Unveiling the Crucial Indicator for Profitability

Options trading holds immense potential for financial success, but it’s essential to master the intricate complexities that govern it. One such crucial concept is the break-even point, a pivotal benchmark that denotes the exact point at which an options trader neither gains nor loses. Embracing a clear understanding of this determinant is paramount to informed decision-making and maximizing profitability.

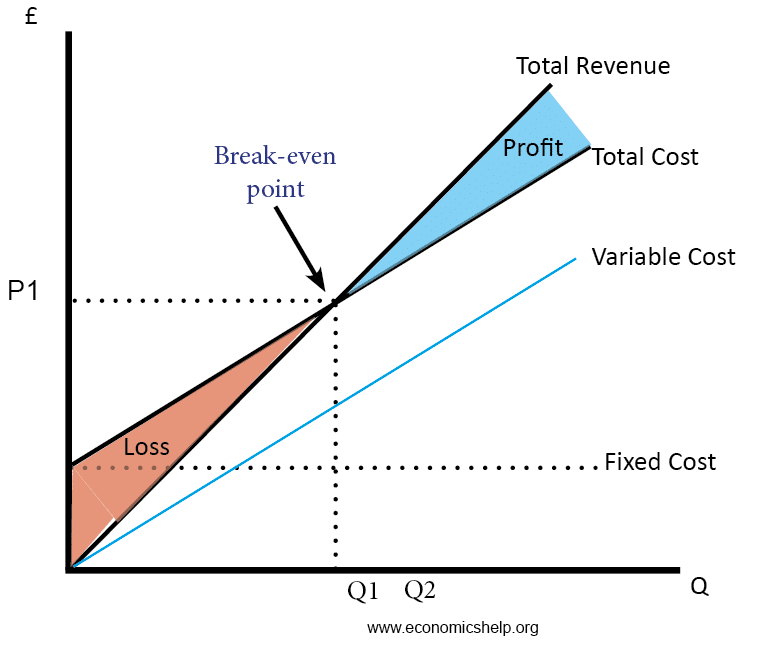

Image: www.economicshelp.org

Delving into the Break-Even Point

The break-even point represents the price at which the premium paid for an option is equal to the potential profit that can be made from the trade. More specifically, it signifies the point at which the trader’s gain on the option offsets the initial investment. Achieving this point ensures that the trader avoids a loss while potentially setting the stage for profits.

Calculating the Break-Even Point for Different Option Types

The calculation of the break-even point varies depending on the type of option being traded. For a call option, which grants the trader the right to buy an underlying asset at a specific price, the break-even point is calculated as follows:

- Break-Even Point = Strike Price + (Premium Paid / Number of Shares)

Conversely, for a put option, which provides the trader with the right to sell an underlying asset at a specific price, the break-even point is determined using the following formula:

- Break-Even Point = Strike Price – (Premium Paid / Number of Shares)

Historical Trends and Market Insights

Stay abreast of the latest trends and developments in options trading by following credible news sources, forums, and social media platforms. Market movements can significantly impact the break-even point, necessitating constant monitoring and timely adjustments to strategies.

Image: www.youtube.com

Tips and Expert Advice for Success

1. Determine the break-even point before entering any trade:

By calculating the break-even point upfront, you establish a clear understanding of the potential profitability and risk involved, enabling informed trading decisions.

2. Factor in transaction costs:

Consider the impact of broker fees, commissions, and other transaction costs when calculating the break-even point, as these expenses can erode potential profits.

FAQs

Q1: How does the break-even point differ for different strike prices?

A: The strike price directly influences the break-even point. Higher strike prices lead to higher break-even points for call options and lower break-even points for put options.

Q2: What happens when the market price exceeds the break-even point?

A: In such scenarios, call option holders can exercise their right to buy the underlying asset at a lower price, securing profit. Put option holders, conversely, have the opportunity to sell the underlying asset at a higher price, generating gains.

What Is Break Even Point In Options Trading

Image: paxforex.org

Conclusion

Understanding the break-even point is indispensable for successful options trading. By embracing this knowledge, you gain a potent tool to assess profitability, manage risk, and make informed decisions. Consistently leveraging this critical concept will empower you to navigate the ever-fluid landscape of options trading with greater confidence and the potential to optimize returns.

Are you fascinated by the intricacies of options trading? Engage with us in the comments section below, and let’s delve deeper into the art of harnessing this powerful financial instrument.