As an avid investor, I’ve witnessed firsthand the exhilarating and potentially lucrative realm of option trading. Among its many intricacies lies the concept of an option trading chain, a roadmap that unravels the complex interweaving of options contracts for a specific underlying asset.

Image: www.ozarkalabama.org

Unveiling the Option Trading Chain: A Guiding Light in Market Volatility

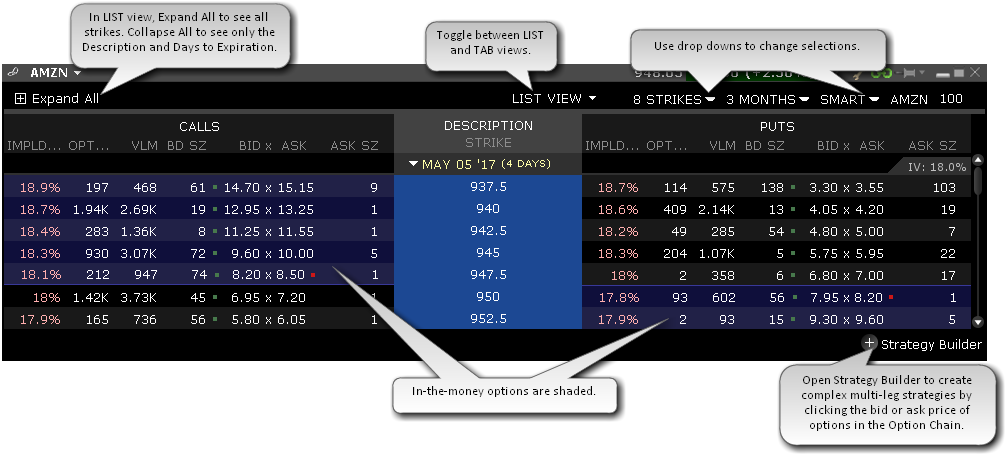

An option trading chain is a tabular representation of all available options contracts for an underlying asset, such as a stock, index, or commodity. Each contract is defined by its strike price, expiration date, and option type (call or put). By examining the chain, traders can analyze the market sentiment, gauge potential price movements, and identify trading opportunities.

Decoding the Language of Options Chains

To fully comprehend an option trading chain, it’s crucial to understand the terminology associated with it. Strike Price refers to the predetermined price at which the underlying asset can be bought (in the case of a call) or sold (in the case of a put). Expiration Date marks the day on which the option contract expires and becomes worthless. Lastly, Option Type distinguishes between call options, which grant the buyer the right to purchase the underlying asset at the strike price, and put options, which grant the right to sell the asset at the same price.

Navigating the Options Chain: A Trader’s Compass

Option trading chains serve as invaluable tools for traders seeking to decipher market dynamics. By analyzing the strike prices, expiration dates, and option types, traders can gauge the following key aspects:

- **Market Sentiment:** The distribution of options contracts across strike prices provides insights into market sentiment. A concentration of contracts at higher strike prices implies bullish sentiment, while a preponderance at lower strike prices indicates bearishness.

- **Volatility Assessment:** The option chain reflects market expectations regarding the volatility of the underlying asset. Contracts with higher premiums suggest higher implied volatility, signaling the potential for significant price fluctuations.

- Trading Opportunities:** The chain enables traders to identify potential trading opportunities. By comparing options prices across different strike prices and expiration dates, traders can pinpoint contracts with favorable risk-reward profiles.

Image: www.ibkrguides.com

Emerging Trends and Developments in Option Trading Chains

The world of option trading chains is continuously evolving, with the emergence of new strategies and technological advancements. Some of the latest trends and developments shaping the landscape include:

- Multivariate Analysis: Traders are increasingly employing advanced analytics to assess multiple variables within option chains, such as historical volatility, implied correlation, and liquidity, for more comprehensive market insights.

- Algorithmic Trading: Automated trading algorithms are being leveraged to analyze vast amounts of option chain data in real-time, enabling traders to identify and exploit trading opportunities with greater speed and efficiency.

Expert Advice for Navigating Option Trading Chains

Based on my experience as a trader, I offer the following tips for navigating option trading chains:

- Start Small and Simple:** Begin by focusing on a few key strike prices and expiration dates until you gain confidence and a deeper understanding.

- Utilize Technical Analysis:** Combine chain analysis with technical indicators like moving averages and Bollinger Bands to enhance your decision-making process.

- Manage Risk Wisely:** Clearly define your risk tolerance and never trade with more than you can afford to lose.

- Consult with a Financial Professional:** If you’re new to option trading, seeking guidance from an experienced financial professional is highly advisable.

Frequently Asked Questions (FAQs) on Option Trading Chains

Q: What is the best way to analyze an option trading chain?

A: There is no single “best” way, but a comprehensive approach should include evaluating market sentiment, assessing volatility, and identifying potential trading opportunities.

Q: Can I use option trading chains to predict future market movements?

A: While option chains provide insights into market expectations, they cannot accurately predict future price movements. Traders should exercise caution and rely on a combination of factors for decision-making.

Q: Are there any risks associated with trading options?

A: Yes, option trading involves significant risk and can result in substantial losses. It’s crucial to understand the risks involved and trade accordingly.

Option Trading Chain

Conclusion: Embracing the Power of Option Trading Chains

Option trading chains are indispensable tools for traders seeking to maximize their potential in the ever-changing financial markets. By harnessing the power of data, traders can unravel market dynamics, identify opportunities, and navigate the complexities of option trading with increased confidence. As you delve deeper into this fascinating topic, I encourage you to continuously explore, learn, and refine your strategies. Whether you’re a seasoned trader or just starting your journey, the world of option trading chains holds immense potential for growth and success.

Are you ready to explore the enigmatic realm of option trading chains and unlock the potential for enhanced market navigation?