In the realm of finance, the earnings season, when companies release their financial performance, is an electrifying spectacle. It’s a period where investors, analysts, and traders alike eagerly dissect every piece of data, seeking insights and opportunities. Amidst the flurry, options trading emerges as a potent weapon for astute investors seeking to amplify their potential returns or hedge against potential risks.

Image: optionalpha.com

Options trading, in essence, grants traders the ability to speculate on the future price of an underlying asset, such as a stock or index. These contracts provide flexibility, allowing traders to choose between purchasing a call option for the right to buy an asset or a put option for the right to sell an asset at a predetermined price, known as the strike price. As earnings announcements loom on the horizon, understanding the dynamics of options trading becomes paramount for unlocking substantial rewards.

Embracing Options Trading in Earnings Season: A Calculated Gamble

Earnings season presents a unique opportunity for options traders to capitalize on market volatility and potentially reap significant profits. With companies releasing their financial results, stock prices tend to fluctuate dramatically, creating an environment ripe for option plays. By strategically purchasing or selling options contracts before an earnings announcement, investors can position themselves to potentially profit from subsequent price movements.

The allure of options trading during earnings season lies in the potential for outsized gains. By leveraging options contracts, traders can amplify their returns considerably compared to simply holding the underlying asset. However, it’s imperative to recognize the inherent risks involved. Options trading involves a higher degree of risk than traditional stock trading, and substantial losses can occur if the underlying asset’s price movement deviates significantly from expectations.

Navigating the Options Landscape: A Step-by-Step Guide

To effectively navigate the options trading landscape during earnings season, several steps should be meticulously followed:

-

Thorough Research: Conduct extensive research on the companies reporting their earnings. Analyze their historical financial performance, industry trends, and market expectations. Identify companies with a high likelihood of surpassing or falling short of analyst estimates.

-

Option Selection: Choose the appropriate option contract based on your market outlook. If you anticipate a surge in the stock price following positive earnings, consider purchasing a call option. Conversely, if you expect a decline, purchasing a put option might be a prudent strategy.

-

Strike Price Selection: Determine the strike price of the option contract that aligns with your risk tolerance and profit targets. A higher strike price will reduce your premium cost but also lower your potential payout.

-

Expiration Date: Choose an expiration date that provides sufficient time for the underlying asset’s price to move in your favor. Typically, options expiring within a few weeks of the earnings announcement date offer the greatest potential for profit.

Case Study: Unlocking Profits in the Earnings Frenzy

Consider a hypothetical scenario where Company XYZ is scheduled to release its earnings results in two weeks. Based on your analysis, you anticipate a strong earnings beat that will drive the stock price higher. To capitalize on this opportunity, you could purchase a call option with a strike price of $100 and an expiration date two weeks after the earnings announcement.

If Company XYZ indeed surpasses analyst estimates and its stock price rises to $110, your call option will gain significant value. The premium you paid for the option contract will be dwarfed by the profit you earn from exercising your right to buy the stock at the strike price. This scenario exemplifies the potential rewards that a well-timed options trade can offer.

Mitigating Risks: A Prudent Approach to Options Trading

While options trading during earnings season offers alluring prospects, it’s essential to exercise caution and adopt a risk-averse approach:

-

Capital Constraints: Only allocate a portion of your portfolio to options trading, never risking more capital than you can afford to lose. Options trading magnifies your potential returns but also amplifies your potential losses.

-

Market Volatility: Recognize that options trading involves substantial risk, especially during earnings season. Market volatility can lead to rapid price fluctuations, potentially eroding your profits or even resulting in significant losses.

-

Time Sensitivity: Options contracts have a limited lifespan, expiring on a predetermined date. If the underlying asset’s price movement doesn’t align with your expectations within that timeframe, you could incur substantial losses.

-

Seek Professional Guidance: Consider consulting with a qualified financial advisor for personalized advice and guidance on options trading. A professional can help you navigate the intricacies of options trading, identify suitable strategies, and manage your risk exposure effectively.

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Image: aytoo.ma

Options Trading Earnings Season

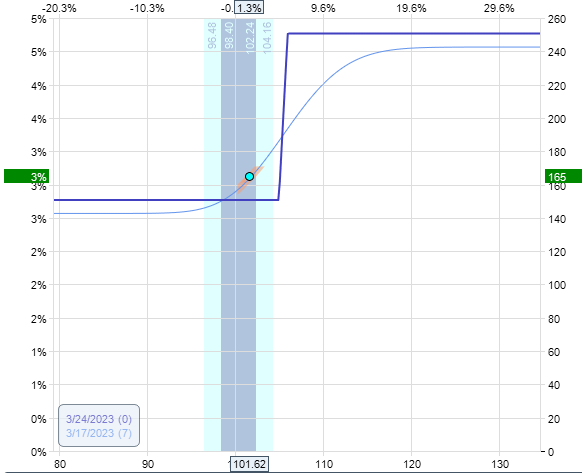

Image: optionstradingiq.com

Conclusion: Unveiling the Potential of Options Trading in Earnings Season

Options trading during earnings season offers a unique opportunity for astute investors and traders to capitalize on market volatility and potentially generate substantial returns. By meticulously researching companies, selecting appropriate options contracts, and managing risks prudently, traders can harness the power of options to enhance their profitability. However, it’s imperative to approach options trading with a deep understanding of the risks involved and a commitment to disciplined risk management.