Introduction: Navigating the World of Option Strategies

In the realm of financial markets, options trading presents a dynamic avenue for investors seeking to enhance their investment opportunities. Among the diverse strategies employed in this domain, the bull put spread stands out as a preferred choice for traders seeking to capitalize on bullish market sentiment while mitigating potential risks. This article delves into the complexities of bull put spread option trading, exploring its mechanics, applications, and techniques to empower traders with the knowledge and insights necessary for successful execution.

![Bull Put Spread [Download Your Free Option Strategy Guide]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60187f92472afb1daddfd4b6_QdSK__RDEhTY2JxjcrMqlXC58hr9Yi3aTNLYOWYfIv2B63D7dwv0U_iHsD02XAWQjtlRRgYmDk56mc28pumibd7U_unVAgUOV9BhA7QNfGwITFrzEKW7vgvj425eAExUe7qmKgKO.png)

Image: optionalpha.com

Deciphering the Bull Put Spread Strategy

A bull put spread, also known as a vertical bull spread, is an options trading strategy that involves simultaneously buying a lower-priced put option and selling a higher-priced put option with the same expiration date but different strike prices. This strategy essentially positions the trader to benefit from a rise in the underlying asset’s price while limiting potential losses.

Rationale and Mechanics of the Bull Put Spread

The bull put spread strategy is predicated upon the expectation of a moderate increase in the underlying asset’s price. By purchasing a put option at a lower strike price, the trader secures the right to sell the asset at a higher price than its current market value. Simultaneously, selling a put option at a higher strike price generates an upfront premium, effectively reducing the net cost of the spread. The ideal outcome occurs when the underlying asset’s price rises, but not sufficiently to trigger the purchased put option. In such scenarios, the trader retains the premium received from selling the higher-priced put option, generating a profit.

Practical Applications in Bullish Markets

Bull put spreads are particularly suited for bullish market conditions where the trader anticipates a modest price appreciation in the underlying asset. By carefully selecting the strike prices and expiration date, traders can tailor the strategy to their specific risk tolerance and profit objectives. The strategy’s limited risk profile and potential for defined returns make it an appealing choice for investors seeking measured exposure to bullish market trends.

Image: optionalpha.com

Maximizing Bull Put Spread Strategy Returns

To optimize returns from bull put spread trading, several key considerations come into play:

- Strike Price Selection: The appropriate strike prices for the purchased and sold put options depend on market conditions and the trader’s risk tolerance. It is crucial to strike a balance between maximizing profit potential and minimizing risk.

- Time to Expiration: The duration of the trade is another important factor. Longer expirations provide greater time for the underlying asset’s price to move in the desired direction, but also carry higher premiums. Shorter expirations limit the profit potential but reduce the cost of the spread.

- Implied Volatility: Implied volatility, a measure of market expectations regarding future price fluctuations, plays a significant role in premium pricing. Higher implied volatility leads to higher premiums, which can impact the overall profitability of the spread.

Historical Performance and Notable Examples

Empirical evidence suggests that bull put spreads have historically delivered positive returns in bullish market environments. Notable examples include the S&P 500 index, which has exhibited a long-term upward trajectory, making bull put spread trading a viable strategy for investors seeking to align their portfolios with bullish trends.

Cautions and Risks Associated with Bull Put Spread Trading

As with any investment strategy, bull put spreads carry inherent risks. Unexpected market fluctuations, adverse economic conditions, and geopolitical events can influence the underlying asset’s price, leading to potential losses. Traders should carefully assess their financial circumstances, investment objectives, and risk tolerance before implementing this strategy.

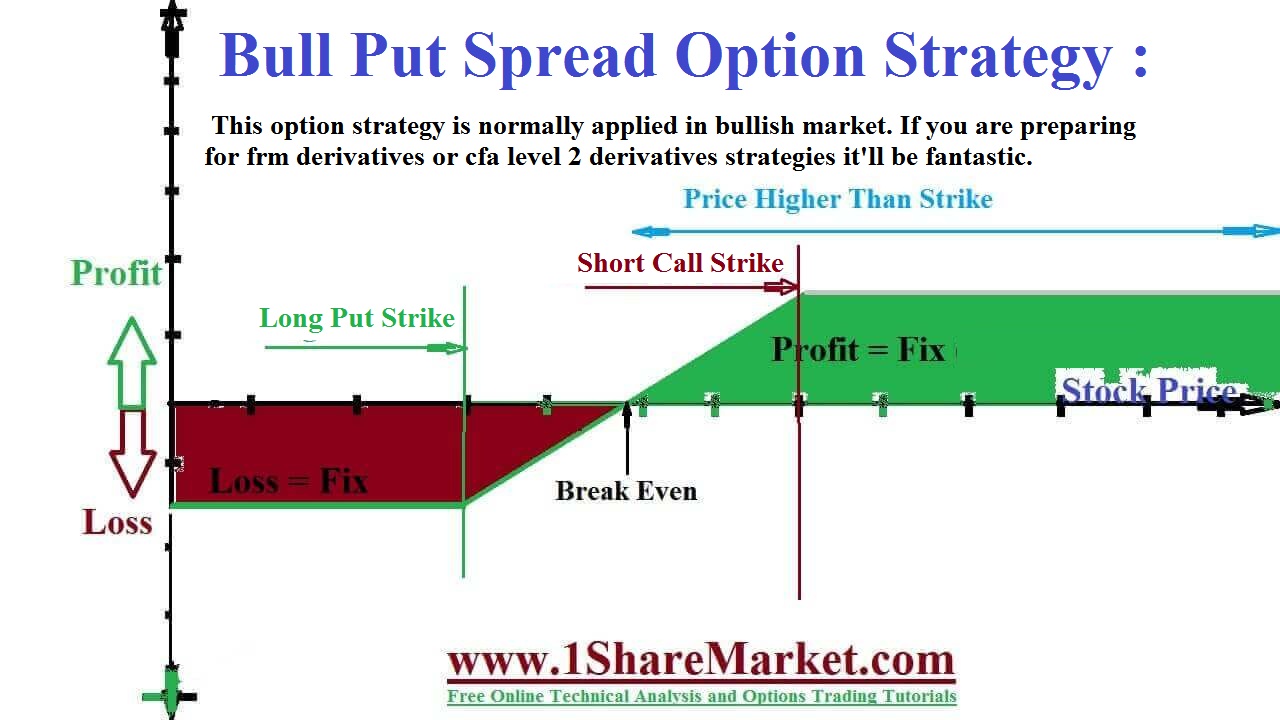

Bull Put Spread Option Trading Strategy

Image: 1sharemarket.com

Conclusion: Unveiling the Power of Bull Put Spreads

The bull put spread option trading strategy presents a valuable tool for investors seeking to harness bullish market sentiment while managing risk. By understanding the mechanics, applications, and nuances of this strategy, traders can enhance their investment toolkit and navigate market dynamics with greater confidence. As with all investment strategies, thorough research, prudent risk management, and a disciplined approach are key to maximizing potential returns and mitigating potential losses. Embrace the opportunities offered by bull put spreads and embark on a journey of financial growth and success.