Unlocking Profitable Opportunities during Earnings Season

Image: jsmithmoore.com

Earnings season, a highly anticipated event in the stock market, presents investors with the potential for substantial returns through options trading. By leveraging earnings calendar options trading, traders can capitalize on the volatility surrounding earnings announcements, but it requires a deep understanding of the concept.

Earnings Calendar Options Trading Explained

Options trading involves the buying or selling of contracts that give traders the right, but not the obligation, to buy (call) or sell (put) a certain number of shares of a specific underlying stock at a predetermined price (strike price) before a certain date (expiration date).

During earnings season, options markets price in anticipated stock price movements following earnings announcements. If a company exceeds expectations, its stock price tends to rise, benefiting call option holders. Conversely, if earnings disappoint, stock prices may decline, favoring put option holders.

Preparation and Execution

To engage in earnings calendar options trading effectively, traders must meticulously prepare. Firstly, it’s crucial to research companies, their historical earnings performance, and analysts’ estimates. Identifying companies with strong fundamentals and consistent earnings records enhances potential profitability.

Once suitable stocks are selected, traders can assess options contracts that align with their risk tolerance and investment horizon. Key considerations include expiration date, strike price, and premium (contract price). The expiration date determines the time frame for potential profit, while the strike price sets the level at which the stock must move to yield returns. The premium, on the other hand, represents the initial investment required to enter the trade.

Trading Strategies

Various strategies can be employed in earnings calendar options trading. Common approaches include:

-

Bullish Call Option: Buying a call option with a strike price above the current stock price, anticipating an increase in stock value after positive earnings.

-

Bearish Put Option: Selling a put option with a strike price below the current stock price, expecting a decline in stock value after disappointing earnings.

-

Straddle: Buying both a call and a put option with the same strike price, hedging against unpredictable stock movements.

-

Strangle: Similar to a straddle, but the call and put options have different strike prices, creating a wider range of potential profits.

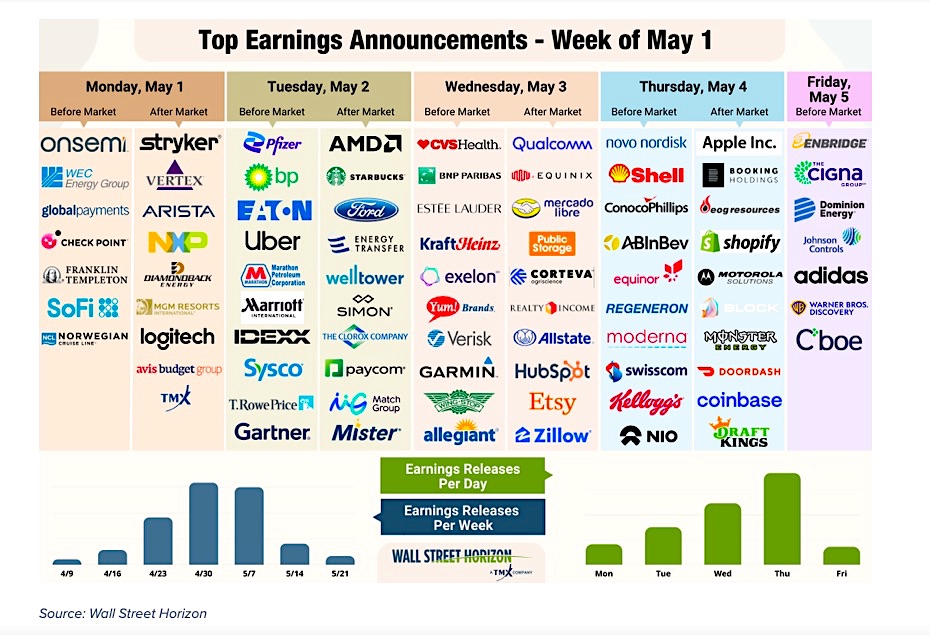

Image: www.seeitmarket.com

Risks and Considerations

Earnings calendar options trading conllevate significant risks. Options contracts are time-sensitive, and their value rapidly decays as the expiration date approaches. Unexpected market events or missed earnings forecasts can result in substantial losses.

Moreover, options trading requires a solid understanding of options concepts, market dynamics, and risk management strategies. Traders should diligently educate themselves before participating in this complex marketplace.

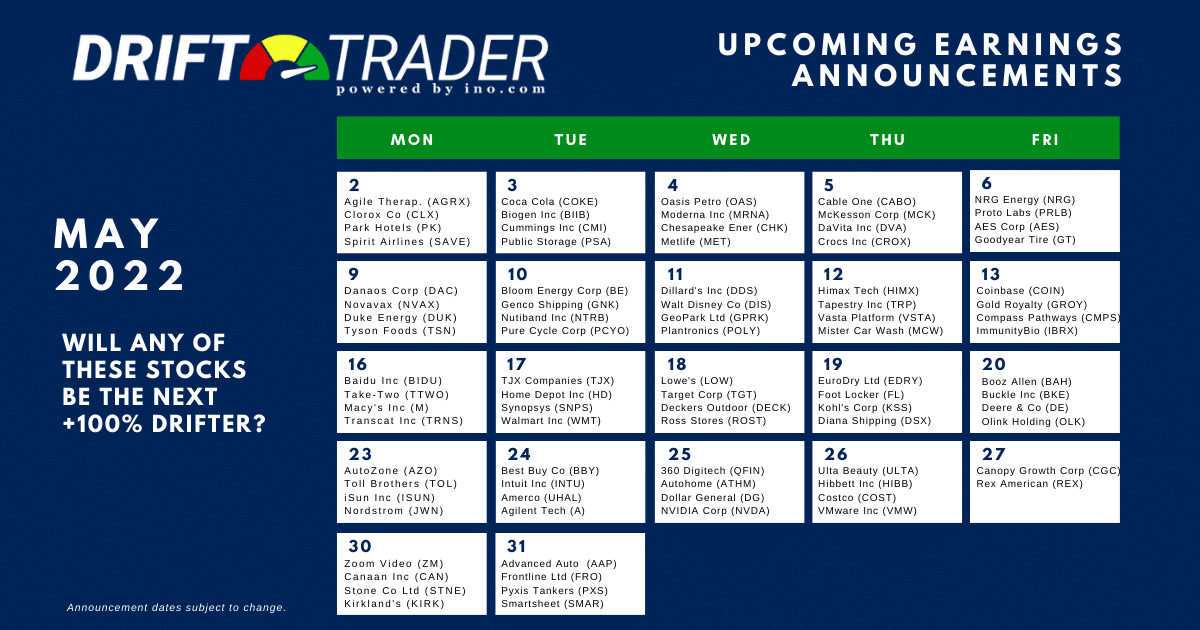

Example Of Earnings Calendar Options Trading

Image: www.ino.com

Conclusion

Earnings calendar options trading offers the potential for lucrative returns, capitalizing on the volatility surrounding earnings announcements. By carefully selecting stocks, meticulously analyzing options contracts, and adopting sound trading strategies, investors can navigate the complexities and enhance their chances of success. However, it’s crucial to recognize and effectively manage the risks inherent in options trading to ensure a well-rounded approach that maximizes opportunities while minimizing potential losses.