In the labyrinthine world of finance, understanding the intricacies of investment instruments and trading strategies is paramount. Options, futures, derivatives, algorithmic trading, and DMA are interconnected concepts that can open doors to new financial frontiers. This article will demystify these concepts, providing a comprehensive guide to empower traders and investors alike.

Image: aws.amazon.com

These financial instruments have revolutionized the way we trade assets, from providing risk management tools to facilitating seamless execution. Whether you’re a seasoned trader or just starting your investment journey, understanding these concepts will pave the way for informed decision-making and successful trading outcomes.

Options and Futures: A Deeper Dive

Options

Options, as the name suggests, grant the holder the “option” to buy or sell an underlying asset at a specified price, known as the strike price, within a defined time frame. They provide flexibility, allowing traders to hedge against market risks or speculate on price movements without having to own the underlying asset.

Futures

Futures contracts, on the other hand, obligate the buyer to purchase and the seller to deliver an underlying asset at a predetermined price on a future date. Unlike options, futures carry no optionality. They are commonly used for hedging, price discovery, and managing market exposures.

Image: www.onemint.com

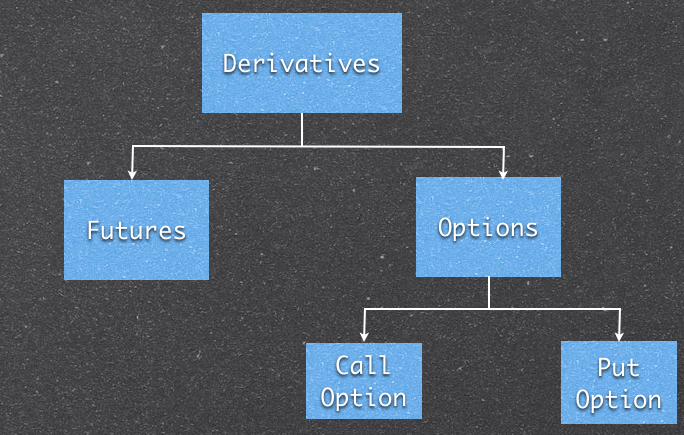

Derivatives: A Complex Ecosystem

Derivatives, as their name implies, derive their value from an underlying asset or multiple assets. They come in various forms, including options, futures, forwards, swaps, and many more. Derivatives allow traders to speculate, hedge, and leverage their positions, creating complex risk-reward scenarios.

Algorithmic Trading and DMA: The Automation Revolution

Algorithmic trading, powered by pre-defined rules and computer programs, automates the trading process. This technology analyzes market data, identifies trading opportunities, and executes trades in real-time. DMA (Direct Market Access) enables traders to connect directly to exchanges, bypassing intermediaries and gaining faster access to liquidity.

Tips and Expert Advice for Success

Navigating the complex world of options, futures, derivatives, and algorithmic trading requires knowledge, strategy, and expert guidance. Here are a few tips to help you succeed:

- Understand the Risks: These instruments come with inherent risks. Thoroughly comprehend the potential risks and manage them effectively.

- Define Your Strategy: Establish a clear trading strategy that aligns with your risk tolerance, investment goals, and market analysis.

- Choose the Right Platform: Select a trading platform that provides the tools, functionality, and support you need.

- Start Small: Don’t venture too deep into the market without experience. Start with small positions and gradually increase your involvement as you gain confidence.

- Educate Yourself: Continuously update your knowledge and stay informed about market trends, new strategies, and regulatory changes.

Remember, these tips are guidelines; always seek professional advice before making significant trading decisions.

FAQs on Options, Futures, and More

- Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy, while a put option gives the right to sell an underlying asset. - Q: How does a futures contract differ from a forward contract?

A: Futures are standardized and traded on exchanges, while forwards are customized agreements between two parties. - Q: What are the benefits of algorithmic trading?

A: Algorithmic trading can improve execution speed, reduce emotional decision-making, and protect against certain market risks.

Options Futures And Other Derivatives And Algorithmic Trading And Dma

Image: www.slideshare.net

Conclusion

The world of financial instruments is constantly evolving, with new concepts and strategies emerging. Understanding options, futures, derivatives, algorithmic trading, and DMA will empower you to harness their potential and navigate the intricate market landscape. Whether you’re a novice or an experienced trader, continuous learning and expert guidance will lead you towards informed investment decisions and successful outcomes.

Are you ready to embark on the exciting path of mastering these concepts and unlocking new trading possibilities? Let us know your thoughts and questions in the comments below!