Introduction

Image: www.thehansindia.com

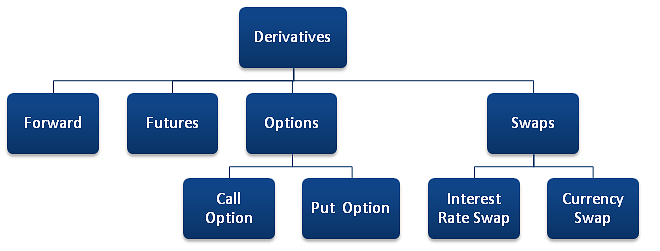

In the labyrinthine realm of finance, derivatives trading reigns supreme, opening doors to opportunities and risks in equal measure. Derivatives, like futures and options, empower investors with a sophisticated toolbox to manage financial portfolios, speculate on market movements, and hedge against potential losses. For seasoned traders and aspiring market mavens alike, navigating the intricacies of derivatives trading can lead to financial success and risk mitigation.

This comprehensive guide will delve into the captivating world of derivatives, futures, and options. We’ll unveil their historical roots, unravel their complex mechanisms, and illuminate the latest trends shaping these markets. Through expert insights and actionable tips, you’ll gain the knowledge to navigate the turbulent waters of financial markets with confidence and precision.

Derivatives: The Cornerstones of Risk Management

Derivatives, like the venerable options contract, evolved centuries ago as instruments for managing risk in agricultural markets, shielding farmers from volatile price fluctuations. Today, their applications extend far beyond, encompassing every corner of global finance. Futures contracts, another derivative instrument, allow investors to lock in prices for future delivery, offering hedging against unanticipated price swings.

The Mechanics of Futures and Options: A Step-by-Step Guide

Futures contracts trade on designated exchanges, standardizing contract terms such as underlying asset, quantity, and delivery date. Buyers of futures acquire the obligation to purchase an asset at a predetermined price on a future date, while sellers take on the responsibility to deliver. Options contracts, in contrast, confer a right but not an obligation upon the holder. Options buyers can choose to exercise their right to buy or sell an underlying asset at a specified price before the contract expires.

The Art of Trading Futures and Options: Expert Insights

Navigating the volatile waters of derivatives trading demands both technical proficiency and a keen understanding of market dynamics. Seasoned traders emphasize the importance of thorough research, risk management, and constant adaptation to evolving market conditions. They advise aspiring traders to start small, cultivate patience, and seek guidance from experienced mentors or reputable sources.

Real-World Strategies: Harnessing Derivatives for Success

Derivatives trading offers a multitude of strategies to enhance portfolio returns and mitigate risks. Conservative investors may employ long futures positions to capitalize on expected price increases, while more aggressive traders may opt for options to leverage market volatility for higher returns. Hedging strategies, which involve offsetting the risk of an existing position through a corresponding futures or options contract, provide a valuable tool for risk management.

Conclusion: Embracing the Power with Responsibility

Derivatives trading, futures, and options offer unparalleled opportunities for financial empowerment and risk management. By mastering the fundamentals, employing expert strategies, and embracing continuous learning, you can navigate the markets with confidence. Remember, derivatives are double-edged swords, simultaneously offering great rewards and potential risks. Trade wisely, and conquer the markets with knowledge and prudence.

Image: www.finideas.com

Derivatives Trading Futures And Options

Image: www.century.ae