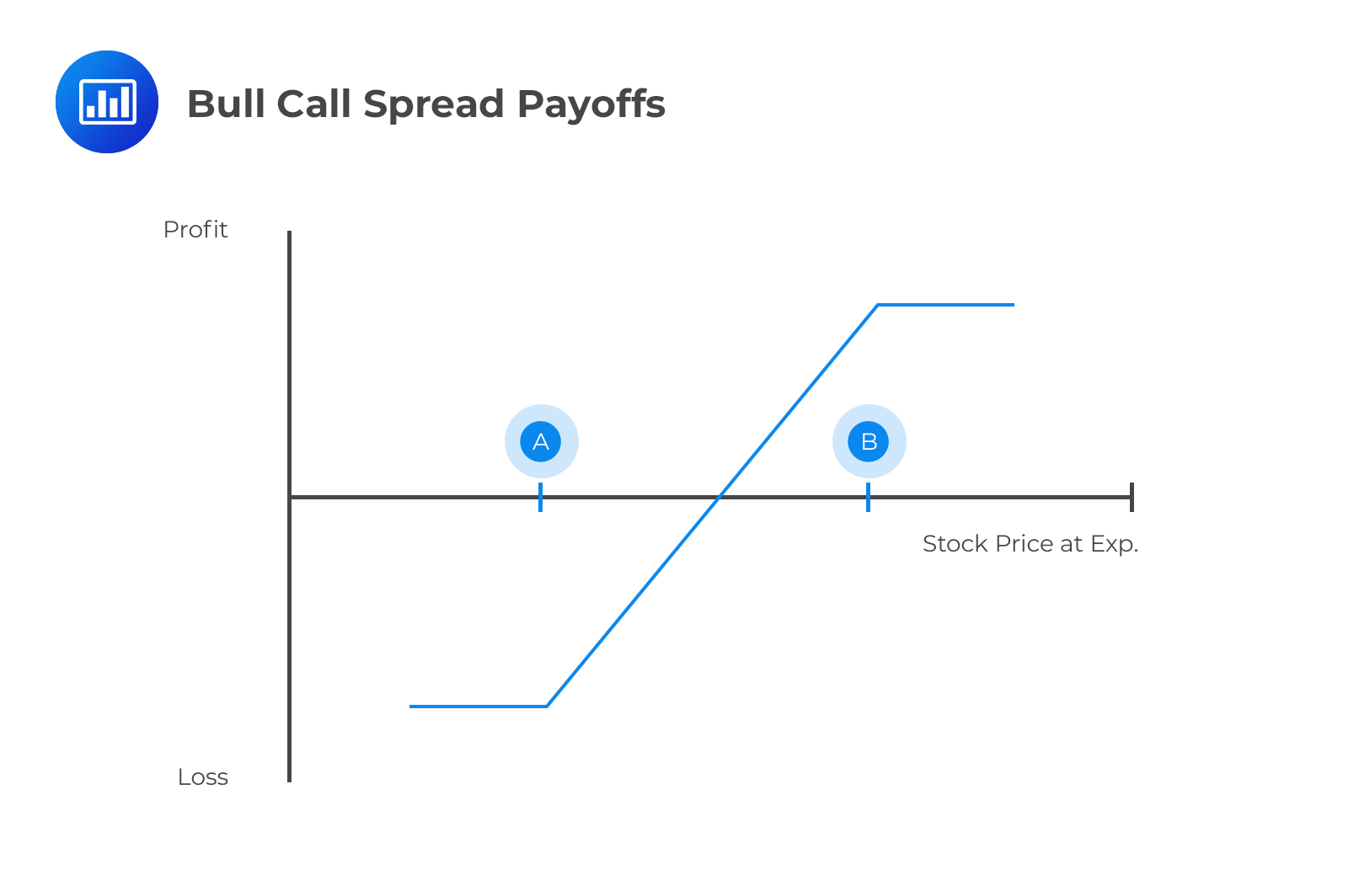

Image: analystprep.com

Bull Call Spread Unveiled

A bull call spread involves the simultaneous purchase of a lower-priced call option and the sale of a higher-priced call option with the same underlying asset, expiration date, and quantity. The critical element lies in ensuring that both call options are “in-the-money” at the time of execution. This structure creates a bullish position, betting on the continued ascent of the underlying asset’s price.

Benefits and Potential

Bull call spreads provide numerous advantages for savvy traders:

- Limited Risk: Unlike buying a single call option, the sale of the higher-priced call reduces the overall cost of the spread, resulting in limited potential losses.

- Profit Potential: The profit potential is capped but can be substantial if the underlying asset’s price rises significantly.

- Leverage: Bull call spreads offer leverage, allowing traders to control a larger position with a smaller investment.

Trading Execution

To execute a bull call spread, traders must carefully consider several key parameters:

- Underlying Asset: Select an asset with strong bullish momentum.

- Option Strike Prices: Determine the appropriate strike prices based on the current market price and expected price movement.

- Expiration Date: Choose an expiration date that aligns with the anticipated market conditions.

Image: oracleofomahasays.com

Risk Management and Profit Maximization

Risk management plays a pivotal role in options trading. Constantly monitor the underlying asset’s price and adjust the spread accordingly. Implementing stop-loss orders is crucial to limit potential losses. Profit maximization involves closing the spread before expiration to secure gains or rolling the spread over to a later expiration date if the market outlook remains favorable.

Expert Tips for Success

- Research and understand the underlying asset’s fundamentals and historical performance.

- Determine the most suitable spread strategy based on your risk tolerance and profit goals.

- Utilize options trading simulators or paper accounts to practice and fine-tune your trading techniques.

- Consult with experienced traders or financial advisors to seek professional guidance.

Frequently Asked Questions

- Is bull call spread trading suitable for beginners? While options trading requires a certain level of experience, bull call spreads are relatively accessible, offering limited risk compared to other options strategies.

- What is the ideal profit target for a bull call spread? The profit target will vary depending on the strike prices and market conditions. Generally, a 20-30% profit is considered a reasonable target.

- How do I adjust a bull call spread if the market moves against me? If the underlying asset’s price falls, traders can consider adjusting the strike prices by buying or selling additional options contracts to reduce losses.

Options Trading Platforms Bull Call Spread

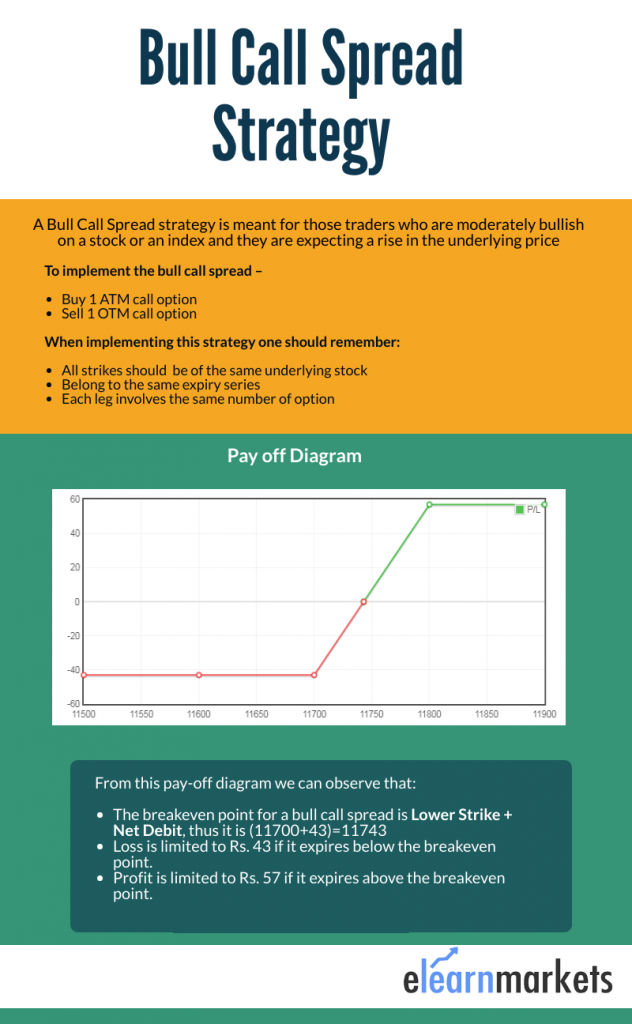

Image: blog.elearnmarkets.com

Conclusion

Embracing the bull call spread strategy on options trading platforms empowers traders to exploit market opportunities while mitigating risk. By following the principles outlined in this guide, investors can enhance their knowledge and confidently navigate the intricacies of options trading for maximum profits. Are you ready to unlock the boundless potential of bull call spreads?