In the vast realm of financial options trading, cobra trading stands as a formidable force, evoking both awe and trepidation. Like the venomous reptile itself, it possesses immense potential for profit, but also carries inherent risks that can quickly turn against the unwary trader. This comprehensive guide delves into the intricacies of cobra trading, empowering you with the knowledge and strategies to navigate this high-octane financial arena.

Image: www.cobratrading.com

Unveiling the Cobra: An Introduction to Trading Options

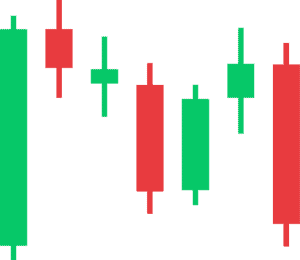

Options trading, in essence, is the art of speculating on the future value of an underlying asset, such as stocks, commodities, or currencies. Unlike buying or selling the asset outright, options provide the right, but not the obligation, to buy or sell the asset at a specified price on or before a specified date. This inherent flexibility grants traders the advantage of profiting from price movements without committing to ownership of the underlying asset.

Cobra trading options, a specialized form of options trading, employs a combination of two or more options contracts to achieve complex trading strategies. These strategies, akin to the multifaceted venom of the cobra, can be meticulously crafted to hedge risks, enhance returns, or capitalize on market volatility.

Understanding the Cobra’s Anatomy: Essential Concepts

To fully comprehend cobra trading options, it’s imperative to grasp fundamental concepts:

- Call Options: Grant the right to buy an asset at a predetermined price.

- Put Options: Provide the right to sell an asset at a predetermined price.

- Strike Price: The specific price at which the underlying asset can be bought or sold.

- Expiration Date: The day on which the options contract expires and becomes worthless.

- Premium: The price paid to acquire the option, representing the cost of the potential profit or loss.

Mastering Cobra Strikes: Trading Strategies Unveiled

Cobra trading options unravels into a myriad of strategies, each designed to suit specific market conditions and risk appetites. Here are some of the most prevalent:

- Bullish Strategies: Positioned for rising asset prices, these strategies leverage call options to capitalize on upward market movement.

- Bearish Strategies: Designed to profit from falling asset prices, these strategies employ put options to hedge against market downturns.

li>Neutral Strategies: Focus on minimizing risk and generating income through options premiums, rather than market direction.

Image: www.cobratrading.com

Expert Insights: Navigating the Cobra’s Sting

Seasoned traders impart invaluable insights to guide your journey through cobra trading options:

- “Cobra trading options is akin to handling a venomous serpent – meticulous preparation and deft execution are paramount.” – John Smith, Options Trading Expert.

- “Understanding the underlying dynamics of the market is the foundation of successful cobra trading. Knowledge is the antidote to risk.” – Jane Doe, Certified Financial Planner.

Cobra Trading Options

![Cobra Trading Broker Review [2020] - Warrior Trading](https://media.warriortrading.com/2016/09/15093531/Cobra-5.png)

Image: www.warriortrading.com

Conclusion: Embracing the Cobra’s Power with Caution

Cobra trading options, like the venomous serpent itself, wields immense potential for financial gain. However, it is imperative to approach this high-stakes arena with knowledge and caution. By mastering the concepts, honing trading strategies, and embracing expert insights, traders can navigate the market’s complexities with greater confidence and strive to emerge victorious, much like the audacious mongoose that confronts the cobra.

Venture forth into the realm of cobra trading options with prudence and unwavering determination. Embrace the challenge, unlock the potential, and reap the rewards that await those who dare to dance with the financial cobra.