John, a seasoned investor, reminisced about his first profitable trade – a bull spread option strategy. The exhilaration of watching the stock price surge and the options premium inflate was an unforgettable experience. This intricate strategy ignited his passion for option trading, leading him on a journey of financial exploration.

Image: fabalabse.com

In the realm of option trading, a bull spread strategy emerges as a bullish tactic. It empowers traders to capitalize on the anticipation of a stock’s upward trajectory, offering limited risk and potentially substantial returns compared to simply buying the stock.

Bull Spread Option Trading: A Strategic Insight

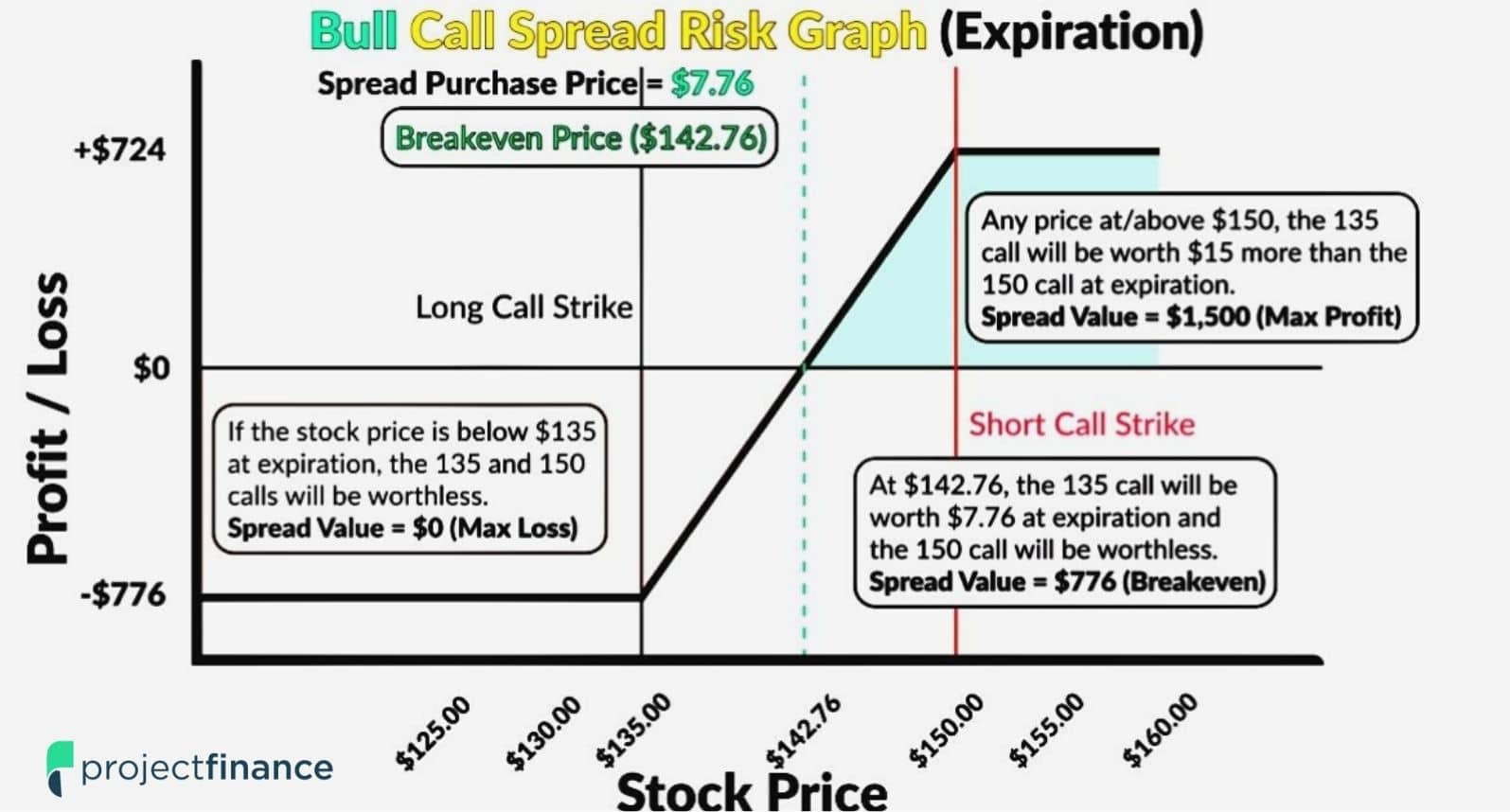

The essence of a bull spread lies in buying an option contract at a lower strike price while simultaneously selling an option contract at a higher strike price. This action creates a “spread,” with a lower net premium investment than buying the underlying stock outright. If the stock price rises as anticipated, the value of the purchased option will outpace the decline in the value of the sold option, resulting in a profitable spread.

The selection of strike prices for the purchased and sold options is critical. The purchased option should possess a strike price below the current market price, while the sold option should carry a strike price above the current market price. This strategic placement allows traders to capture potential gains while limiting potential losses.

Expert Tips for Bull Spread Success

To navigate the complexities of bull spread trading, heed the following expert advice:

1. Choose liquid options contracts: Liquidity ensures ease of entry and exit from trades, reducing market impact and slippage.

2. Manage risk by calculating the maximum loss: Determine the maximum potential loss before entering a trade by subtracting the net premium from the difference between the strike prices.

Common Questions on Bull Spread Trading

To address common inquiries surrounding bull spread trading, consult the following Q&A:

Q: What is the optimal timeframe for holding a bull spread?

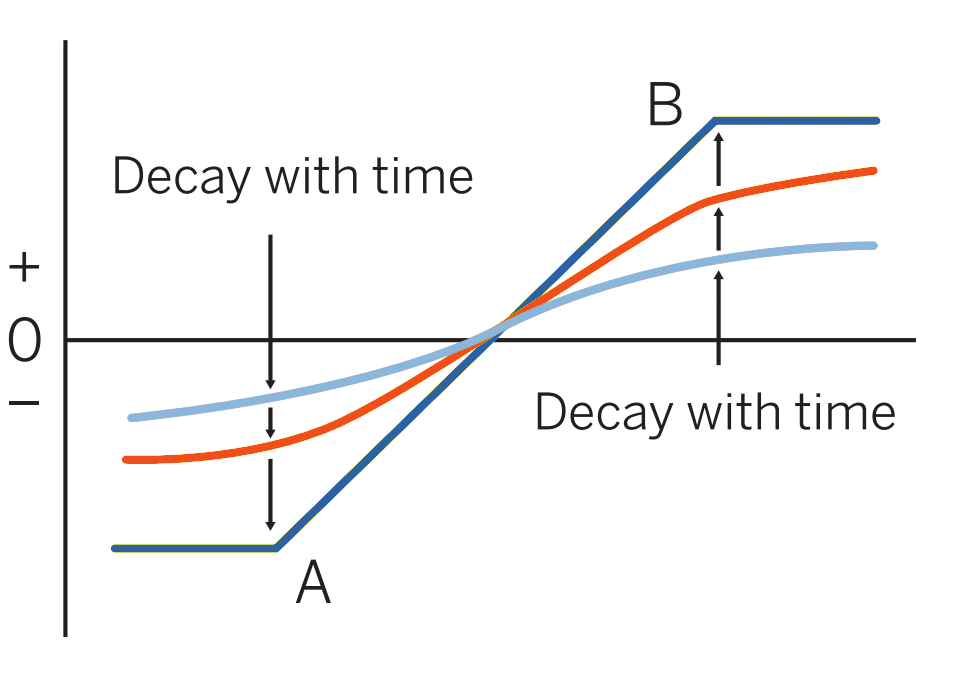

A: The holding period varies depending on factors like market volatility and the underlying stock’s price movement. Short-term trades typically span a few days to several weeks, while longer-term strategies may extend for months.

Q: How can I maximize profit potential with bull spreads?

A: Closely monitor the stock’s price and option premiums. Exit the trade when the spread reaches your target profit or if market conditions change significantly.

Image: www.danielstrading.com

Bull Spread Option Trading Strategy

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)

Image: www.investopedia.com

Conclusion

Unveiling the intricacies of bull spread option trading empowers traders with a multifaceted strategy for capitalizing on anticipated stock price increases. By understanding the mechanics, selecting strike prices judiciously, and implementing expert tips, you can navigate market fluctuations with greater confidence. Remember, the journey to trading mastery is paved with continuous learning and adaptation.

Are you intrigued by the intricacies of bull spread trading? Let us know in the comments below, and stay tuned for more insights into the dynamic world of option trading.