In the intricate world of financial markets, options trading stands out as a versatile and potentially lucrative avenue. Within this domain, option chain trading strategies have emerged as a sophisticated toolset, empowering traders with the ability to navigate market complexities and optimize returns. This comprehensive guide delves into the multifaceted aspects of option chain trading, providing a roadmap for understanding its concepts, applications, and nuances.

Image: www.1investing.in

Introduction to Option Chain Trading

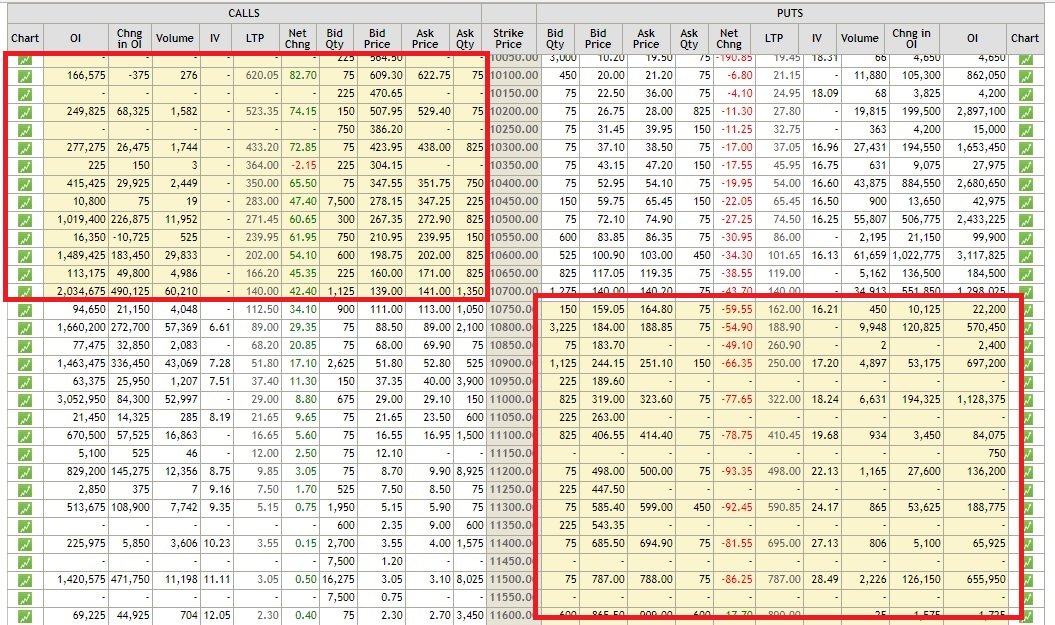

An option chain is a graphical representation of all available options contracts for a specific underlying asset, such as a stock or index. Each option contract consists of a strike price, expiration date, and option type (call or put). By analyzing the option chain, traders can assess the market’s sentiment, implied volatility, and potential price movements of the underlying asset.

Option chain trading strategies involve combining multiple options contracts to achieve specific objectives. These strategies can range from simple spreads to complex multi-leg structures, each tailored to different market conditions and risk appetites. Understanding the mechanics of option chains is crucial for developing effective trading strategies that align with one’s investment goals.

Unveiling the Basic Concepts

Strike Price: The strike price of an option contract is the predetermined price at which the underlying asset can be bought (for calls) or sold (for puts) upon expiration. It serves as a benchmark against which the option’s value is measured.

Expiration Date: This marks the end of the option contract’s life. Options can expire weekly, monthly, or quarterly, providing traders with varying durations to hold their positions.

Option Type: Call options grant the holder the right to buy the underlying asset at the strike price, while put options convey the right to sell the asset at the strike price. The choice of option type depends on the trader’s market outlook.

Implied Volatility: Implied volatility is a key metric that measures the expected price fluctuations of the underlying asset. It is an integral factor in determining the premium (price) of an option contract.

Exploring Practical Applications

Option chain trading strategies find widespread application in real-world trading. Some common strategies include:

Bull Call Spread: This involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. This strategy benefits from an upward movement in the underlying asset’s price.

Bear Put Spread: The reverse of a bull call spread, it entails selling a put option at a higher strike price and buying a put option at a lower strike price. This strategy profits from a downward movement in the underlying asset’s price.

Iron Condor: A neutral strategy that involves selling an out-of-the-money call spread and buying an out-of-the-money put spread. This strategy benefits from limited price fluctuations of the underlying asset.

Image: blog.dhan.co

Embracing the Latest Trends

The world of option chain trading is constantly evolving. Recent trends include:

Increased Use of Artificial Intelligence: AI algorithms are now employed to analyze vast amounts of option chain data, optimizing trade execution and risk management.

Development of Multi-Leg Strategies: Complex option chain strategies involving multiple legs have gained popularity due to their enhanced risk-reward profile.

Rising Importance of Volatility Trading: Implied volatility has become a crucial component in determining option pricing, leading to increased focus on volatility trading strategies.

Option Chain Trading Strategy

Conclusion

Option chain trading strategies empower traders with diverse tools to tackle financial markets. By understanding the fundamental concepts, leveraging analytical tools, and staying abreast of industry developments, individuals can harness the potential of option chain trading to optimize their investment outcomes. This comprehensive guide has provided a solid foundation for traders to explore the complexities of option chains and unlock the opportunities they offer.