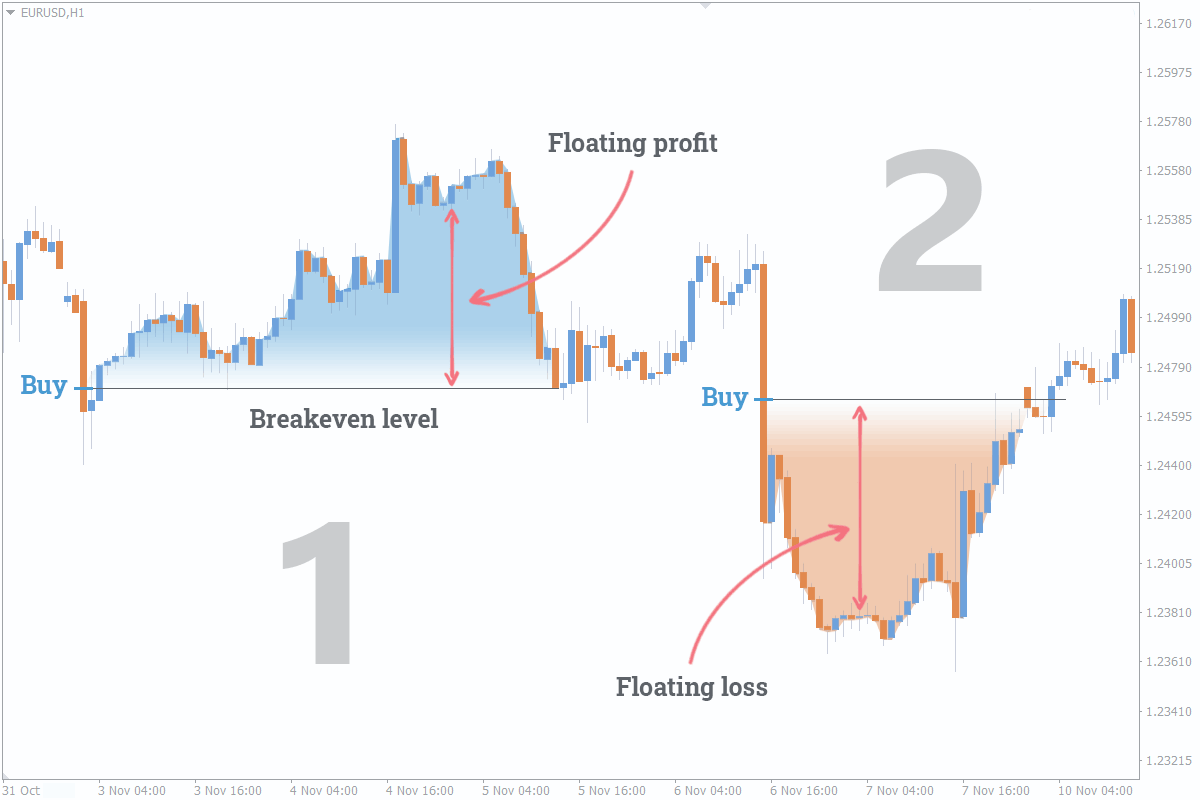

Have you ever wondered what it takes to break even in option trading? The breakeven price in option trading is a critical concept that traders must understand to manage risk and maximize potential returns. This article will delve into the intricacies of option trading, focusing on the breakeven price and its importance.

Image: fxssi.com

Understanding Option Trading and the Breakeven Price

Option trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) on or before a given date (the expiration date). The breakeven price in option trading is the price at which the option holder neither makes a profit nor incurs a loss.

Formula for Call Option: Breakeven Price = Strike Price + [Premium Paid – (Net Commission + Fees)]

Formula for Put Option: Breakeven Price = Strike Price – [Premium Paid – (Net Commission + Fees)]

Factors that Affect the Breakeven Price

The breakeven price in option trading depends on various factors, including:

- Strike Price: The strike price significantly impacts the breakeven price. IT represents the price the holder can buy or sell the underlying at

- Option Premium: It is the price the option trader pays to purchase the option contract.

- Trading Fees and Commissions: All associated fees and commissions must be taken into account alongside the breakeven price.

- Time Decay: Option premiums tend to decline overtime as the option approaches its expiration date.

Importance of Breakeven Price in Option Trading

Understanding the breakeven price is crucial in option trading because it allows traders to:

- Manage Risk: Knowing the breakeven price helps traders assess potential losses and set appropriate stops to limit risk.

- Maximize Returns: Traders can determine if the potential profits outweigh the costs of the option.

- Make Informed Decisions: By understanding how external factors affect the breakeven price, traders can make more informed trading decisions.

- Calculate Profitability: The breakeven price is a crucial factor in determining the profitability of option trades post-execution.

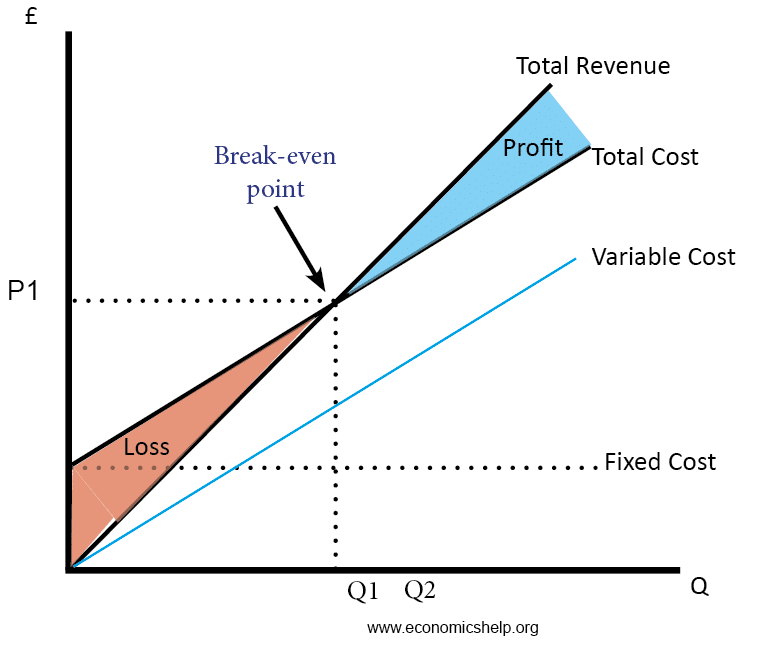

Image: www.economicshelp.org

Trading Strategies Based on Breakeven Price

Traders employ various strategies based on the breakeven price, including:

- Covered Call Strategy: Selling a call option against a stock owned, with the strike price above the breakeven price.

- Cash Secured Put Strategy: Selling a put option secured by cash, with the strike price below the breakeven price.

- Spread Trading: Trading a combination of options with different strike prices to create a defined breakeven point.

What Is Breakeven Price In Option Trading

Image: derivbinary.com

Conclusion

The breakeven price in option trading is a key concept every trader must grasp. Understanding the calculation and factors that affect the breakeven price empowers traders to manage risk, maximize returns, and make informed trading decisions. By skillfully implementing various breakeven price strategies, traders can potentially improve the profitability of their option trades. Through continuous learning, informed analysis, and refined trading techniques, traders can navigate the complexities of option trading with greater confidence and reach their financial goals.