Dive Into the World of Options with Robinhood

In the realm of investments, options trading presents a labyrinth of opportunities for savvy individuals seeking to maximize returns. And for beginners taking their first steps into this complex arena, Robinhood emerges as the ideal platform, offering a user-friendly interface and the resources necessary to navigate the intricate world of options. Through this comprehensive guide, we unravel the nuances of option trading on Robinhood, empowering you with a foundational understanding of this captivating market.

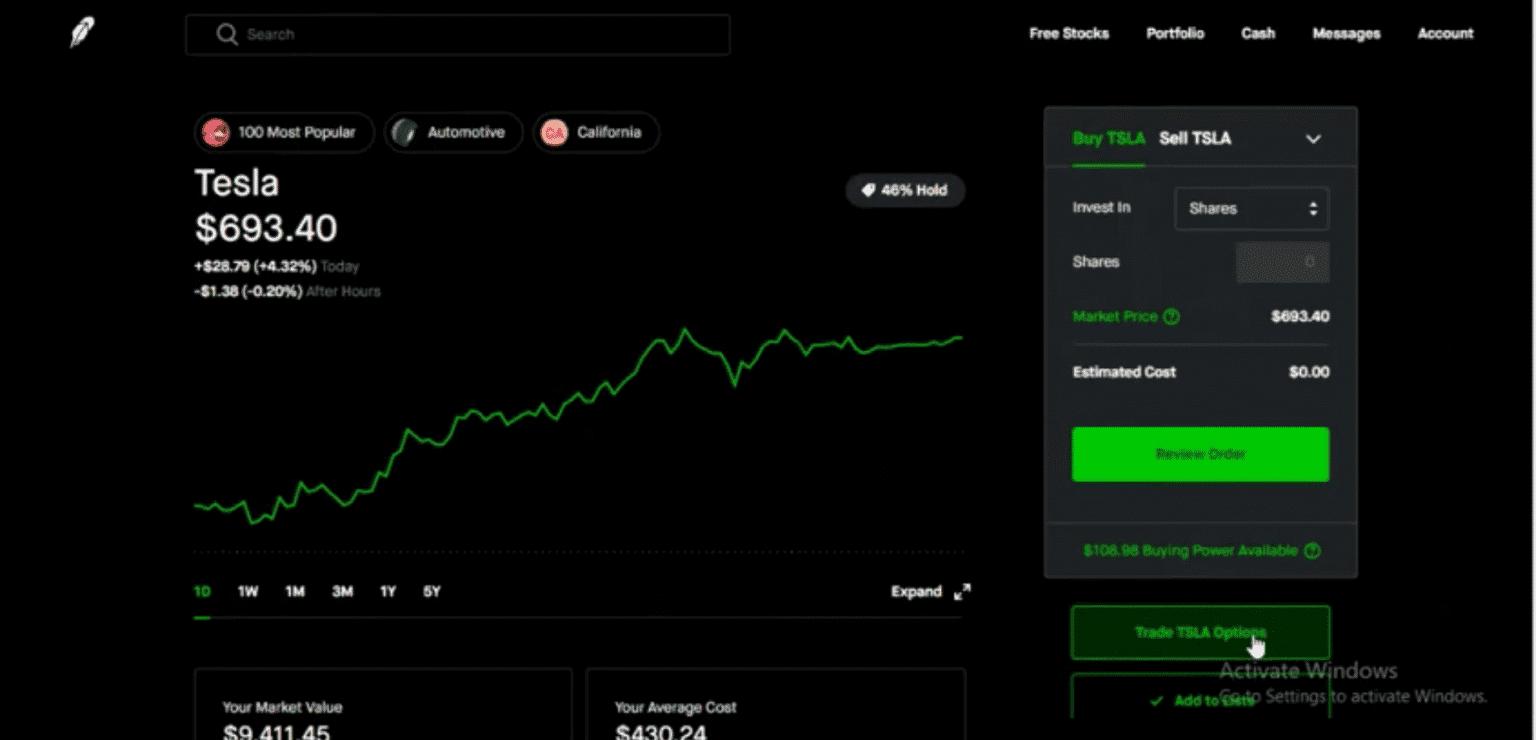

Image: medium.com

Understanding the Basics of Options

An option can be likened to a contract that grants the buyer the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Options come in two primary forms: calls and puts. A call option grants the buyer the right to purchase the underlying asset, while a put option grants the right to sell.

How Options Work on Robinhood

Robinhood simplifies option trading by offering a streamlined process. To initiate a trade, you first select the underlying asset and the desired expiration date. Next, you choose the appropriate call or put option based on your market outlook. The price you pay for the option, known as the premium, represents the cost of acquiring this right.

Types of Option Strategies

Once familiar with the basics, you can explore various option strategies tailored to specific market conditions and investment goals. Covered calls involve selling call options against shares you own, generating premium while limiting upside potential. Cash-secured puts, on the other hand, entail selling put options without owning the underlying asset, aiming to profit from a potential decline in price.

Image: www.warriortrading.com

Assessing Risk and Managing Trades

Understanding the risks associated with option trading is paramount. Options are inherently more volatile than stocks, and their value can fluctuate significantly based on market movements. To mitigate risk, consider employing stop-loss orders or implementing hedging strategies. Regularly monitoring your trades and adjusting your positions as market conditions change is crucial for prudent risk management.

Benefits of Option Trading on Robinhood

Harnessing the power of Robinhood for option trading affords several advantages. The platform provides accessible educational resources, enabling beginners to grasp the intricacies of options. Furthermore, Robinhood offers flexible account types catering to various experience levels. Low commissions and mobile trading capabilities enhance the overall user experience.

Option Trading For Beginners Robinhood

Image: marketxls.com

Conclusion

Venturing into option trading on Robinhood empowers you to participate in a sophisticated financial market with the potential for substantial returns. However, the path to success requires a comprehensive understanding of options, their risks, and the strategies involved. By diligently studying this guide, seeking expert advice, and practicing prudent risk management, you can unlock the transformative power of option trading and embark on a rewarding investment journey.