In the ever-evolving landscape of financial markets, the ability to analyze and interpret market data effectively can give traders a significant edge. Among the plethora of trading platforms, TradingView stands out as a comprehensive tool that empowers traders with robust charting capabilities, advanced technical analysis indicators, and an intuitive user interface. This article will delve into the intricacies of using TradingView option chains, a powerful tool that provides valuable insights into the options market.

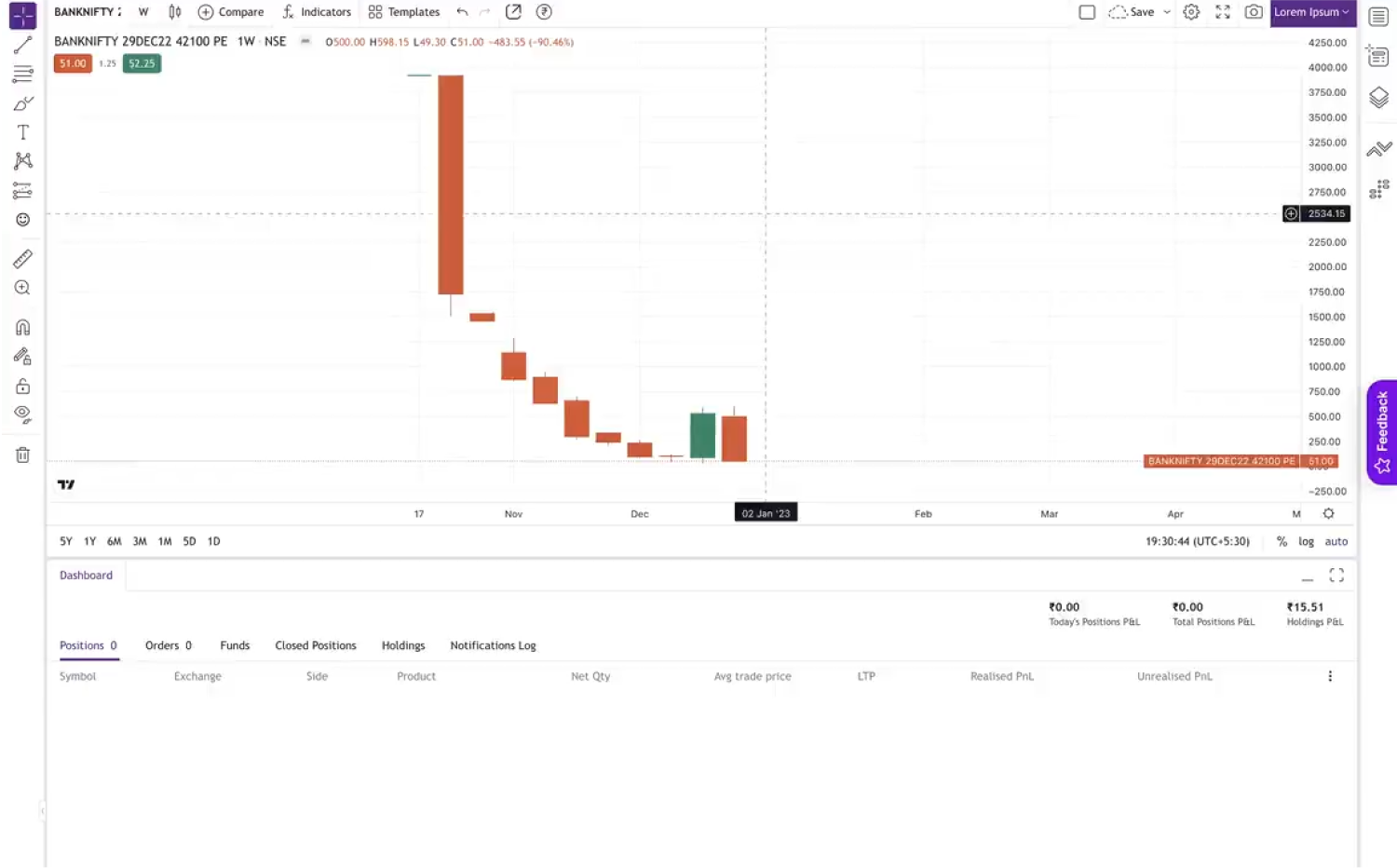

Image: upstox.com

What are Option Chains?

An option chain is a graphical representation of all available option contracts for a specific underlying security, such as a stock, index, or currency. Each contract has unique characteristics, including strike price, expiration date, and premium. Option chains display the relationship between these variables, enabling traders to gain a comprehensive understanding of the market sentiment and potential trading opportunities.

Understanding the Basics of Option Chains

Option chains consist of two main components: calls and puts. Call options give the holder the right, but not the obligation, to buy the underlying asset at the strike price on or before the expiration date. Put options, on the other hand, provide the right to sell the underlying asset at the strike price.

The strike price is a crucial factor when selecting an option contract. Options with strike prices above the current market price are called “out of the money” (OTM), while those with strike prices below are called “in the money” (ITM). OTM options have a lower premium than ITM options, as they are less likely to be exercised profitably.

Using Option Chains for Trading Insights

TradingView’s option chains provide a range of valuable insights for traders. The visual representation allows traders to quickly identify trends, potential trading ranges, and support and resistance levels. By analyzing the strike prices and premiums, traders can assess the market’s expectations for the underlying asset’s future price movement.

The volume and open interest data associated with each option contract can also provide valuable indications of market sentiment. High volume and open interest suggest that a particular option is actively traded, while low volume and open interest may indicate a less liquid contract.

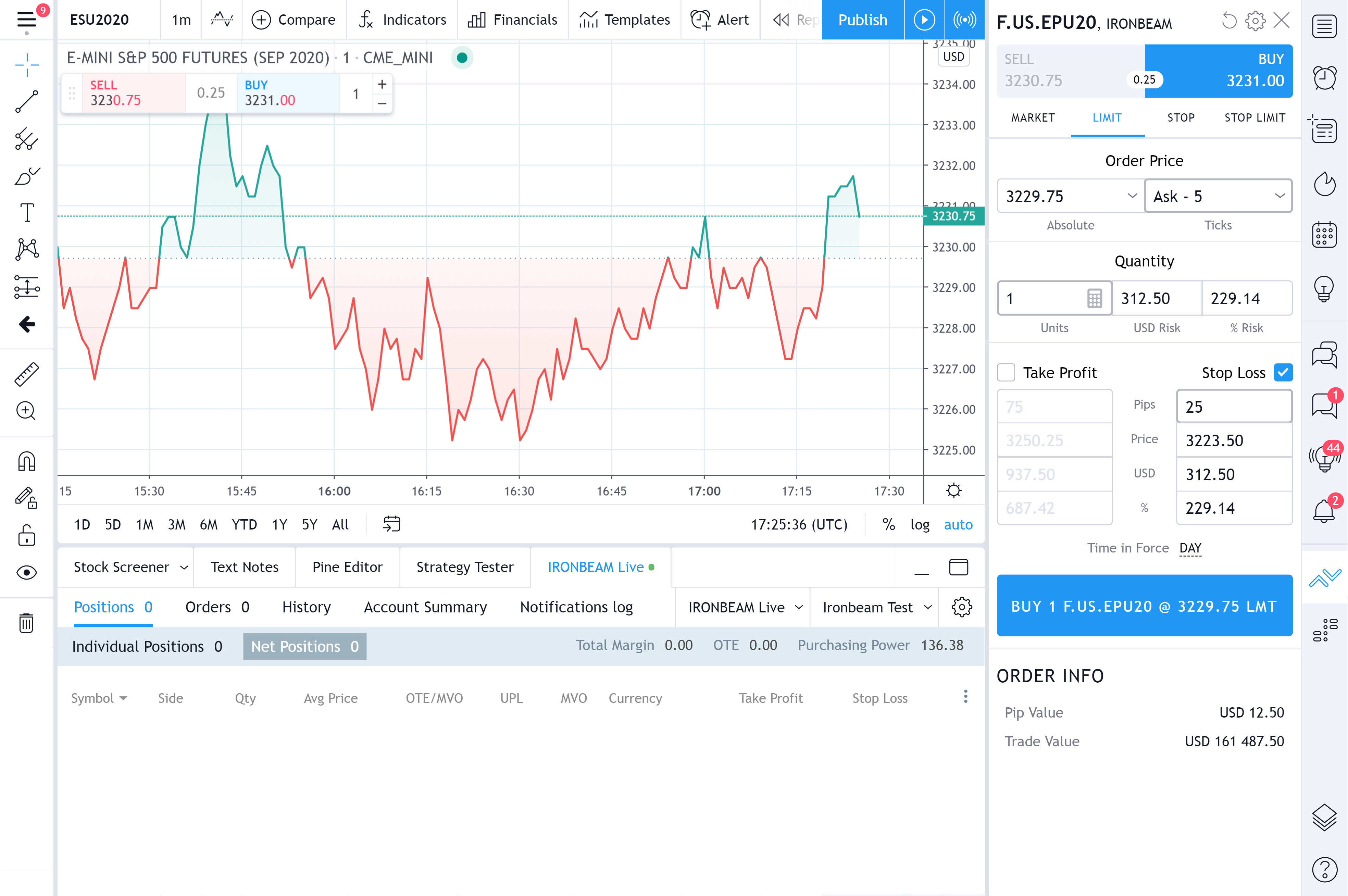

Image: tickertape.tdameritrade.com

Advanced Features of TradingView Option Chains

TradingView’s option chains offer numerous advanced features that cater to experienced traders. The platform allows traders to create custom option strategies, including spreads and combinations, which can provide unique risk-return profiles.

Additionally, TradingView integrates with popular brokerages, enabling traders to execute trades directly from the platform. This seamless integration streamlines the trading process and saves time and effort.

Trading View Option Chins

Image: www.ironbeam.com

Conclusion

Mastering option chains on TradingView can significantly enhance a trader’s analytical abilities and provide valuable insights into the options market. By understanding the basics of option chains and utilizing the advanced features of TradingView, traders can make more informed decisions, identify potential opportunities, and navigate the financial markets with confidence. Whether you are a seasoned trader or just starting your journey into options trading, TradingView’s option chains are an indispensable tool that can help you unlock the true potential of the options market.