In the labyrinthine realm of finance, derivatives trading and option pricing emerge as captivating concepts that have revolutionized the way investors navigate risk and seek opportunities. Derivatives, financial instruments that derive their value from an underlying asset, offer a nuanced mechanism for managing risk and amplifying gains. Among these derivatives, options stand out as versatile contracts granting purchasers the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame.

Image: www.financestrategists.com

This intricate realm of options and derivatives offers investors a tantalizing array of possibilities and complexities. With proper understanding, these instruments can empower traders to hedge against potential losses, speculate on future price movements, and unlock a wider spectrum of investment strategies. In this comprehensive guide, we will delve into the intricacies of derivatives trading and option pricing, illuminating their historical roots, fundamental principles, and practical applications.

A Historical Glimpse into the Evolution of Derivatives

The concept of derivatives has its genesis in ancient civilizations, where forward contracts facilitated trade by locking in future prices for agricultural commodities. The formalization of derivatives gained momentum in the 20th century with the introduction of standardized contracts on exchanges, paving the way for widespread trading and risk management.

Navigating the Maze of Derivatives: Myriad Types and Functions

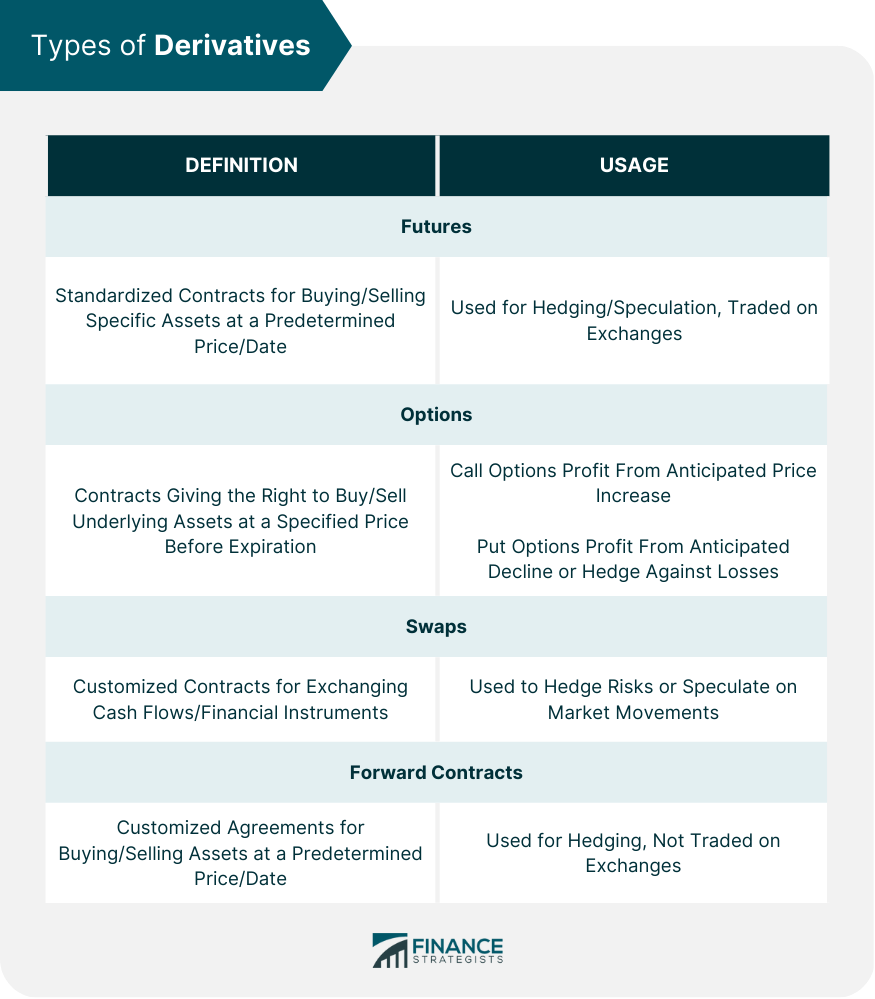

The universe of derivatives encompasses a diverse range of instruments, each tailored to specific investment goals. Futures contracts, forwards, swaps, and options constitute the primary types of derivatives, employed for purposes such as hedging against price fluctuations, speculating on price movements, and engineering complex investment strategies.

Options: A Tale of Rights and Obligations

Within the derivatives landscape, options hold a prominent position as contracts that confer upon their purchasers the right, but not the obligation, to buy or sell an underlying asset at a preset price (strike price) on or before a specified date (expiration date). Call options grant purchasers the right to buy, while put options confer the right to sell.

Image: www.kagamasumut.org

Option Pricing Models: Unraveling the Enigma

The pricing of options represents an intricate interplay of various factors, necessitating specialized models to determine their fair value. Among the most widely utilized pricing models are the Black-Scholes model, the binomial option pricing model, and the Monte Carlo simulation. These models consider parameters such as the underlying asset’s price, strike price, time to expiration, risk-free interest rate, and volatility to arrive at a theoretical value for the option.

Real-World Applications: Unleashing the Power of Derivatives

In the practical realm of investing, derivatives serve a multitude of purposes. Hedging strategies utilize derivatives to offset potential losses by locking in future prices or compensating for adverse price movements. Speculators leverage derivatives to profit from anticipated price fluctuations in underlying assets. Institutional investors employ derivatives as sophisticated investment tools to enhance portfolio returns and manage risk.

Derivatives Trading And Option Pricing

Image: fxreviewtrading.com

Conclusion: Embracing Derivatives and Options: A Journey of Risk and Reward

The world of derivatives trading and option pricing presents investors with a vast array of opportunities and challenges. By arming themselves with a thorough understanding of these instruments, investors can harness their potential for risk management, speculative gains, and enhanced investment strategies. Embracing derivatives and options requires a deep understanding of their intricacies, a prudent approach to risk, and a continuous pursuit of knowledge. As the financial landscape evolves, derivatives and options will undoubtedly continue to play a pivotal role in shaping investment decisions and empowering investors seeking to conquer the enigmatic realm of risk and reward.