Imagine the excitement as a company’s quarterly earnings report looms on the horizon. Investors eagerly anticipate the numbers, hoping for a strong financial performance that could send stock prices soaring. Amidst this anticipation, there exists an intriguing opportunity to profit from the volatility that often accompanies such reports: options trading.

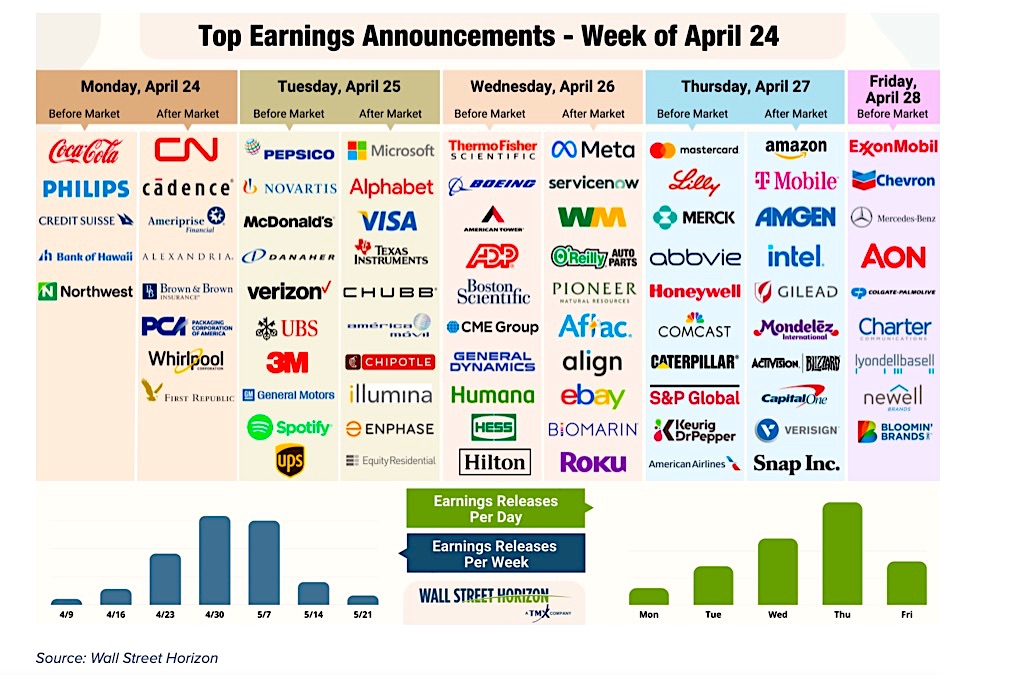

Image: centerpointsecurities.com

Options trading, a sophisticated yet lucrative strategy, allows traders to bet on an underlying security’s future price movement, potentially earning significant returns. And when it comes to quarterly earnings, options trading can be incredibly rewarding for those who understand its intricacies.

Deciphering the Options Trading Landscape

At the heart of options trading lies the concept of call and put options. A call option gives the buyer the right to purchase a stock at a predetermined price (strike price) by a specific date (expiration date). Conversely, a put option grants the buyer the right to sell a stock at the strike price by the expiration date.

Traders purchase options contracts based on their predictions of the stock’s price movement. If the stock price moves in their favor, they can exercise their option or sell it for a profit. However, if the stock price moves against them, they may lose the premium paid for the option.

Earnings Report and Options Trading – A Symbiotic Relationship

Earnings reports play a pivotal role in options trading, as they provide a window into a company’s financial health and future prospects. Traders closely scrutinize these reports, looking for signs of growth, profitability, and overall market sentiment.

In the lead-up to an earnings report, options volatility often spikes, creating ample opportunities for traders to profit. A positive earnings surprise can send stock prices skyrocketing, making call options highly valuable. On the flip side, a disappointing report can trigger a sharp sell-off, presenting opportunities for put option holders.

Unlocking the Secrets of Earnings Report Options Trading

Navigating the complexities of earnings report options trading requires a combination of technical expertise and strategic planning. Here are some insider secrets that can enhance your trading success:

-

Do Your Due Diligence: Thoroughly research the company issuing the earnings report, examining its financial performance, industry trends, and market sentiment.

-

Identify Potential Catalysts: Determine the key metrics and insights that could significantly impact the stock price after the earnings release.

-

Choose the Right Options: Carefully select call or put options based on your prediction of the stock’s price movement. Consider the strike price, expiration date, and implied volatility.

-

Manage Your Risk: Implement a prudent risk management strategy by setting stop-loss orders and limiting your exposure to a predetermined level of capital.

-

Seek Expert Guidance: Consult with experienced options traders or financial advisors to gain insights and navigate the complexities of earnings report options trading.

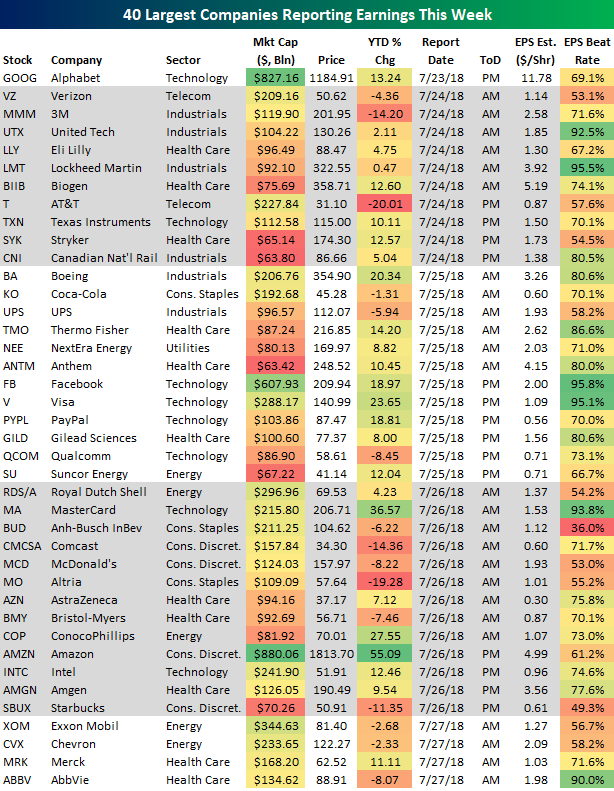

Image: www.seeitmarket.com

Earnings Report Options Trading

Image: www.bespokepremium.com

Ride the Earnings Wave to Trading Success

Options trading during earnings season can be a exhilarating and rewarding experience. By understanding the nuances of options contracts, leveraging earnings reports, and employing sound trading strategies, you can unlock the potential for substantial profits.

Remember, earnings season is a symphony of market anticipation and volatility, a time when options traders can showcase their expertise and reap the rewards of informed decision-making. So, prepare your trading strategies, study your charts, and seize the opportunities that earnings season has in store. The path to options trading mastery awaits the curious and the bold.