Introduction

In the dynamic world of financial trading, option chains have emerged as a potent tool, providing astute traders with a panoramic view of available options contracts. Navigating through the complexities of option chains can be a daunting task for even experienced traders. However, equipping oneself with the right knowledge and understanding can unlock the full potential of this invaluable trading tool. In this comprehensive guide, we will explore the intricacies of option chains in TradingView, empowering traders to harness their power and make informed decisions.

Image: club.ino.com

Understanding Option Chains

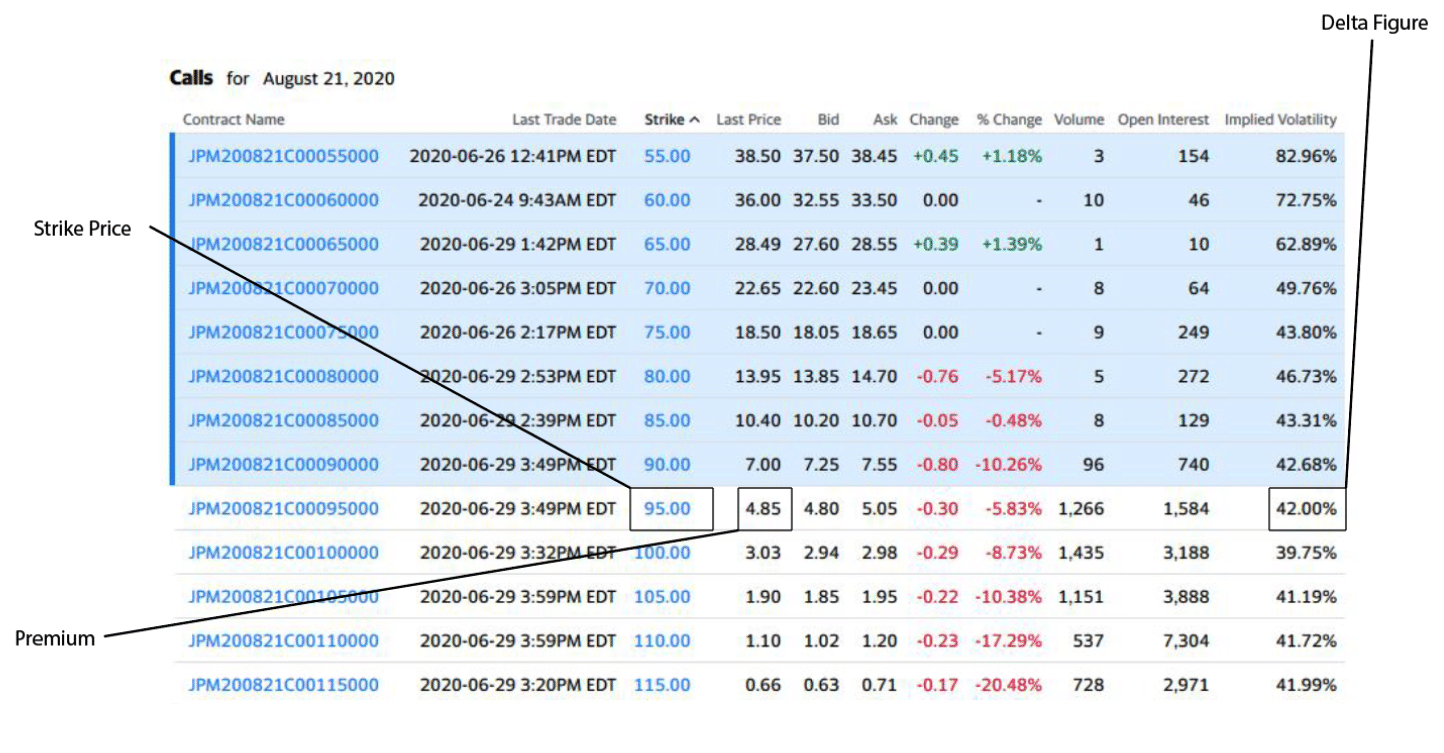

An option chain is a tabular representation of all the option contracts, both calls and puts, available for a particular underlying asset within a predetermined period. Each option contract carries specific characteristics, including the strike price, expiration date, and implied volatility. By examining the option chain, traders can gain valuable insights into the market’s sentiment toward the underlying asset.

Analyzing Option Chains

Option chains offer a wealth of information that can be leveraged by traders to analyze market dynamics. By comparing the prices and volumes of different option contracts, traders can derive valuable information about implied volatility, potential price movements, and market sentiment. Understanding these dynamics empowers traders to make informed decisions and fine-tune their trading strategies.

Option Chain Dynamics

The behavior of option prices within a chain is influenced by several factors, including:

Image: guide.traderevolution.com

Implied Volatility:

This measures the market’s expectation of future price volatility for the underlying asset. Options with higher implied volatility tend to be more expensive.

Strike Price:

The strike price represents the price at which the underlying asset can be bought (in the case of calls) or sold (in the case of puts) upon exercise.

Expiration Date:

The expiration date marks the last day an option contract can be exercised. Closer expiration dates result in higher option prices due to reduced time value.

Trading Strategies with Option Chains

Option chains offer versatile trading opportunities for both aggressive and conservative traders. Some popular option chain strategies include:

Bull and Bear Spreads:

These strategies involve buying or selling combinations of options with varying strike prices to capitalize on specific market movements or to hedge existing positions.

Strangles and Straddles:

These are neutral strategies that involve buying or selling options with different strike prices but the same expiration date to benefit from large price fluctuations in either direction.

Using Option Chains in TradingView

TradingView provides a user-friendly and comprehensive platform for analyzing option chains. The platform offers advanced charting capabilities, technical indicators, and real-time data, enabling traders to seamlessly integrate option chain analysis into their trading workflow.

Option Chain In Trading View

Image: wealthbuildershq.com

Conclusion

Mastering the intricacies of option chains is a valuable skill that can enhance the trading performance of any aspiring or seasoned trader. By harnessing the power of option chains in TradingView, traders can gain invaluable insights into market dynamics, develop effective trading strategies, and make informed decisions. Embracing this knowledge can empower traders to navigate the complexities of the financial markets and achieve their trading goals.