In the ever-fluctuating landscape of global economics, the United States Oil Fund (USO) has emerged as a beacon of stability for investors seeking exposure to the volatile oil market. This article delves into the intricate world of USO and its associated options trading strategies, empowering traders with the knowledge to navigate the complexities of the oil market.

Image: seekingalpha.com

Understanding USO: A Gateway to the Oil Market

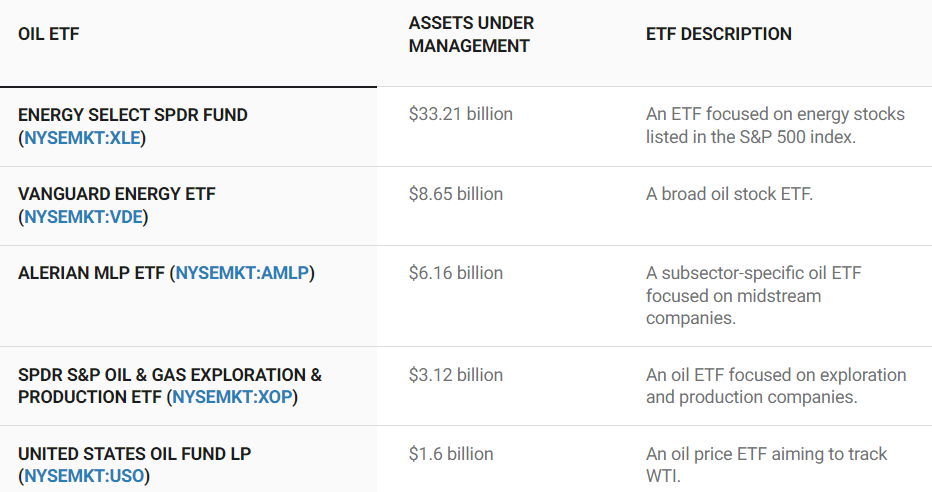

The United States Oil Fund is a highly sought-after commodity-based exchange-traded fund (ETF) that tracks the spot price of West Texas Intermediate (WTI) crude oil. By investing in USO, traders gain exposure to the price fluctuations of oil without the need to physically possess oil barrels. The fund’s structure allows investors to diversify their portfolios, mitigate risk, and potentially reap significant returns from the oil market’s cyclical nature.

Options Trading: Unlocking the Potential of USO

Options trading offers investors sophisticated strategies to enhance their returns and manage risk. By leveraging options on USO, traders can speculate on the future direction of oil prices, protect their portfolios from adverse price movements, and generate income through premium sales. The two primary types of options traded on USO are calls and puts, each carrying unique characteristics and applications.

Deciphering Call Options: Betting on Oil’s Rise

Call options provide traders with the right to purchase a security at a specified price (strike price) within a defined time frame (expiration date). In the context of USO options trading, a call option gives the holder the right to buy USO at the strike price, regardless of the market’s volatility. When traders expect oil prices to rise, they may buy call options on USO to capitalize on the potential gains. If the market indeed moves in their favor, the value of their call options increases substantially.

Image: buyshares.co.uk

Unveiling Put Options: Hedging Against Market Downturns

Put options, on the other hand, grant traders the right to sell a security at a specified price within a specified time frame. For USO options trading, a put option grants the holder the right to sell USO at the strike price, regardless of market fluctuations. Traders who anticipate a decline in oil prices may purchase put options on USO as a hedge against potential losses in their underlying portfolio. If the market moves as predicted, the put options gain value, providing a buffer against the downside risk.

Real-World Applications: Navigating the Market’s Ebb and Flow

Options trading on USO is not without its risks and complexities. Successful traders must possess a comprehensive understanding of the oil market, option pricing dynamics, and risk management techniques. However, when executed strategically, options can enhance the potential returns and mitigate the risks associated with investing in oil.

For instance, consider an investor who holds a long position in a portfolio of oil stocks. To protect against a sudden and significant downturn in oil prices, the investor could purchase a put option on USO. If the oil market declines, the value of the put option will increase, providing a hedge against the losses incurred in the stock portfolio.

On the other hand, traders anticipating a surge in oil prices may employ call options on USO to amplify their returns. If the oil market rallies, the call option holders will reap substantial gains. However, if the market moves against their expectations, they may incur losses on their options investment.

United States Oil Fund Etfs Options Trading

Image: www.pinterest.com

Conclusion

Options trading on United States Oil Fund ETFs offers a powerful tool for investors seeking to capitalize on the opportunities and manage the risks inherent in the oil market. By understanding the intricacies of USO and the nuances of options trading, traders can develop robust strategies that align with their investment goals and risk tolerance. While options trading on USO requires a comprehensive understanding of the market and sound risk management practices, it remains an indispensable element in the arsenal of savvy investors navigating the ever-changing landscape of global economics.