In the ever-evolving landscape of financial markets, futures trading has emerged as a potent instrument for sophisticated investors seeking to navigate volatility and maximize returns. To harness the potential of this dynamic market, futures trading software options offer tailored tools and advanced functionalities that empower traders to execute strategies with precision and efficiency.

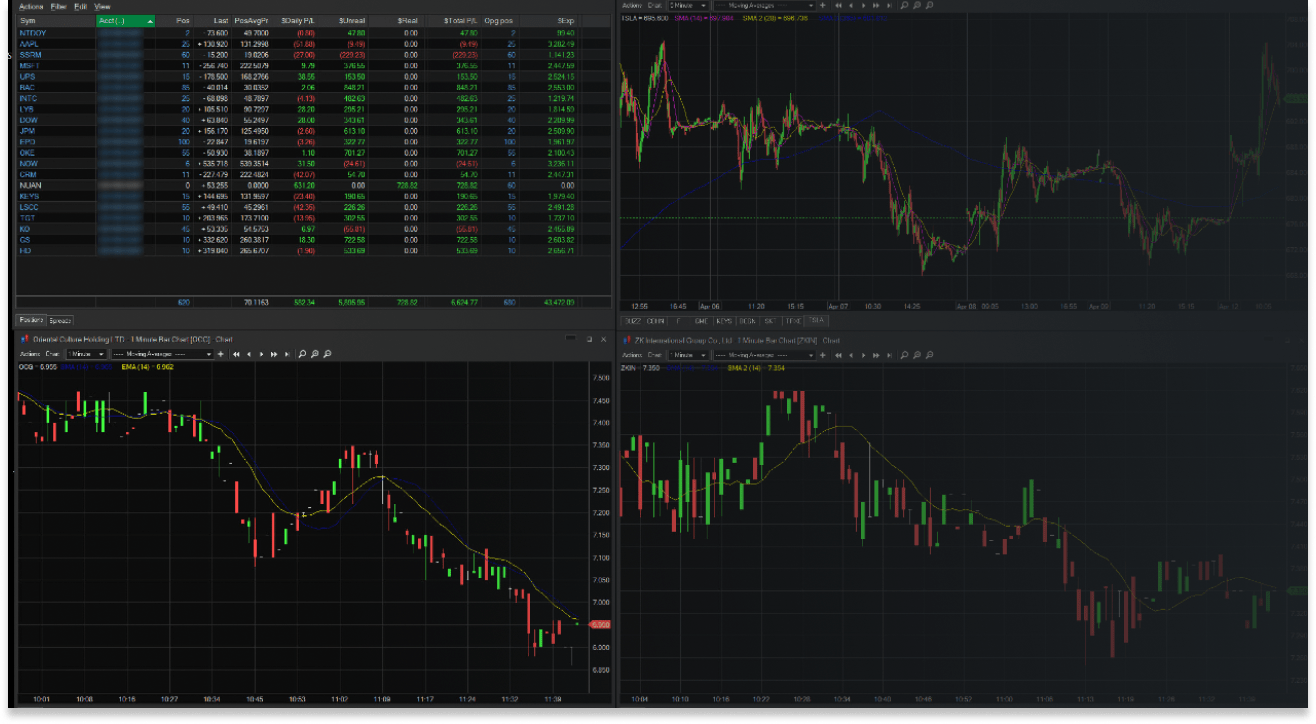

Image: www.cobratrading.com

Futures contracts, essentially standardized agreements to buy or sell an underlying asset at a predetermined price on a specified future date, provide investors with the flexibility to manage risk and hedge against market fluctuations. With futures trading software, traders gain access to real-time data, analytical tools, and automated order execution capabilities that streamline the entire trading process.

Demystifying Futures Trading Software

Futures trading software encompasses a wide range of platforms, each designed to cater to specific trading styles and requirements. These platforms offer a comprehensive suite of features, including:

- Real-time Data Monitoring: Stay abreast of market movements and identify trading opportunities with up-to-the-minute data feeds from exchanges.

- Advanced Charting: Analyze market trends and price patterns using customizable charts that display various technical indicators and drawing tools.

- Backtesting and Simulation: Refine trading strategies and test new ideas in a risk-free environment before deploying them in live markets.

- Automated Order Execution: Execute trades swiftly and efficiently using pre-defined rules and algorithms that respond to specific market conditions.

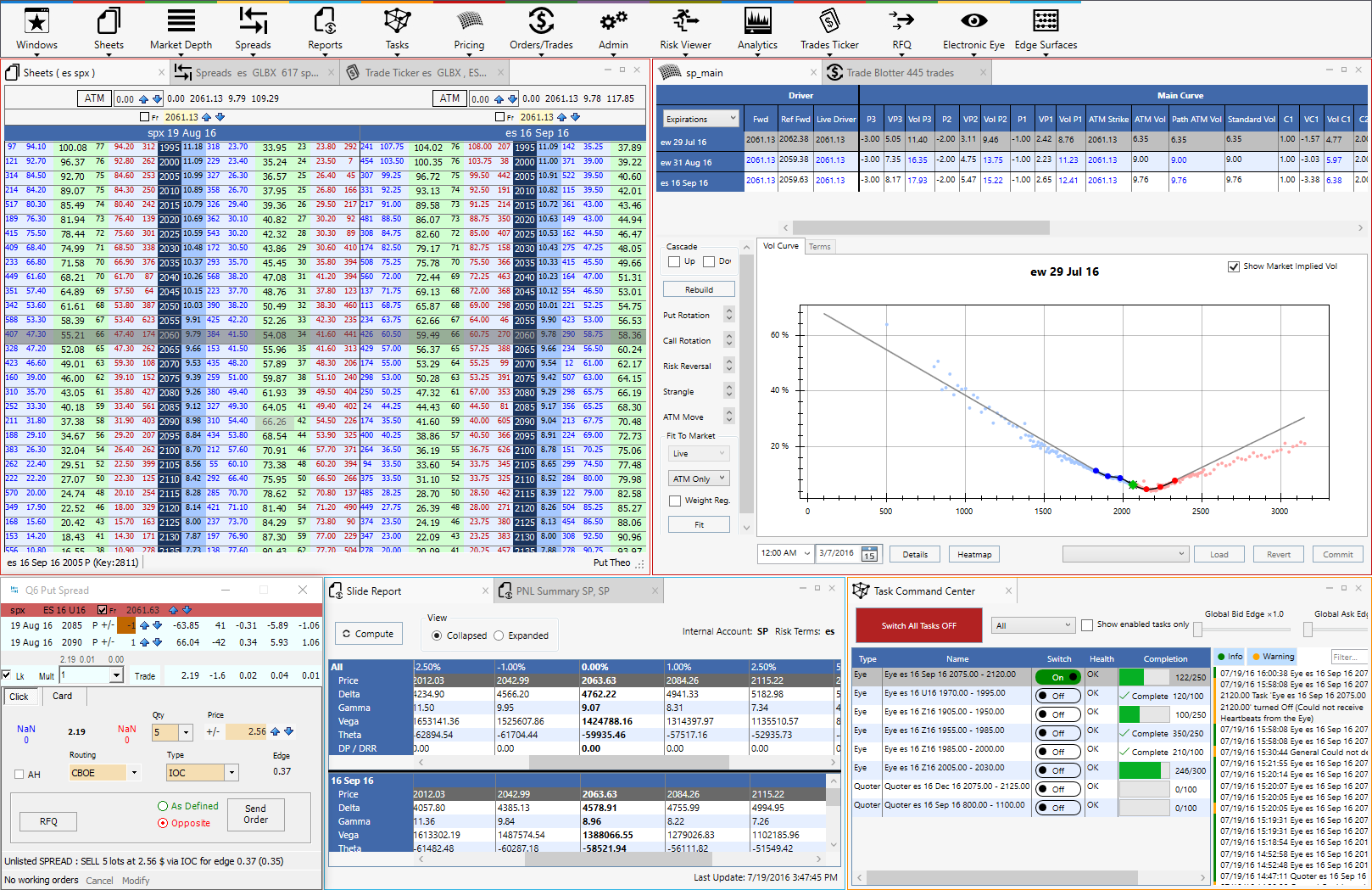

Unlocking the Benefits of Options on Futures

Options on futures, derivative contracts that grant the holder the right but not the obligation to buy or sell the underlying futures contract, extend the versatility of futures trading. With options, traders can create sophisticated strategies that suit their risk tolerance and market outlook:

- Hedging Against Risk: Options can be used to mitigate the risks associated with existing futures positions or underlying assets.

- Speculation and Volatility Trading: Exploit market volatility by trading options that provide leverage and the potential for substantial returns.

- Income Generation: Sell options premiums to generate income while maintaining exposure to the underlying futures contract.

Navigating the Options on Futures Trading Landscape

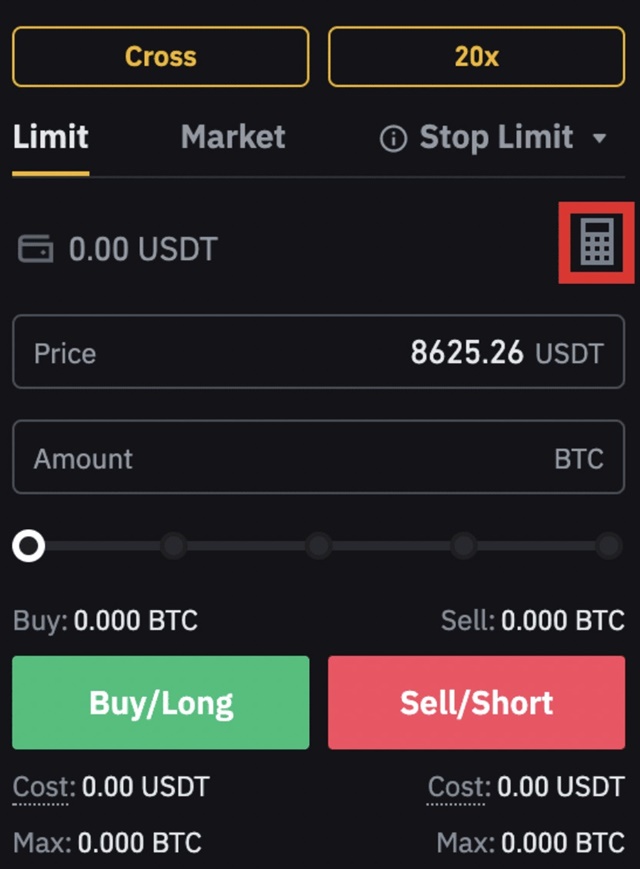

Venturing into options on futures trading requires a solid understanding of futures contracts and options concepts. Aspiring traders should consider the following:

- Identify Trading Objectives: Clearly define your trading goals, risk tolerance, and investment horizon.

- Understand Options Mechanics: Grasp the fundamentals of options, including strike prices, expiration dates, and option premiums.

- Master Market Analysis: Develop a comprehensive understanding of futures markets and the factors influencing price movements.

- Select a Reputable Software Provider: Choose a software provider that aligns with your trading style, offers robust features, and provides reliable support.

Image: www.advantagefutures.com

The Future of Futures Trading Software

As technology continues to transform the financial industry, futures trading software is poised for further advancements. Cutting-edge innovations like artificial intelligence (AI) and machine learning (ML) are expected to revolutionize trade execution, risk management, and market analysis.

AI-powered trading algorithms will automate complex trading strategies and optimize portfolio management. ML algorithms will enhance data-driven decision-making by identifying emerging patterns and making insightful predictions.

Futures Trading Software Options On Futures

Image: th-bigbike.com

Conclusion

Futures trading software options on futures provide traders with a powerful toolkit to navigate market complexities. By leveraging the capabilities of advanced software, investors can unlock new trading opportunities, manage risk effectively, and maximize returns in the dynamic futures markets. With a comprehensive understanding of futures trading and options concepts, as well as a tailored futures trading software solution, you can unlock the full potential of this dynamic financial instrument.