In the realm of financial markets, options trading provides traders with a powerful tool to speculate on the future price movements of underlying assets. Central to this practice is the option chain, an essential tool for assessing market sentiment and evaluating potential strategies. Embarking on a trading journey requires familiarity with this critical tool, and this article aims to empower you with a comprehensive understanding of option chain trading views.

Image: www.samco.in

Options 101: A Brief Overview

Understanding the Option Chain

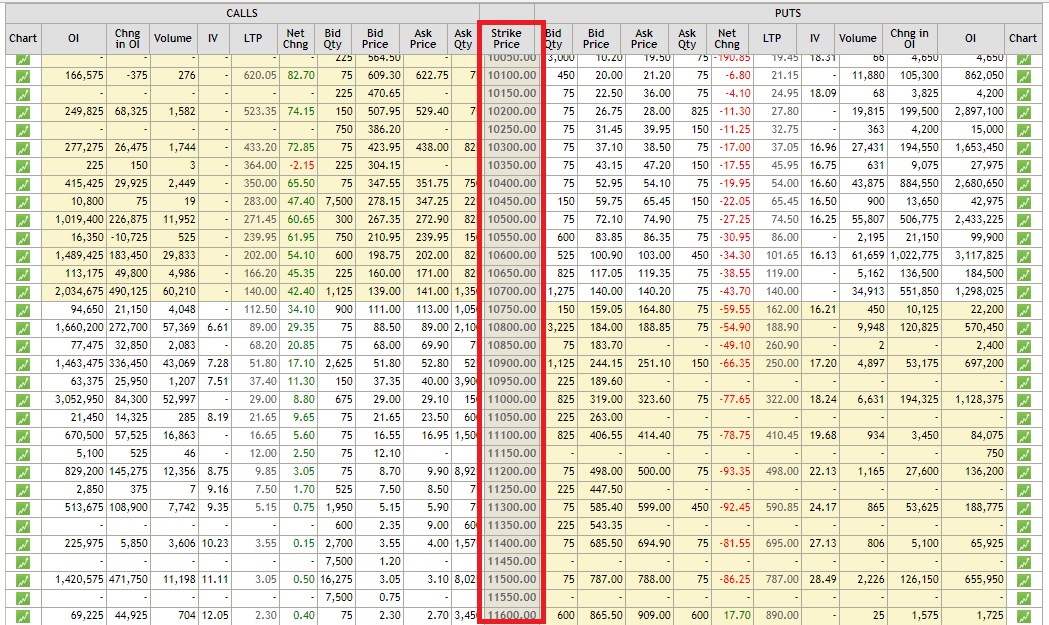

An option chain is a graphical representation of all available options contracts for a specific underlying asset at a particular point in time. Each contract represents a right, not an obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The option chain organizes these contracts by strike price and expiration date, providing a snapshot of the market’s expectations for the asset’s price movement.

Deciphering Option Chain Data

The option chain displays a wealth of information, including:

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date on or before which the option can be exercised.

- Bid Price: The highest price a buyer is willing to pay for the option.

- Ask Price: The lowest price a seller is willing to accept for the option.

- Last Price: The most recent price at which the option traded.

- Volume: The number of option contracts traded.

- Open Interest: The number of option contracts currently outstanding.

By interpreting this data, traders can gain insights into market sentiment, volatility expectations, and potential trading opportunities.

Analyzing Option Chains for Trading Decisions

Option chains serve as invaluable tools for formulating trading strategies. Here are some common analysis techniques:

- Volatility Assessment: The distribution of option prices across strike prices indicates implied volatility, a measure of the market’s expectation of price fluctuations.

- Trend Identification: By comparing option chains over time, traders can identify emerging trends in market sentiment.

- Spread Trading: Analyzing the relative prices of options with different strike prices and expiration dates can reveal potential spread trading opportunities.

- Unusual Activity Detection: Sudden spikes in option volume or open interest may indicate unusual market activity or potential trading opportunities.

These techniques empower traders to make informed trading decisions, assess risk, and optimize their strategies.

Image: www.chittorgarh.com

Tips and Expert Advice for Option Chain Trading

To enhance your option chain trading experience, consider these tips:

- Understand Market Dynamics: Familiarize yourself with the underlying asset, market conditions, and recent news events.

- Set Realistic Expectations: Options trading involves risk, and it is crucial to set realistic profit targets and risk management strategies.

- Time is of the Essence: Options have limited lifespans, so consider expiration dates carefully and monitor the time decay.

- Seek Professional Guidance: If needed, consult with a qualified financial advisor to navigate the complexities of options trading.

By adhering to these guidelines, you can increase your chances of successful option chain trading.

FAQ: Common Questions about Option Chain Trading

To address common queries, here is a brief FAQ:

- What is the difference between a call and a put option? Call options give the right to buy, while put options provide the right to sell the underlying asset.

- What is implied volatility? Implied volatility reflects the market’s expectation of future price fluctuations.

- How do I read an option chain? Option chains display strike prices, expiration dates, bid, ask, and volume information.

- Can I make money selling options? Yes, selling options can generate income through premiums, but it also carries risk.

Exploring these questions can further expand your understanding of option chain trading.

Option Chain Trading View

Conclusion

Understanding option chain trading views is paramount for successful options trading. By interpreting option chain data, traders can gain valuable insights into market sentiment, volatility expectations, and potential trading opportunities. Armed with this knowledge, traders can make informed decisions, manage risk, and enhance their trading strategies. Whether you’re a seasoned trader or just starting, embracing the power of option chains will empower you to navigate the financial markets with confidence.

Are you interested in delving deeper into the world of option chain trading? Share your questions and insights in the comments section below, and I’ll be happy to continue the discussion.