**Introduction

Image: www.youtube.com

As a day trader navigating the volatile waters of the stock market, your ability to identify the most lucrative strike prices in the option chain holds immense sway over your profit potential. With the right strategy, you can transform this bewildering array of choices into a tactical edge that boosts your performance. This article will delve into the intricate world of option chain strike prices, illuminating the factors that shape their value and equipping you with an informed approach to selecting the best strikes for your day trading endeavors.

Navigating the Strike Price Maze

A strike price, in its essence, represents the predetermined price at which you have the contractual right to buy or sell an underlying asset. These prices form a continuum within the option chain, with each strike offering a distinct set of risks and rewards. Understanding the factors that influence strike prices is paramount to making sound trading decisions.

1.) The Underlying Asset’s Price: The most influential determinant of strike prices is the current price of the underlying asset. Options with strike prices close to the spot price tend to have higher premiums, reflecting the increased likelihood of being exercised.

2.) Volatility: Market volatility, a measure of price fluctuations, plays a significant role in option pricing. When volatility is high, traders are willing to pay higher premiums for options that offer protection against large price swings.

3.) Time to Expiration: Options with shorter time frames to expiration typically carry lower premiums. This is because the probability of them being exercised before expiration diminishes as time progresses.

Unveiling the Art of Strike Price Selection

Choosing the optimal strike price for day trading options is a skill that requires careful consideration and meticulous analysis:

1.) Identifying Your Trading Strategy: Different trading strategies dictate distinct strike price preferences. Scalpers, who aim to capture small profits over short time frames, often opt for strikes close to the underlying asset’s price. Conversely, swing traders, who hold positions for longer periods, may favor strikes further away from the current price.

2.) Assessing Market Conditions: Market conditions greatly influence strike price selection. In upward trending markets, calls with higher strike prices become more valuable, while in downward trending markets, puts with lower strike prices gain prominence.

3.) Utilizing Technical Analysis: Technical indicators, such as support and resistance levels, can provide valuable insights into potential price movements and help you identify strike prices that align with your trading bias.

Expert Insights for Informed Decisions

“Strike price selection is a critical factor in option day trading success. By considering the underlying asset’s price, volatility, and time to expiration, you can identify strike prices that offer the best risk-reward ratio,” says John Carter, a renowned options trading expert.

“Don’t get caught up in chasing the highest premiums. Instead, focus on selecting strikes that align with your trading strategy and market conditions,” advises Mary Anne Bartels, a veteran day trader.

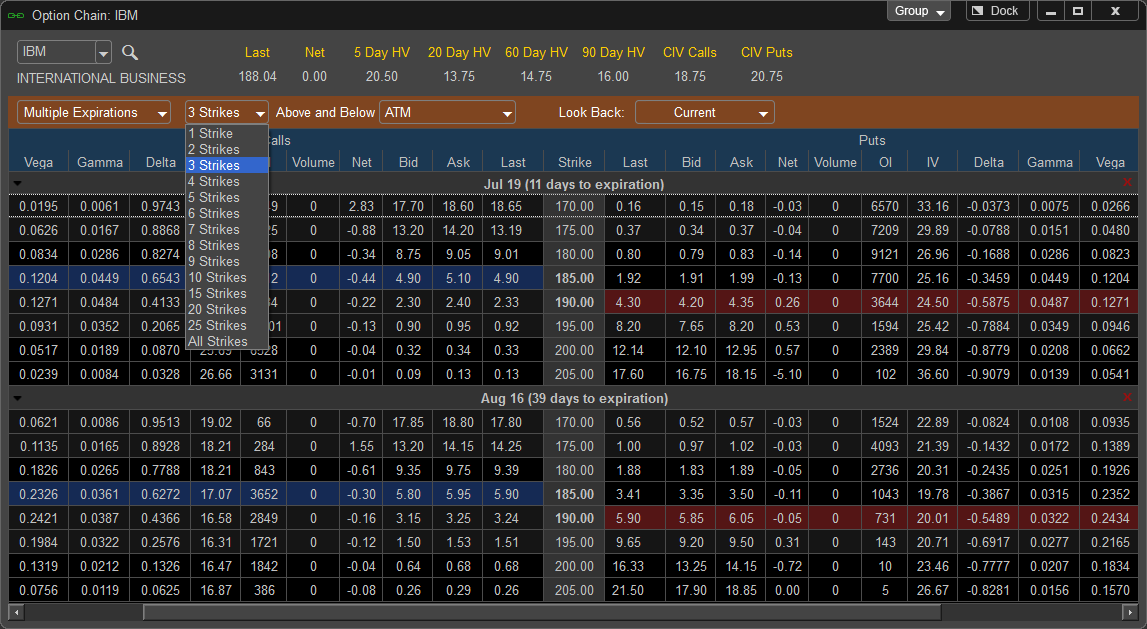

Image: oahelp.dynamictrend.com

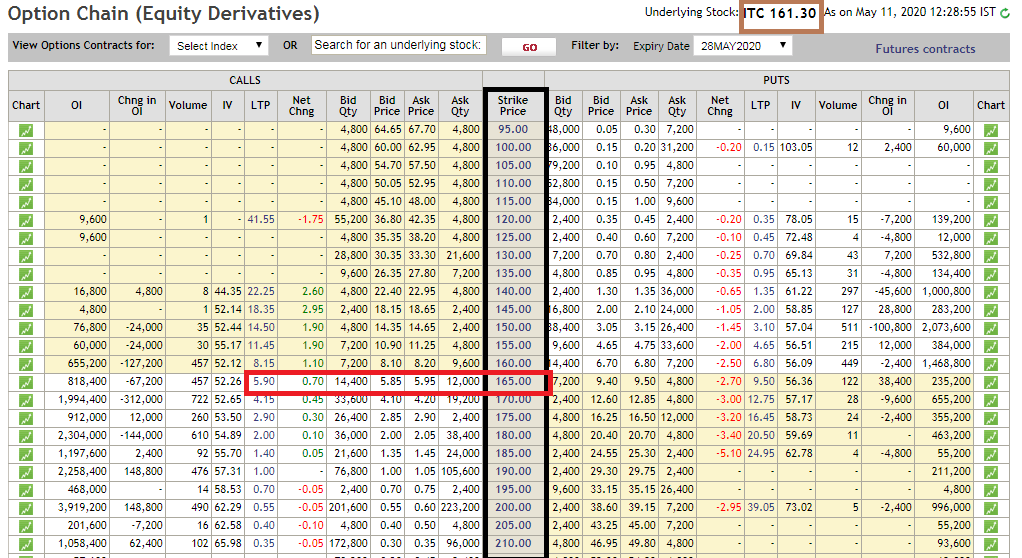

Which Strike Best In Option Chain For Day Trading

Image: blog.elearnmarkets.com

Conclusion

The ability to select the optimal strike price in the option chain is a fundamental skill for day traders who seek to maximize their profit potential. By understanding the factors that influence strike prices and employing a judicious selection process, you can navigate the complexities of option trading with confidence and precision. Remember, the path to trading mastery is paved with continuous learning and refinement. Stay informed about market trends, experiment with different strategies, and seek guidance from reputable sources to enhance your skills and elevate your day trading performance to new heights.