Introduction

:max_bytes(150000):strip_icc()/outrightoptiontradeexampleAAPL-01e05f85d910444cb5c8119c7b830dc5.jpg)

Image: www.investopedia.com

In the dynamic world of finance, options trading has emerged as a powerful tool for investors seeking to amplify their returns and manage risk. At the heart of options trading lies a fundamental concept: the options trading chain. Understanding this concept is crucial for harnessing the full potential of options and executing informed investment strategies.

This comprehensive guide will delve into the intricacies of the options trading chain, exploring its history, applications, and recent advancements. By the end of this insightful exploration, you will possess a thorough understanding of this key concept and be equipped with the knowledge to navigate the options market with greater confidence.

Understanding the Options Trading Chain

The options trading chain is an interconnected network of options contracts that represent the various strike prices and expiration dates available for a specific underlying asset. Each contract in the chain grants the holder the right, but not the obligation, to buy or sell the underlying asset at a predetermined price and date. By combining options from different areas of the chain, investors can construct sophisticated strategies to align with their investment goals and risk tolerance.

Types of Options Contracts

Within the options trading chain, two types of contracts are prevalent: calls and puts. Call options confer the right to buy the underlying asset at the strike price, while put options grant the right to sell. The strike price, representing the agreed-upon purchase or sale price, is a critical consideration when selecting an options contract.

Expiration Dates

Each options contract has a set expiration date, indicating the final day on which the contract can be exercised. Expiration dates vary widely, ranging from a few days to several months, providing traders with flexibility in adapting their strategies to the anticipated market movements.

Greeks and Volatility

The behavior of options contracts is influenced by a set of metrics known as Greeks. Delta measures the price sensitivity of an option to changes in the underlying asset’s price. Volatility, gauging the expected fluctuations of the underlying asset, also plays a pivotal role in pricing and trading options effectively.

Constructing Options Trading Strategies

Combining options from different parts of the chain enables the creation of complex strategies tailored to specific market expectations and risk appetites. Some common strategies include:

-

Bullish Call Spread: A bullish strategy involving buying a lower-strike call option and simultaneously selling a higher-strike call option.

-

Bearish Put Spread: A bearish strategy involving selling a higher-strike put option and simultaneously buying a lower-strike put option.

-

Straddle: A neutral strategy, straddle involves buying both a call and a put option with the same strike price and expiration date.

Conclusion

Understanding the nuances of the options trading chain is fundamental to making informed decisions and optimizing strategies. By delving into the depths of this topic, investors can cultivate a refined understanding of the financial landscape and harness the power of options to navigate market fluctuations and unlock opportunities for lucrative returns.

Call to Action: To delve deeper into the world of options trading, explore the accompanying resources and engage in discussions with experienced traders. By embracing the continuous pursuit of knowledge and sharing insights, you can elevate your trading skills and approach the market with an enhanced level of confidence and expertise.

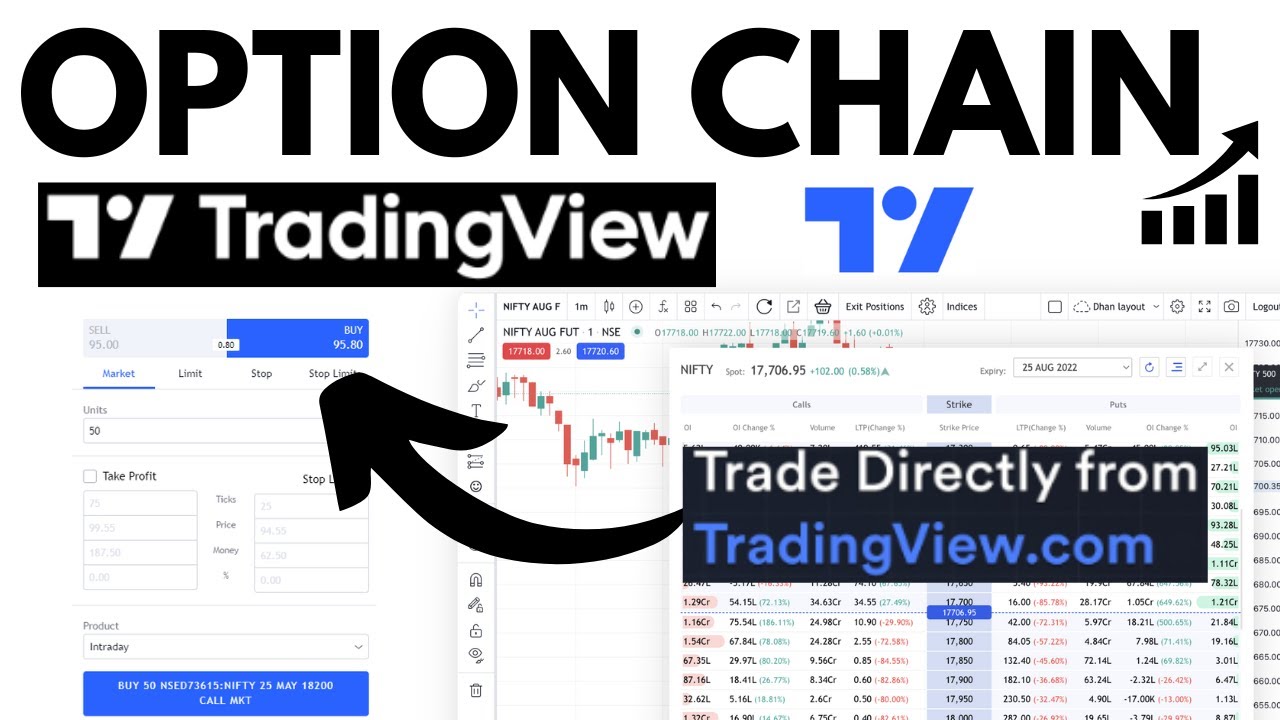

Image: www.youtube.com

Options Trading Chain

Image: wealthbuildershq.com