Standing at the precipice of the earnings season, savvy traders eagerly anticipate the unveiling of corporate financial performances. Earnings announcements present a pivotal juncture for options traders, offering opportunities to harness market volatility and maximize profits. However, navigating the complexities of earnings trading requires a comprehensive understanding of underlying strategies. In this article, we embark on a detailed exploration of options trading strategies that can enhance returns during earnings season.

Image: optionstradingiq.com

Options Trading 101: A Primer

Options contracts, often referred to as the “currency of volatility,” bestow the power to speculate on the future price movements of an underlying asset. Armed with an options contract, traders effectively acquire the right, not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at a predetermined price (known as the strike price) on or before a specified expiry date. This flexibility enables options traders to profit from both rising and falling markets, although options trading carries inherent risks and requires a thorough grasp of market dynamics.

Earnings Season: A Crucible for Volatility

The release of quarterly earnings reports ignites a surge in market volatility due to the inherent uncertainty surrounding the company’s financial performance. This volatility presents lucrative opportunities for options traders to capitalize on sudden price fluctuations. Comprehending the relationship between earnings and stock prices forms the cornerstone of successful earnings trading strategies. Typically, positive earnings surprises drive stock prices higher, while negative surprises exert downward pressure. Options premiums, which reflect anticipated volatility and future price movements, tend to increase in the lead-up to earnings announcements and decline after their release.

Straddle Strategy: Embracing Ambiguity

For those seeking to harness earnings-driven volatility without predicting the direction of stock movement, the straddle strategy emerges as an ideal option. This strategy involves simultaneously buying a call option and a put option with the same strike price and expiration date. The profit potential of a straddle stems from the widening of the option premium due to increased uncertainty in the lead-up to the earnings announcement. However, traders must weigh this potential gain against the potential loss incurred if the stock price remains within the range defined by the strike prices.

Image: centerpointsecurities.com

Strangle Strategy: Betting on Extreme Moves

Traders with a stronger conviction regarding the magnitude of stock price movement may opt for the strangle strategy. Similar to the straddle strategy, a strangle involves buying both a call option and a put option, albeit with different strike prices. By widening the gap between the strike prices, traders enhance their chances of profiting from significant stock price fluctuations. However, this increased potential reward comes at the cost of higher upfront investment and greater risk.

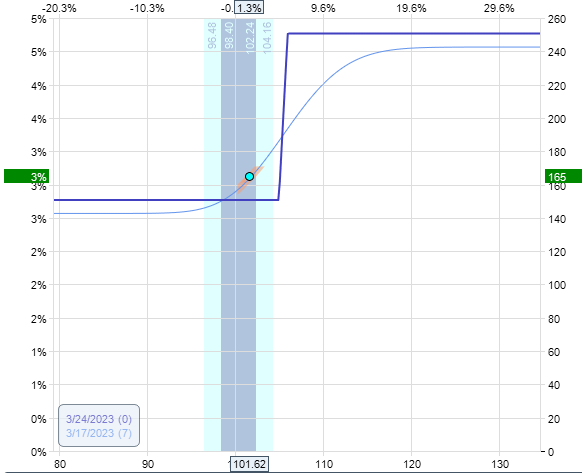

Options Trading Earnings Strategy

Iron Condor Strategy: Balancing Risk and Reward

For those seeking to strike a balance between risk and reward, the iron condor strategy presents an intriguing option. This strategy entails selling a call option and a put option at a higher strike price while simultaneously buying a call option and a put option at a lower strike price. The profit zone for an iron condor lies within a specific range that encompasses both the upper and lower strike prices. This strategy excels when the stock price remains relatively stable within this predefined range. However, traders must carefully consider the potential for losses if stock prices exhibit substantial volatility.