Image: zuwywakybobu.web.fc2.com

Introduction

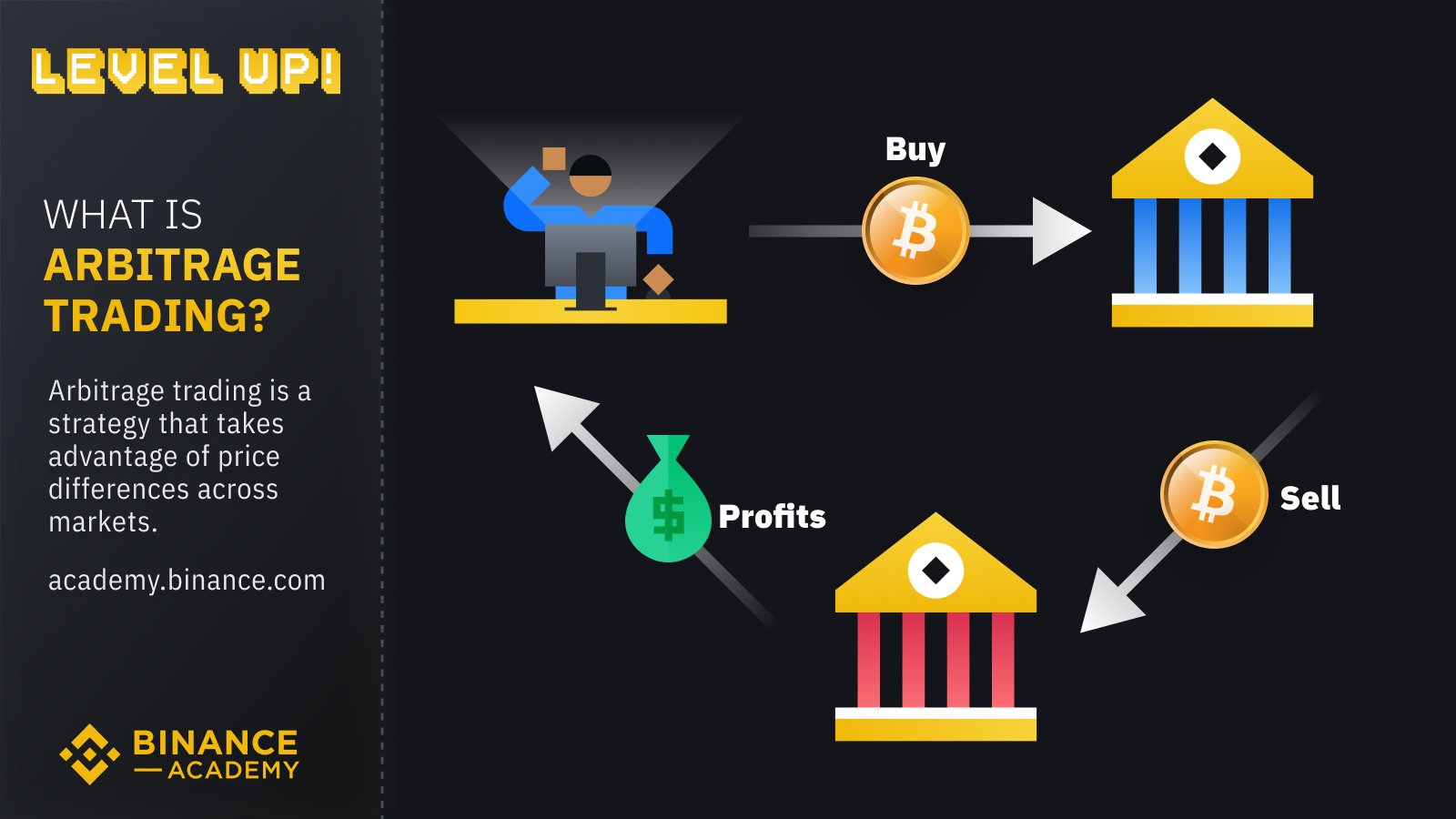

In the captivating realm of finance, where risk meets opportunity, the concept of options trading arbitrage emerges as a shrewd strategy for discerning investors. This intricate technique involves identifying and exploiting pricing discrepancies between similar financial instruments in different markets. As a gateway to potentially lucrative returns, options trading arbitrage has captivated the imagination of traders seeking to outsmart the market.

Delving into the World of Options Trading Arbitrage

At its core, options trading arbitrage involves the simultaneous purchase and sale of an underlying asset in different markets. This disparity in prices, known as the arbitrage spread, represents an opportunity for investors to capitalize on the market’s inefficiency. By purchasing the asset in the lower-priced market and selling it in the higher-priced market, arbitrageurs can capture the price difference as profit.

Understanding the Types of Options Trading Arbitrage

The spectrum of options trading arbitrage strategies is as diverse as the financial markets themselves. Some of the most prevalent types include:

– Covered Arbitrage: Involves buying the underlying asset and selling a call option on that asset, effectively creating a synthetic short position.

– Uncovered Arbitrage: Riskier approach where the trader enters into the arbitrage trade without owning the underlying asset.

– Volatility Arbitrage: Capitalizes on differences in implied volatility between options with different strike prices or expiration dates.

Navigating the Options Trading Landscape

1. Identify Arbitrage Opportunities: The hunt for arbitrage opportunities requires meticulous research and real-time market monitoring. Utilize data feeds, market scanners, and trading platforms to spot potential discrepancies.

2. Execute with Precision: Once an arbitrage opportunity is identified, swift and precise execution is paramount. Consider the transaction costs associated with the trade to maximize profitability.

3. Manage Risk Effectively: Arbitrage strategies may carry certain risks. Prudent risk management involves setting clear profit targets, employing stop-loss orders, and diversifying the portfolio.

4. Seek Expert Guidance: Consider consulting with financial advisors or experienced traders to gain insights and minimize risks.

Conclusion

Options trading arbitrage is a sophisticated financial technique that can yield substantial returns for those willing to embrace its complexities. By mastering the concepts, identifying opportunities, and managing risk effectively, investors can unlock the potential of this fascinating strategy. Whether you’re a seasoned trader or just beginning your financial journey, options trading arbitrage invites you to explore the world of financial mastery.

Image: twitter.com

Options Trading Arbitrage

Image: www.pinterest.com