Unlocking the Benefits of Advanced Order Execution

Trading options on a direct access trading (DAT) platform can provide significant advantages to both seasoned traders and those venturing into the world of options trading. In this comprehensive guide, we’ll delve into the complexities of DAT, providing an in-depth understanding of its workings, potential benefits, and potential drawbacks. Prepare to navigate the nuances of direct access trading and embrace the power of streamlined and efficient option execution.

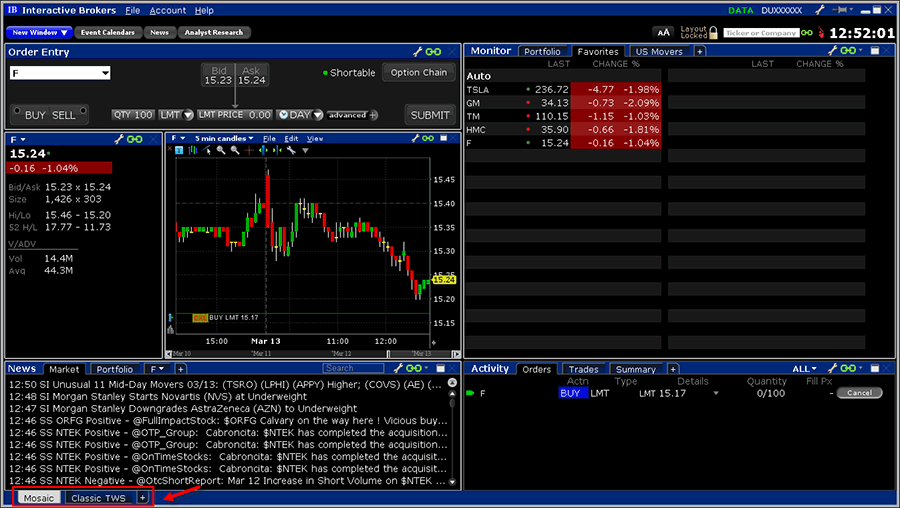

Image: s3.amazonaws.com

Direct Access Trading (DAT): A Deeper Dive

DAT offers a direct link between the trader and the exchange or market. Bypassing traditional brokerages, DAT platforms empower traders with greater control over their orders, enabling them to access Level 2 data, manage real-time risk, and execute trades with enhanced speed and precision. By eliminating intermediaries, DAT platforms facilitate faster trade execution and potentially reduce latency, crucial factors in the fast-paced world of options trading.

Benefits of Options Trading on DAT Platforms

Trading options on DAT platforms unveils a realm of benefits that traditional brokerages may not offer. Let’s explore these advantages in detail:

1. Control and Precision:

DAT platforms provide unparalleled control over order execution. Traders can specify advanced order types, customize routing preferences, and directly manage risk parameters. This level of granularity allows for sophisticated trade strategies that may not be feasible through traditional brokerages.

2. Enhanced Speed and Execution:

The direct connection to the market via DAT platforms minimizes latency, allowing traders to execute trades with lightning-fast speed. This reduced execution time can prove invaluable in capturing fleeting market opportunities or managing risk effectively.

3. Advanced Market Analysis:

DAT platforms often provide integrated access to comprehensive market data, including Level 2 data and advanced charting tools. By analyzing market depth and order flow, traders can make informed trading decisions based on real-time market dynamics.

4. Reduced Costs:

While DAT platforms typically charge fees for their services, these fees can be significantly lower compared to traditional brokerages. The cost savings associated with DAT platforms can translate into increased profitability for frequent traders.

5. Customization and Flexibility:

DAT platforms offer a high degree of customization, allowing traders to tailor their trading environment to their specific needs. From customizing trading interfaces to automating trading strategies, DAT platforms empower traders to streamline their workflow and optimize their trading performance.

Drawbacks of Trading Options on DAT Platforms

While DAT platforms offer a multitude of benefits, it’s essential to acknowledge potential drawbacks:

1. Technical Complexity:

DAT platforms can be more technically complex compared to traditional brokerages. Traders may need to possess a certain level of technical expertise to navigate the platform and utilize its features effectively.

2. Higher Margin Requirements:

DAT platforms often require higher margin requirements compared to traditional brokerages. Traders should ensure they have sufficient capital to meet these requirements and manage risk appropriately.

3. Limited Access to Research and Support:

DAT platforms generally offer limited research and support services compared to traditional brokerages. Traders may need to supplement their knowledge and support through other sources.

Image: www.pinterest.jp

Expert Insights and Actionable Tips

To maximize the benefits of options trading on DAT platforms, it’s essential to heed the advice of experts:

-

Master the fundamental concepts of options trading

before venturing into DAT trading. A solid understanding of options pricing, Greeks, and trading strategies is crucial for success. -

Practice paper trading to familiarize yourself with the platform and test your strategies in a risk-free environment.

-

Start with small positions to gain experience and manage risk before allocating significant capital.

-

Seek mentorship or training from experienced traders to enhance your knowledge and skills effectively.

Can You Trade Options On Direct Access Trading

Image: www.lime.co

Conclusion

Trading options on DAT platforms empowers traders with advanced order executioncapabilities, control over trading parameters, and access to real-time market data. While DAT platforms offer numerous benefits, it’s crucial to navigate their complexities with care and a well-informed approach. By leveraging the insights and actionable tips outlined in this article, you can harness the power of DAT platforms to enhance your options trading performance, optimize your trading strategies, and elevate your trading journey to new heights.