Introduction

Options trading can be a lucrative endeavor, but it’s crucial to understand the concept of breakeven to navigate the intricate world of options effectively. Breakeven refers to the price point at which an options trader neither gains nor loses money on their investment. Understanding breakeven is paramount as it helps traders strategize their entry and exit points, manage risk, and maximize profits.

Image: www.slideteam.net

Understanding Breakeven

Each option contract represents 100 shares of the underlying asset. Therefore, to calculate breakeven for call options, simply multiply the strike price by 100 and add the premium paid. For put options, multiply the strike price by 100 and subtract the premium.

For example, if you purchase a call option with a strike price of $50 and pay a premium of $5, your breakeven point would be $5050 ($50 x 100 + $5).

Determining Breakeven for Different Scenarios

Breakeven calculations vary slightly depending on the type of option (call or put) and whether it is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM). In-the-money options have an intrinsic value and may reach breakeven even before expiration. Out-of-the-money options have no intrinsic value and only gain value if the underlying asset moves substantially in the desired direction.

Breakeven as a Risk Management Tool

Breakeven analysis plays a pivotal role in risk management for options traders. By assessing breakeven points, traders can:

- Set Realistic Expectations: Breakeven limits unrealistically high expectations, ensuring that traders are not solely driven by hopes of exorbitant profits.

- Manage Drawdowns: Determining breakeven points helps traders anticipate potential losses and adjust their trading strategies accordingly.

- Identify Potential Opportunities: Breakeven calculations help traders identify options with favorable risk-reward ratios, increasing their chances of success.

Image: www.dailyfx.com

Strategies for Profiting Above Breakeven

While breakeven is a crucial benchmark, the ultimate goal for options traders is to generate profits. Here are a few strategies to aim for:

- Target Premiums: Selling options at a premium that exceeds the market consensus can increase profitability potential.

- Time Decay: Understanding how time decay affects option premiums can enable traders to make informed decisions about holding or selling options closer to expiration.

- Volatility Trading: Profoundly understanding volatility can help traders exploit market inefficiencies and position themselves favorably to profit from volatility fluctuations.

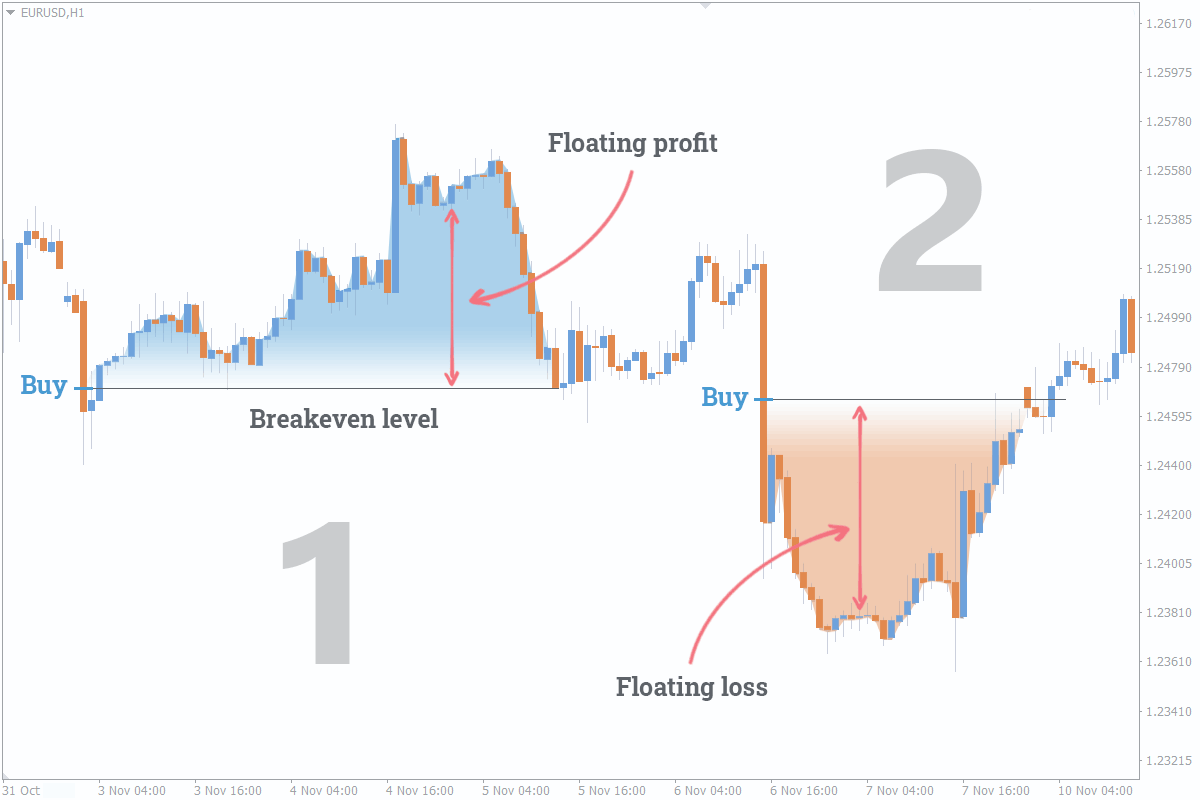

Breakeven In Options Trading

Image: fxssi.com

Conclusion

Navigating the complex realm of options trading requires a comprehensive grasp of breakeven and its implications for risk management and profitability. By mastering breakeven analysis, traders can effectively determine the viability of trades, strategize for success, and maximize their potential for financial gain. Remember, while knowing breakeven is essential, the ultimate measure of a successful options trader lies in their ability to consistently profit above breakeven levels.