Introduction:

Image: www.fidelity.com

In the realm of financial markets, options trading offers a myriad of strategies to harness the power of volatility and potentially generate substantial returns. Among these strategies, bull put option spreads stand out as a powerful tool for savvy investors seeking to capitalize on rising stock prices. This article delves into the intricacies of bull put option spread trading, guiding you through its concepts, applications, expert insights, and practical tips to empower you in your pursuit of financial success.

Understanding Bull Put Option Spread Strategies:

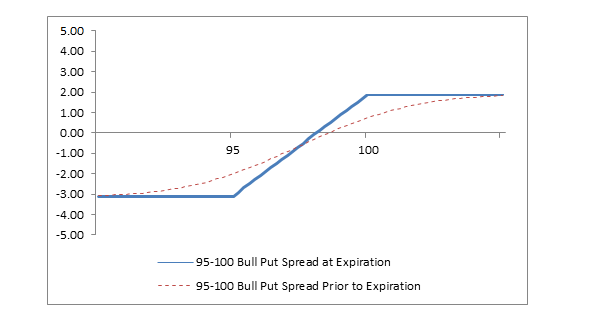

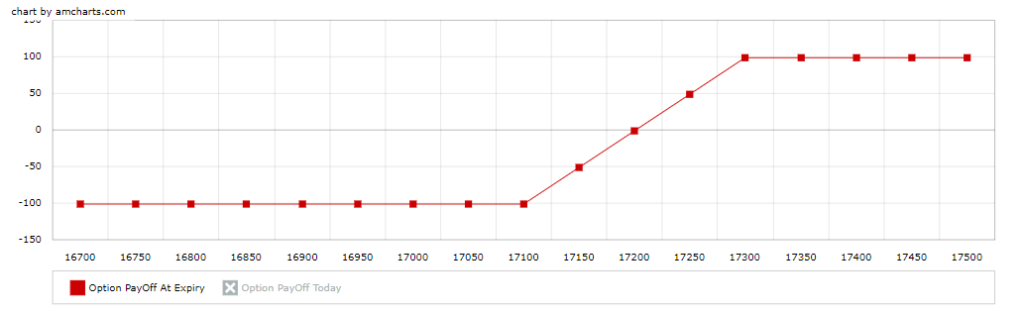

A bull put option spread, also known as a credit spread or simply a bull spread, is a multi-leg options strategy involving the purchase of a lower-priced put option and the sale of a higher-priced put option with the same expiration date. The underlying asset is generally a stock that the trader believes will experience a price increase. By implementing this spread strategy, the investor aims to profit from the upward movement of the stock while limiting their potential losses.

Key Concepts of Bull Put Option Spread Trading:

Net Premium: The difference between the premium received from selling the higher-priced put option and the premium paid for buying the lower-priced put option.

Max Profit: The difference between the strike prices of the two put options multiplied by the number of contracts traded.

Max Loss: The net premium paid plus transaction fees, capped at a known maximum amount.

Breakeven Point: The stock price at which the trader breaks even on the spread, calculated as the higher strike price less the net premium received.

Implementing a Bull Put Option Spread:

To execute a bull put option spread, follow these steps:

-

Identify a rising stock: Conduct thorough research to select an underlying stock with a bullish outlook.

-

Determine strike prices: Choose a lower strike price for the put option you plan to buy and a higher strike price for the put option you intend to sell.

-

Calculate net premium: Calculate the difference between the purchase price of the bought put option and the sales price of the sold put option to determine the net premium.

Image: learn.moneysukh.com

Expert Insights and Actionable Tips:

-

Select liquid options with high open interest: This ensures sufficient liquidity for execution and timely exits when necessary.

-

Manage risk through position sizing: Determine the appropriate number of contracts based on your risk tolerance and capital.

-

Monitor the underlying stock closely: Track the stock’s price movement and make adjustments as needed to optimize your spread.

-

Consider using technical analysis: Employ technical indicators to identify potential trading opportunities and price targets.

-

Seek professional guidance: Consulting with an experienced broker or financial advisor can provide valuable insights and support.

Bull Put Option Spread Trading Strategies

Image: futuresoptionsetc.com

Conclusion:

Bull put option spread strategies offer a sophisticated yet accessible method for profiting from rising stock prices while mitigating potential losses. By comprehending the concepts, implementing these strategies effectively, and incorporating expert insights, you can enhance your trading acumen and potentially achieve your financial goals. Remember, investing involves risk, and seeking professional advice is always recommended.