Are you ready to venture into the dynamic world of options trading but find yourself perplexed by the intricate web of option spread strategies? This newsletter is your ultimate guide to navigating the complexities of multi-legged options strategies, empowering you to make informed decisions and maximize your trading potential.

Image: stewdiostix.blogspot.com

Option spreads involve simultaneously buying and selling multiple options contracts of the same underlying asset with different strike prices and expiration dates. These sophisticated strategies allow traders to craft tailored positions that align with their unique risk appetite and profit objectives. By understanding the mechanics, advantages, and risks involved in option spread trading, you can unlock a world of opportunities in the financial markets.

Deciphering Option Spread Mechanics

Option spreads are typically created using a combination of calls and puts with varying strike prices. A call option grants the buyer the right to purchase the underlying asset at a predetermined price (strike price) before the expiration date, while a put option gives the buyer the right to sell the asset at the strike price before expiration.

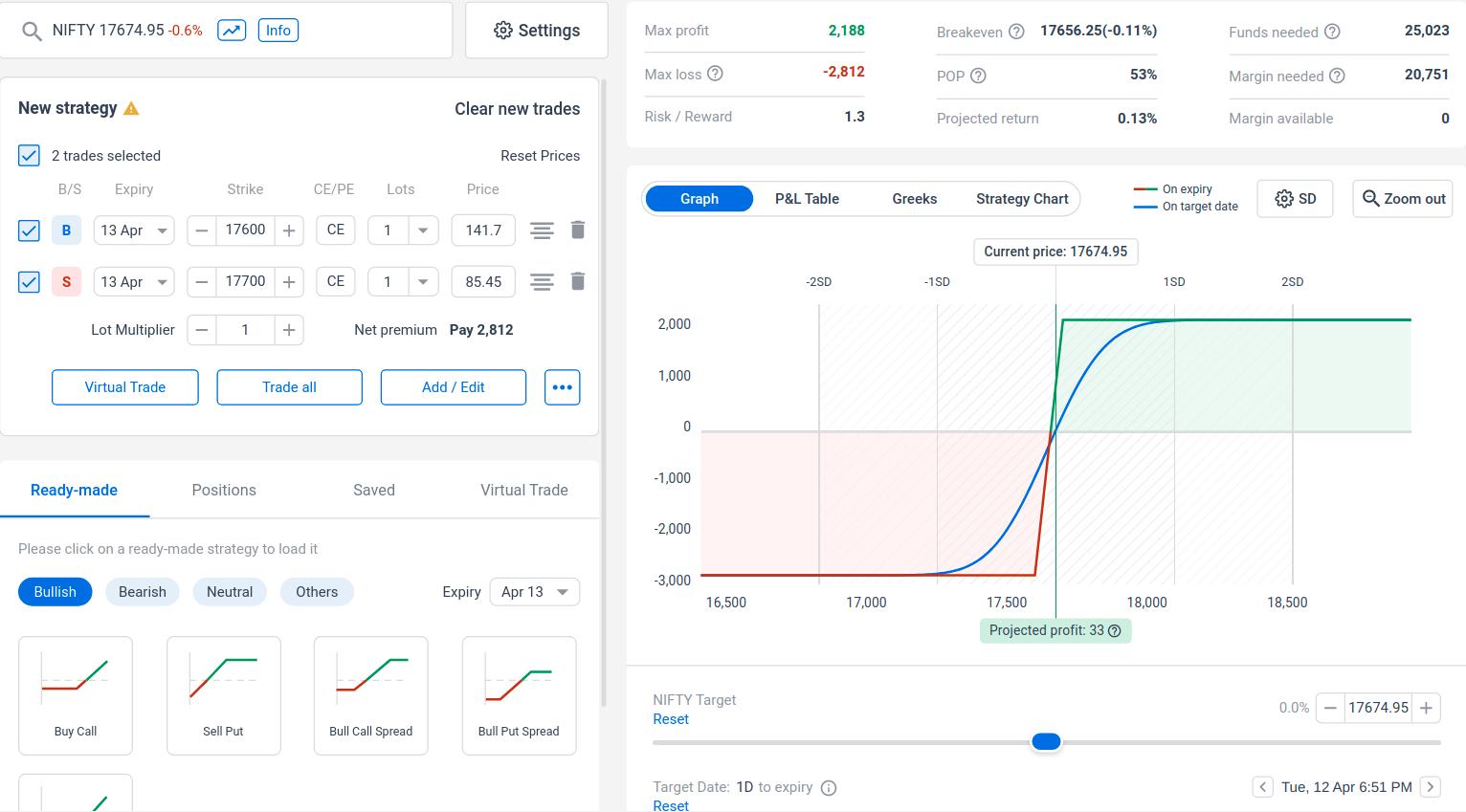

Traders can create numerous spread strategies by combining these options. For instance, a bull call spread involves buying a call option at a lower strike price and simultaneously selling another call option at a higher strike price. This strategy allows traders to capitalize on anticipated bullish price movements within a specific range.

Navigating Spread Trading Strategies

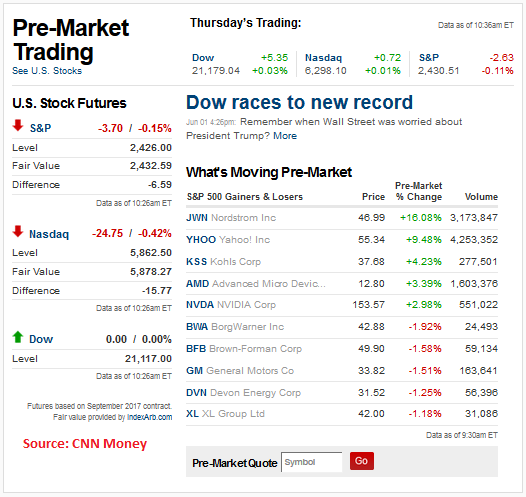

The world of option spread trading offers a diverse array of strategies tailored to various market conditions and trading goals. Here’s a breakdown of some popular spread trading techniques:

- Bull Call Spread: As mentioned earlier, this strategy benefits from bullish price movements while limiting potential losses.

- Bear Put Spread: A similar strategy to the bull call spread, but designed to profit from expectations of a price decline.

- Collar: This strategy combines a long call and a short put to create a protective boundary around a stock position.

- Condor: A more complex spread that involves buying two calls and selling two puts at different strike prices with the aim of capturing a neutral market outlook.

Unveiling the Merits of Option Spread Trading

Option spread trading offers a compelling set of advantages for seasoned traders:

- Defined Risk: Spreads inherently limit potential losses, providing a measure of risk management not available with single-leg options.

- Tailored Profit Objectives: Traders can customize spread strategies to target specific profit goals, ranging from conservative to aggressive.

- Flexibility: Spreads can be adjusted or closed out at any time, granting traders flexibility in managing their positions.

Image: www.goodreads.com

Navigating the Risks

While option spread trading presents numerous opportunities, it’s crucial to acknowledge the potential risks involved:

- Complex Nature: Option spreads require a deeper understanding of options trading mechanics, making them unsuitable for novice investors.

- Time Decay: Option contracts lose value over time, so spread traders need to carefully manage their positions to avoid erosions in premiums.

- Unlimited Profit Potential, Limited Losses: While the potential for profits is theoretically unlimited, losses are limited to the net premium paid for the spread.

Option Spread Trading Newsletter

Image: www.randomwalktrading.com

Conclusion

Option spread trading presents a powerful tool for experienced traders seeking to enhance their returns and manage risk. By embracing a comprehensive understanding of spread mechanics, selecting the right strategies, and mitigating potential risks, you can unlock the vast potential of this sophisticated trading technique. Remember, knowledge is the key to navigating the complexities of option spread trading. Stay tuned for future issues of our newsletter, where we will delve deeper into the nuances of spread trading, providing you with the insights and tools to master this multifaceted investment strategy.