Introduction

Image: pmcaonline.org

Options trading has gained immense popularity as a means to enhance portfolio returns and diversify investments. With the advent of user-friendly platforms like Robinhood, individuals of all experience levels can now access this once-exclusive trading strategy. However, understanding options trading can be overwhelming, especially for beginners. This comprehensive guide will break down the basics, providing a step-by-step approach to options trading on Robinhood, empowering you to make informed decisions in this complex yet rewarding arena.

Understanding Options Trading

An option is a contract that gives the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset (such as a stock, bond, or commodity) at a specified price (strike price) on or before a certain date (expiration date). Options trading involves predicting the future direction of an underlying asset’s price and profiting from that movement.

Options on Robinhood

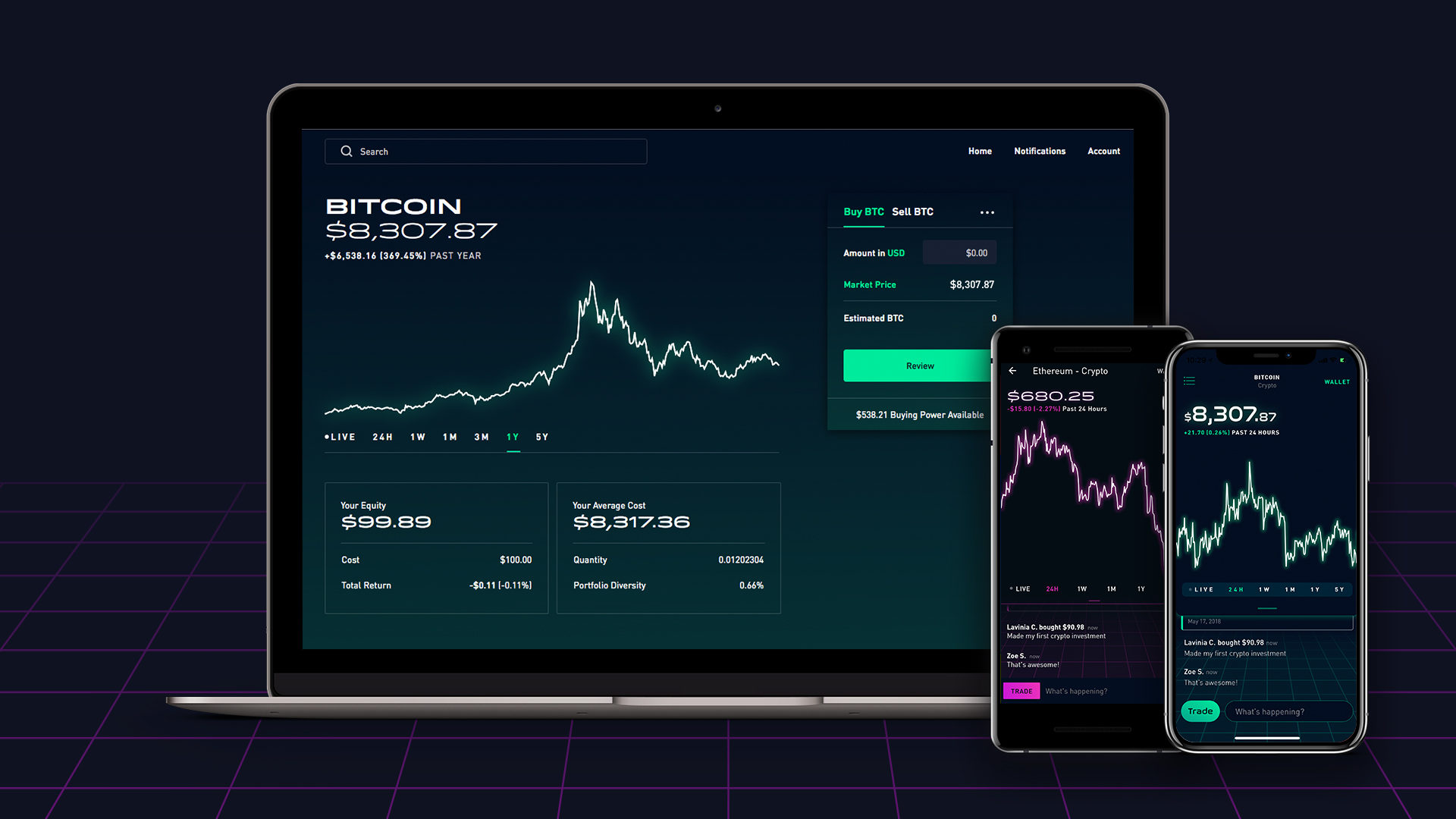

Robinhood offers a wide range of options products, including single-leg options, multi-leg strategies, and commission-free trading. The platform’s intuitive interface makes it easy to place trades, monitor positions, and track performance. However, it’s crucial to note that options trading carries significant risk and is not suitable for all investors.

Getting Started on Robinhood

To begin options trading on Robinhood, you must apply for and be approved for options trading permission. This process involves providing information about your trading experience, investment objectives, and understanding of options trading. Once approved, you’ll need to fund your account and select the suitable options trading strategy based on your risk tolerance and financial goals.

Choosing the Right Options Strategy

There are several options trading strategies to choose from, each with different risk and reward profiles. Selecting the strategy that aligns with your objectives is essential. Some common strategies include:

- Buy Call: To bet on an asset’s price increasing above the strike price.

- Sell Call: To bet on an asset’s price decreasing below the strike price.

- Buy Put: To bet on an asset’s price falling below the strike price.

- Sell Put: To bet on an asset’s price rising above the strike price.

Managing Your Trades

Once you’ve executed an options trade, it’s crucial to monitor its performance closely. You can use Robinhood’s tools to set profit or loss targets, as well as alerts to notify you of changes in the underlying asset’s price. Options contracts have a limited lifespan, so it’s essential to close your positions before they expire or incur losses.

Risks and Considerations

Options trading involves significant risks, including potential for total investment loss. It’s essential to thoroughly research, understand the risks, and consider factors such as volatility, time decay, and implied volatility before entering any trade.

Conclusion

Options trading on Robinhood can be a powerful tool to enhance portfolio returns and navigate market fluctuations, but it’s crucial to approach it with caution and adequate knowledge. By following the steps outlined in this guide, conducting thorough research, and exercising sound risk management practices, investors can unlock the potential of options trading and achieve their financial goals.

Image: www.youtube.com

How To Do Options Trading Robinhood

Image: www.warriortrading.com