Introduction

Image: www.tradingpedia.com

Navigating the intricate world of options trading can be daunting, but the rewards can be substantial for those who master its strategies. One such technique, the bull call spread, offers a unique combination of potential gains and limited risk, making it an attractive option for traders of all experience levels. In this comprehensive guide, we’ll delve into the nuances of bull call spreads, exploring their mechanics, advantages, and implementation on popular trading platforms.

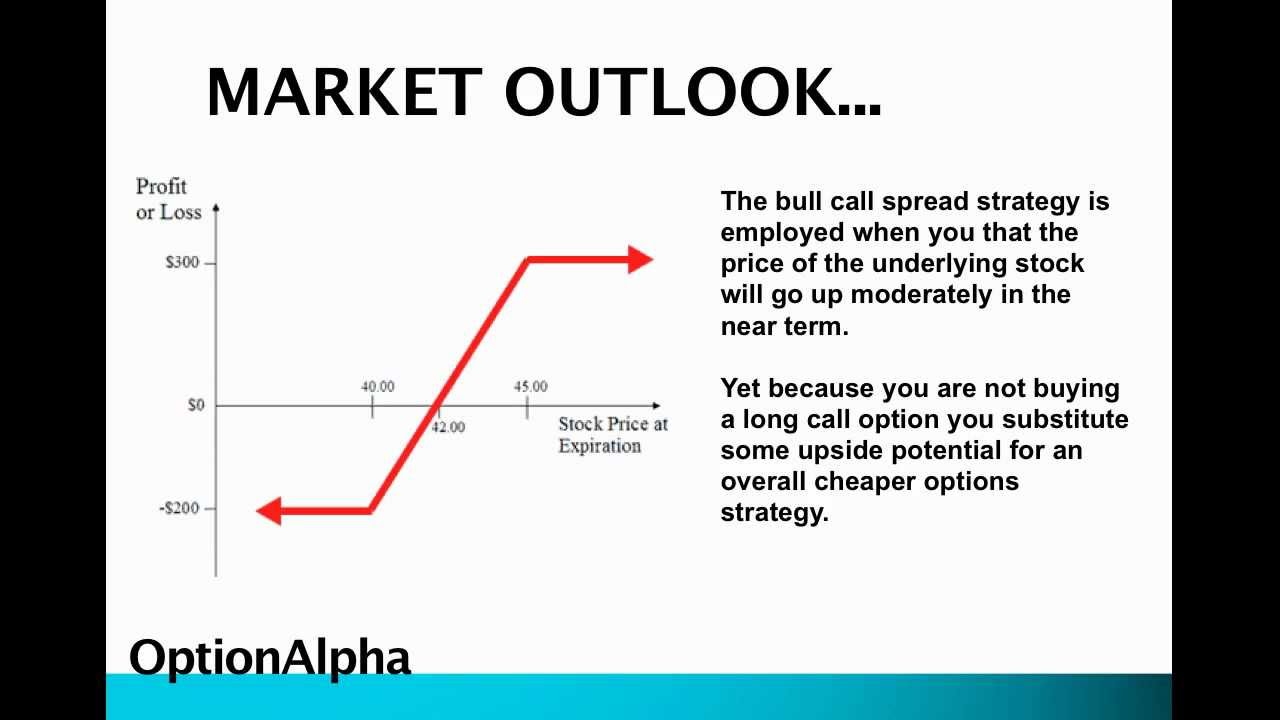

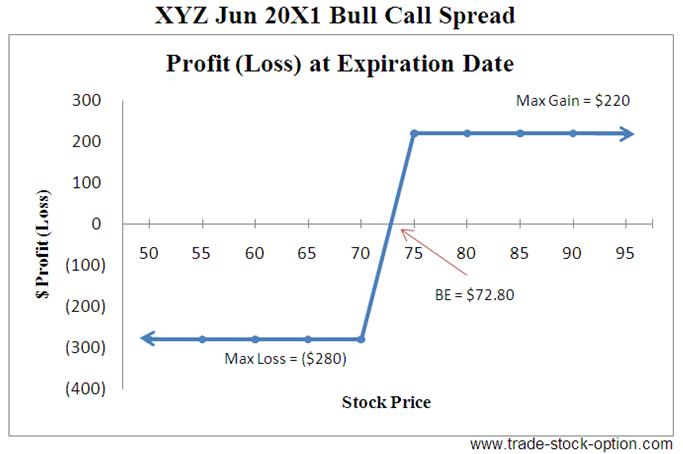

Understanding Bull Call Spreads

A bull call spread involves buying a lower-priced call option (the long call) and simultaneously selling a higher-priced call option (the short call) with the same underlying asset and expiration date. The short call has a lower strike price than the long call. By creating this spread, traders aim to profit from a limited rise in the underlying asset’s price.

Advantages of Bull Call Spreads

- Limited Risk: Unlike traditional call options, where losses can be unlimited, bull call spreads cap your potential loss at the net premium paid.

- Defined Profit Potential: The maximum profit for a bull call spread is limited to the difference in strike prices between the long and short calls, minus the net premium.

- Flexibility: Traders can adjust the strike prices and expiration date of the spread to tailor it to their investment goals and risk tolerance.

- Income Generation: Selling the short call in a bull call spread generates an immediate credit that can offset some of the cost of the long call.

Implementing Bull Call Spreads

For example, let’s say Apple’s stock (AAPL) is trading at $150 and you believe it has the potential to rise in value but only within a limited range. You could create a bull call spread by:

- Buying a 150-strike call option for $5

- Selling a 155-strike call option for $1

This spread would cost you $4 ($5 – $1) in net premium. If AAPL’s stock rises to $154, you would make a profit of $4, which is the difference between the strike prices, minus the net premium. However, if AAPL’s stock falls below $150 or rises above $155, you would incur a loss.

Choosing an Options Trading Platform

The choice of options trading platform is crucial, as it influences the ease and efficiency of your trades. Consider the following factors when selecting a platform:

- Reliability and Security: Choose a platform with a proven track record of reliability and stringent security measures to protect your funds.

- User Interface: A user-friendly interface makes navigating complex trading options smoother.

- Tools and Features: Look for platforms that offer advanced tools such as real-time quotes, customizable charts, and risk management features.

- Brokerage Fees and Commissions: Compare brokerage fees and commissions to minimize the impact on your trading profits.

Conclusion

Bull call spread strategies provide a versatile and potentially rewarding approach to options trading. By understanding the mechanics and advantages of this strategy, traders can capitalize on potential market gains while limiting their risk. Implementing bull call spreads on reputable options trading platforms empowers traders to make informed decisions and pursue their financial goals with confidence.

Image: fyers.in

Options Trading Platforms Bull Call Spread Option Level

Image: www.trade-stock-option.com