Introduction

In the intricate landscape of financial markets, options trading emerges as a powerful tool that empowers investors with the potential to enhance returns or hedge against risks. This options trading report aims to illuminate the nuances of this sophisticated strategy, providing you with the knowledge and confidence to navigate these markets effectively. Whether you’re a seasoned trader or just beginning to explore options, this comprehensive guide will serve as your trusty companion on your financial journey.

Image: www.compuvision.com.au

Delving into the Realm of Options Trading

Options, as financial instruments, bestow upon their holders the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price on a specified date. This flexibility allows investors to tailor their trading strategies to specific market conditions, whether they anticipate a rise, fall, or prolonged stability in the asset’s value.

Unraveling the Mechanics of Options Trading

At the heart of options trading lies a contract between two parties—the buyer and the seller. The buyer acquires the right to exercise the option at the strike price, while the seller assumes the obligation to fulfill the contract if exercised. Premium, the price paid by the buyer to the seller, represents the value of this right. Key factors influencing premium include the underlying asset’s price, time to expiration, volatility, and interest rates.

Navigating the Options Market Landscape

Options trading unfolds across diverse markets, each catering to different needs and preferences. From the Chicago Mercantile Exchange (CME) to the Eurex Exchange, these marketplaces facilitate the trading of a wide range of options contracts on stocks, indices, currencies, and commodities. Understanding the specific characteristics and regulations governing each market is paramount for effective participation.

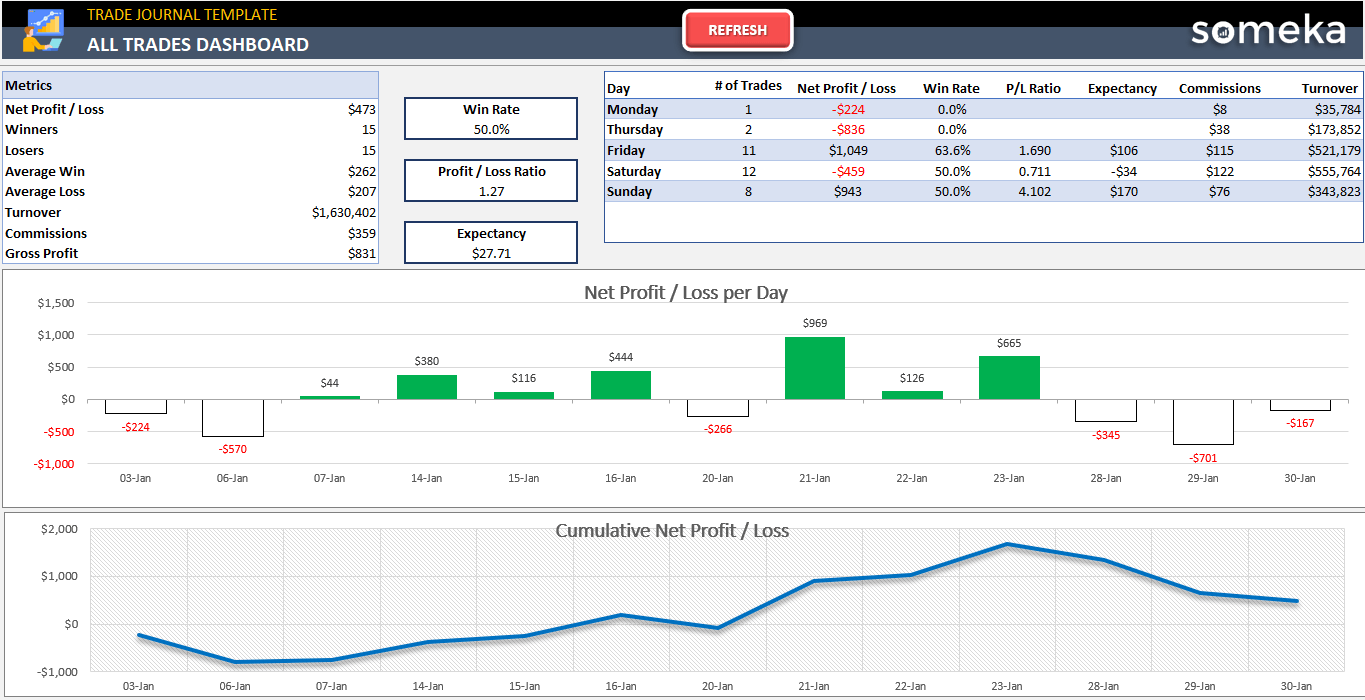

Image: www.someka.net

Decoding Options Strategies

The world of options trading presents a myriad of strategies, each tailored to specific market outlooks and risk tolerances. Covered calls generate income by selling call options against owned shares, while protective puts safeguard portfolios by hedging against potential downturns. From bullish strategies like straddles to neutral strategies like strangles, the choice of strategy depends on the investor’s market outlook and appetite for risk.

Expert Guidance: Navigating the Volatile Waters

Navigating the ever-changing options market demands insights from experienced traders who have weathered countless market storms. In this report, we’ve gathered exclusive interviews with industry experts, uncovering their proven strategies, risk management techniques, and insights into the evolving landscape of options trading. Their wisdom will serve as a beacon of guidance on your trading journey.

Unleashing the Power of Options Analytics

In the digital age, technology empowers traders with robust analytical tools that elevate their understanding and decision-making. From sophisticated option pricing models to real-time market data, these tools help investors identify trading opportunities, assess risks, and fine-tune their strategies with precision. Embracing the power of analytics will give you an edge in the competitive world of options trading.

Options Trading Report

Image: www.walmart.com

Options Trading: A Journey of Informed Decisions

Mastering the art of options trading requires a commitment to continuous learning and a deep understanding of market dynamics. By equipping yourself with the knowledge and tools outlined in this report, you’ll gain the confidence to embark on this exciting yet challenging journey. Remember, options trading, like any investment endeavor, carries potential risks. Prudent risk management, coupled with a well-informed approach, will pave the way for informed decisions, enabling you to harness the full potential of this versatile trading instrument.